Pi Network Price Forecast: PI diverges from crypto market recovery, risking further losses

- Pi Network faces downside risk, targeting the record low reached on Friday as bearish momentum lingers.

- Centralized Exchanges' wallet balances surge, indicating increased deposits from investors.

- The Pi Foundation offloads 2.53 million tokens, increasing its supply .

Pi Network (PI) edges lower by around 2% at press time on Monday, diverging from the broader cryptocurrency market recovery, as selling pressure increases. The bearish sentiment prevails among PI investors as deposits surge on centralized exchanges (CEXs) alongside the Pi Foundation's offloading move.

The technical outlook suggests further losses, risking a new all-time low.

CEX's wallet balances surge as Pi Foundation offloads

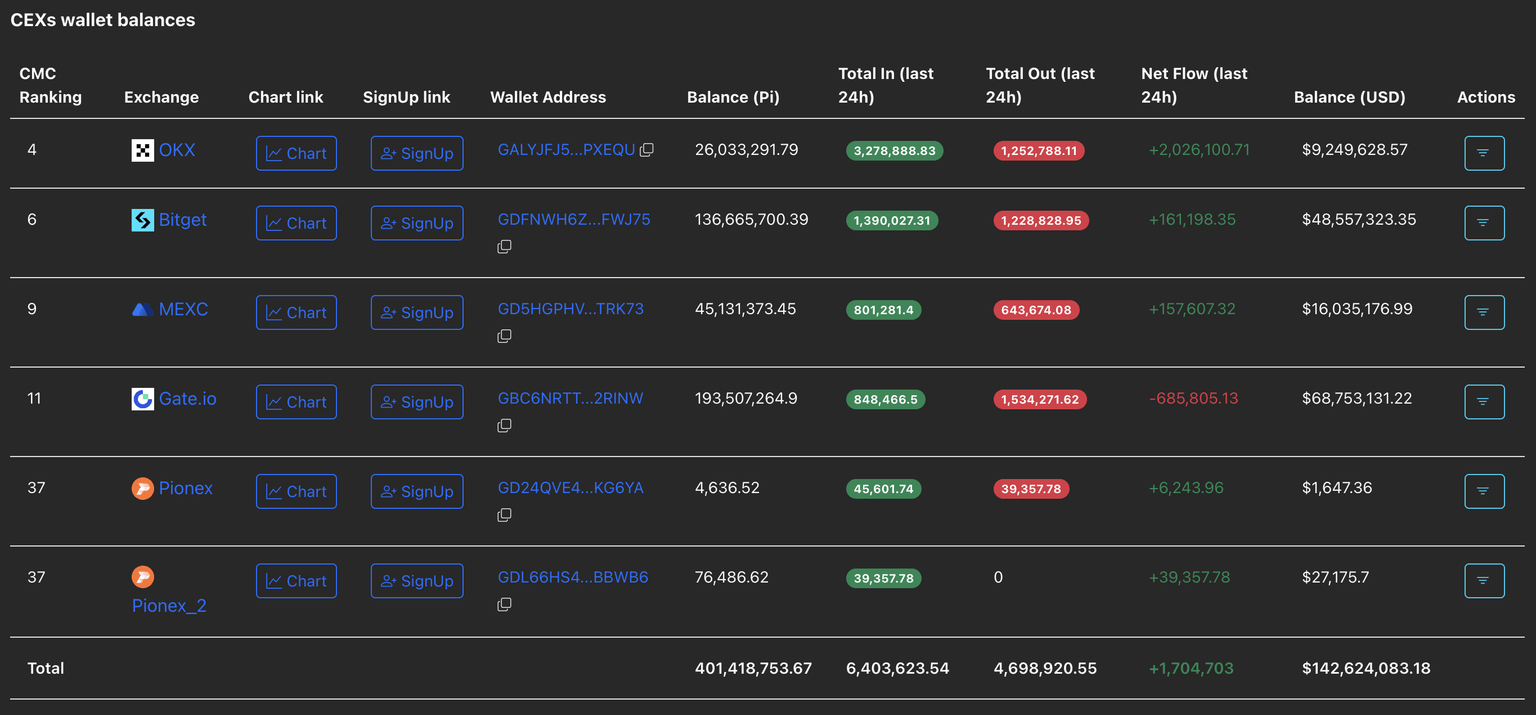

PiScan data shows the CEX's wallet balances rising to more than 401 million PI tokens, adding around 1.7 million tokens over the last 24 hours. Currently, CEXs hold 5.16% of the circulating supply.

Typically, an increase in CEX reserve points to higher selling pressure as investors aim to book profits or cut losses.

The deposits on OKX exchanges outpace other exchanges, with a net flow of over 2 million PI tokens, while Gate.io holds the largest balance of over 193 million PI tokens.

PI CEX balances. Source: PiScan

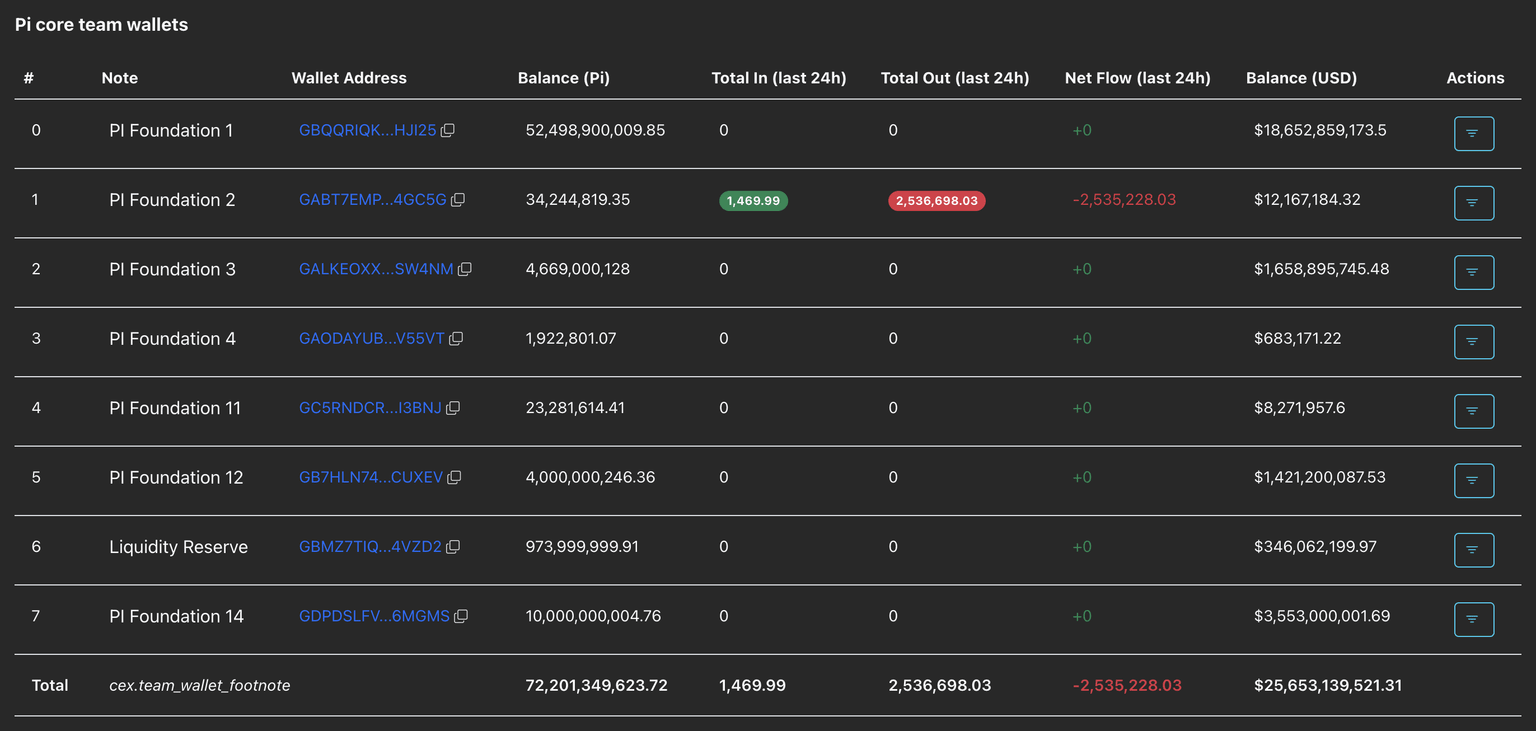

Amid the sell-off, the Pi Foundation has offloaded 2.53 million tokens in the last 24 hours. This sale by the core team suggests declining confidence, boosting the risk-off sentiment among investors and resulting in increased selling pressure.

PI core team wallets. Source: PiScan

Heightened selling pressure escalates risk for the Pi Network

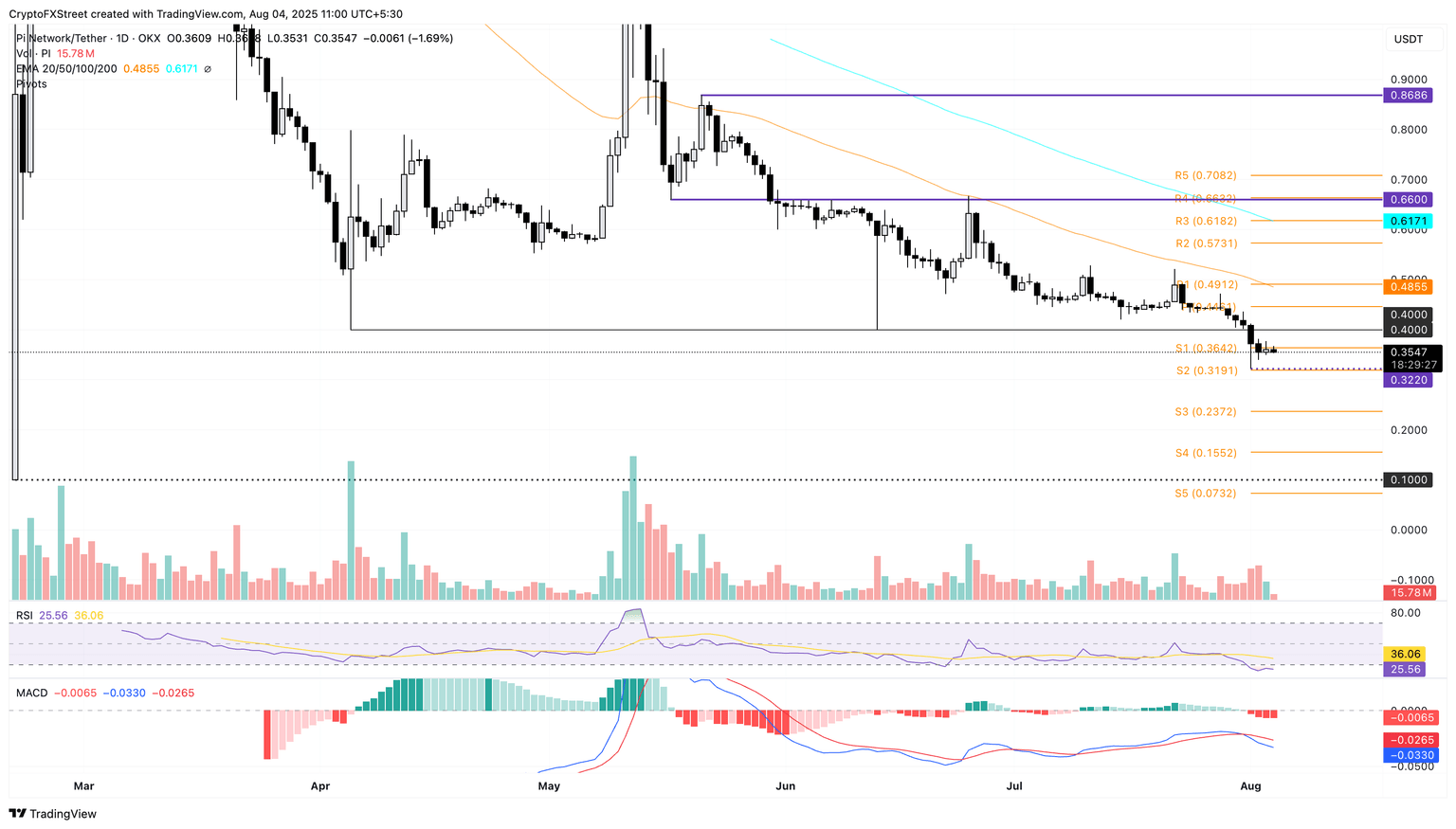

Pi Network edges lower by 2% at press time on Monday, failing to surpass the S1 pivot level at $0.3642 – a support now turned resistance. The token targets the all-time low recorded on Friday at $0.3220, which is slightly above the S2 pivot level at $0.3191.

A decisive push below the S2 pivot level could extend the correction to the S3 pivot at $0.2372.

The Moving Average Convergence Divergence (MACD) flashed a sell signal on Friday with red histogram bars rising from the zero line, as the MACD line crossed below the signal line. Investors could increase the bearish exposure as the average lines decline in the negative direction.

The Relative Strength Index (RSI) reads 25 on the daily chart, steadying a sideways trend in the oversold zone, suggesting heightened selling pressure.

PI/USDT daily price chart.

To reinforce a recovery run, PI should reclaim the $0.4000 level, which previously acted as a crucial support, broken on Friday.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.