NEO Price Analysis: NEO bears threaten a breakthrough below DMA100

- NEO/USD has dropped below SMA100 daily support.

- The initial resistance is created by a psychological $10.00.

NEO, the 19th largest cryptocurrency with the current market value of $653 million, recovered from the recent bottom of $8.40 (November 25). However, the recovery stopped short of $10.00 on November 29. Since that time, the coin has retreated to $9.00, moving in sync with the global cryptocurrency market. The coin lost gained 3.6% of its value since the beginning of the day.

NEO/USD, the technical picture

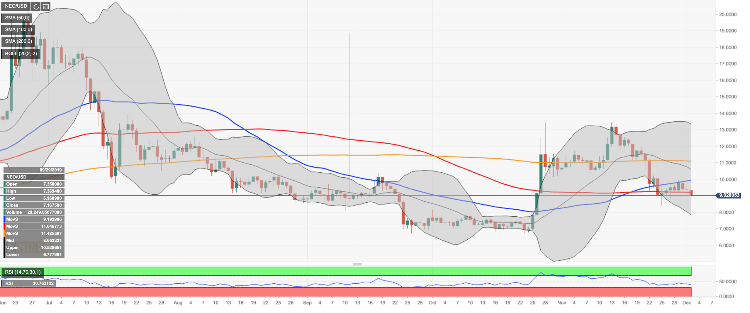

On the daily chart, NEO/USD has broken below DMA100 at $9.20 and tested area below psychological $9.00. A sustainable move above under the lower boundary will trigger an extended sell-off towards the recent low of $8.40. The next support is created by the lower line of the Bollinger Band at $7.87.

On the upside, we will need to see a sustainable move above $10.00 rein=forced by DMA50 for the upside to gain traction. A stronger barrier awaits NEO bulls at $10.40. This is the lower boundary of the consolidation channel where the coin spent the best part of November. SMA200 above the psychological $11.00 is likely to slow down the recovery.

NEO/USD, the daily chart

Author

Tanya Abrosimova

Independent Analyst