Polkadot price set to eke out 10% gains for the week as the world mourns

- Polkadot price trades 3% higher on the day as the dollar backs off.

- DOT price could see a weekly gain of over 13% towards the end of the opening bell.

- As the world mourns the passing of Queen Elisabeth, it looks like London trading hubs are deleveraging their dollar longs.

Polkadot (DOT) price pops up another 3% during the European trading session as markets are reassessing the situation and the Queen of England passes away. Positions are being squared across the board with the dollar on the backfoot, opening up room for cryptocurrencies to move higher. DOT price could be on the verge of breaking above a big technical cap opening up further expansion going into the week ahead.

DOT price could continue to rally towards $10

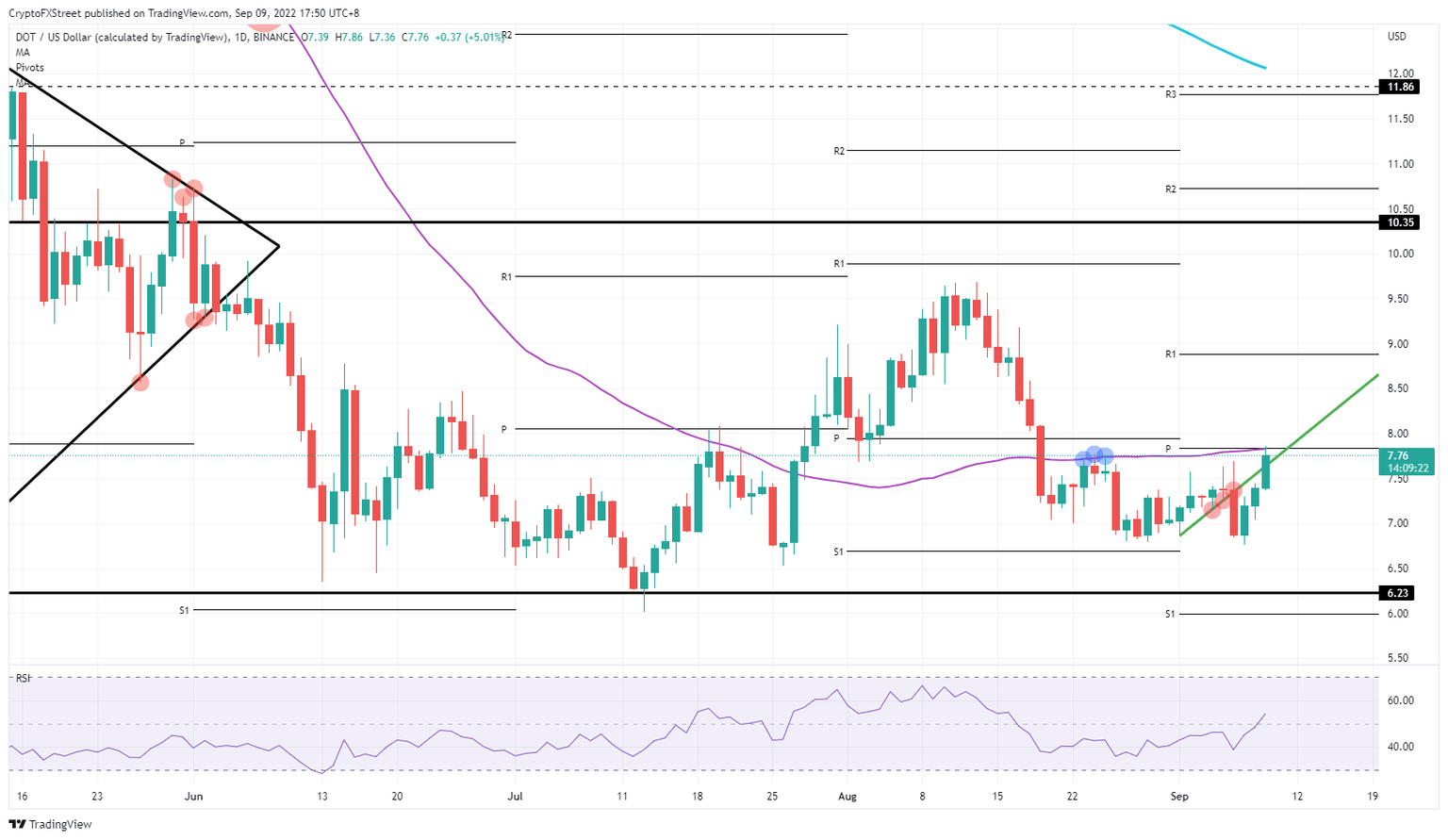

Polkadot price shoots higher as the dollar completely backs off and opens up a wide range of room for equities and cryptocurrencies. For Polkadot, that means a move up towards the monthly pivot and the 55-day Simple Moving Average at $7.82. That level will be key in the future into next week and over the weekend.

DOT price could be set for a staggering rally up to $10.35 in a bold but doable move that could bring another 31% upside potential. That would depend on two elements: if bulls can close the price action on Sunday above the monthly pivot and the 55-day SMA at $7.82, and if the dollar on Monday weakens even more, as the UK government issues a possible whole week of mourning. In such a case, the high of August and $10.35 could come into play if those two elements have been met.

DOT/USD Daily chart

The risk to the downside, of course, could be that the move that is unfolding today will be erased on Monday once traders and markets are back to focusing on more mundane matters. This move today is purely sentimental, and due to several hedge funds and banks following preset scenarios and unloading their positions because a big political figure has died or a war has broken out. Traders are likely to see heavy buying back into those dollar-long positions on Monday, with DOT price collapsing back to $7.00.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.