Polkadot price action could see $37 as DOT prepares to enter new uptrend

- Polkadot price is back in favor of the bulls after entries at $29.12

- DOT price action needs to stay above $31.61, or at least close above, to attract fresh buyers into the rally.

- With risk-on returning to the stock markets, expect a favorable tailwind to help bulls bring Polkadot price action back to $37.03.

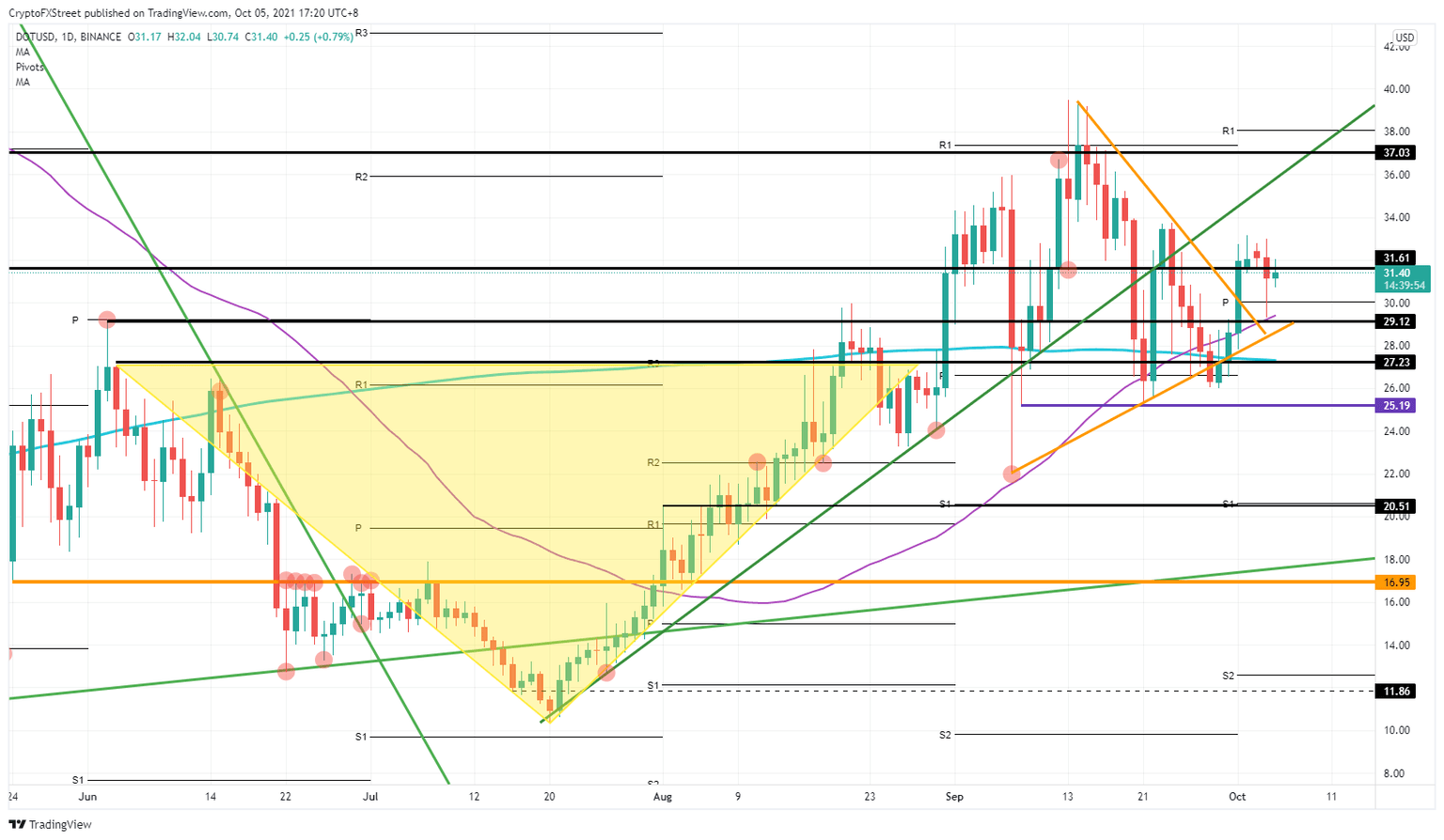

Polkadot (DOT) price bounced off two crucial technical levels on Monday, and bulls in DOT were able to regain control of the $31.61 level. As the global equity markets are turning back to risk-on, expect this to act as a tailwind for DOT price action and help lift the price to $37.03. Once above there, buyers will face a lot of resistance, and bulls will start to lock in profits.

Bulls can be rewarded 17% upside if they can close DOT price action above $31.61 this week

Polkadot bulls had a nervous day yesterday with DOT price action almost completely retracing the breakout move from October 1. But it offered a perfect entry with the bounce off $29.12 and the 55-day Simple Moving Average (SMA) at that same level. Bulls now have to defend $31.61 to keep the momentum going and attract new buyers into the rally.

DOT price holds 17% of upside potential in case bulls can hold $31.61. With not much in the way, a retest back to $37.03 looks to be the only possible outcome as Polkadot bulls are helped by favorable tailwinds emerging from global markets with a recovery from inflation and stagflation worries.

DOT/USD daily chart

Expect around $37.03 for bulls to face a lot of resistance. Both the monthly R1 resistance levels are around that area, between $37 and $38. With failed and faded attempts last month, expect these levels to be seen as ideal profit-taking levels for buyers in DOT.

Should markets roll over and turn back to red figures, expect a break of $29.12 to the downside in DOT. That yellow ascending trend line will be tested and broken as well, with prices dropping further toward $27.23.

Like this article? Help us with some feedback by answering this survey:

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.