NEO/USD Elliott Wave technical analysis [Video]

![NEO/USD Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Digital Currencies/Ethereum/Ethereum_1_XtraLarge.jpg)

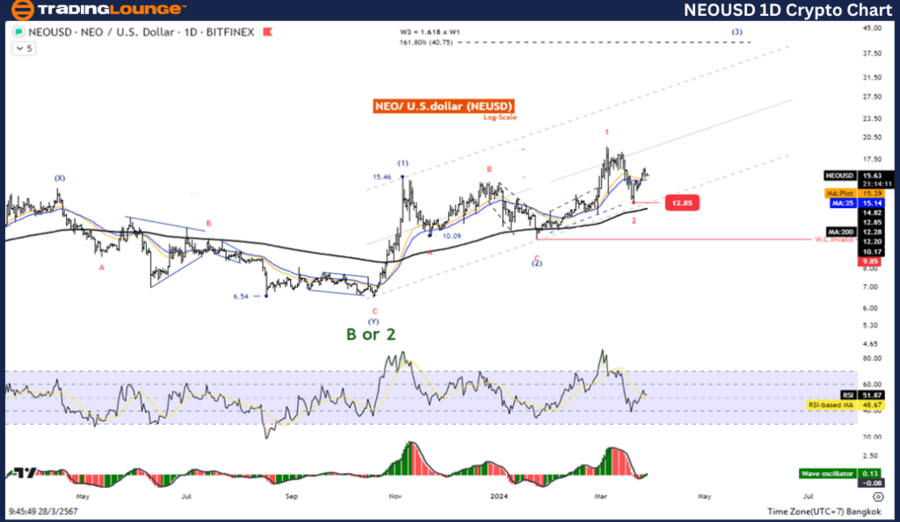

NEO/USD Elliott Wave technical analysis

Function: Follow Trend.

Mode: Motive.

Structure: Impulse.

Position: Wave (3).

Direction Next higher Degrees: Wave ((3)) of Impulse.

Wave Cancel invalid Level: 9.85.

Details: Wave (3) is Equal to 161.8% of Wave (1) at 24.52.

NEO/USD trading strategy

NEO is still in an uptrend from Prices remain in the third wave price structure. We expect the price to test the 40.75 level, which is 161.8% of the length of the first wave. So look for opportunities to join the uptrend.

NEO/ U.S. dollar(NEOUSD)Technical Indicators: The price is above the MA200 indicating an Uptrend, Wave Oscillator is a bullish Momentum.

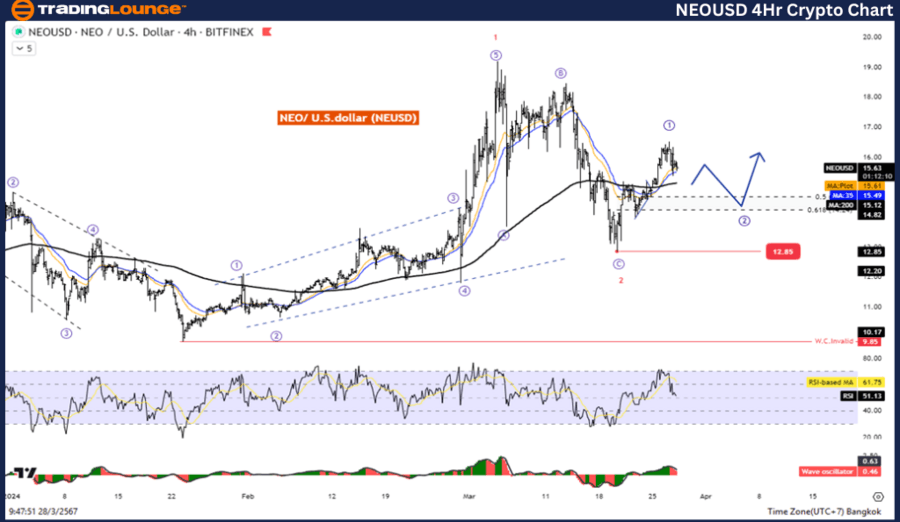

NEO/USD Elliott Wave technical analysis

Function: Counter Trend.

Mode: Corrective.

Structure: Zigzag.

Position: Wave (C).

Direction Next higher Degrees: Wave ((2))) of Impulse.

Wave Cancel invalid Level: 9.85.

Details: The Wave ((2)) is equal to 61.8% of Wave ((1)) at 14.24.

NEO/USD trading strategy

NEO is still in an uptrend. But there may be a short-term pullback of the second wave at the level of 14.14 before rising again in the third wave. So wait for the correction to complete to rejoin the trend.

NEO/ U.S. dollar(NEOUSD)Technical Indicators: The price is above the MA200 indicating an Uptrend, Wave Oscillator is a bullish Momentum.

NEO/USD Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.