MATIC Price Prediction: These signals are key to catching Polygon’s 20% rally

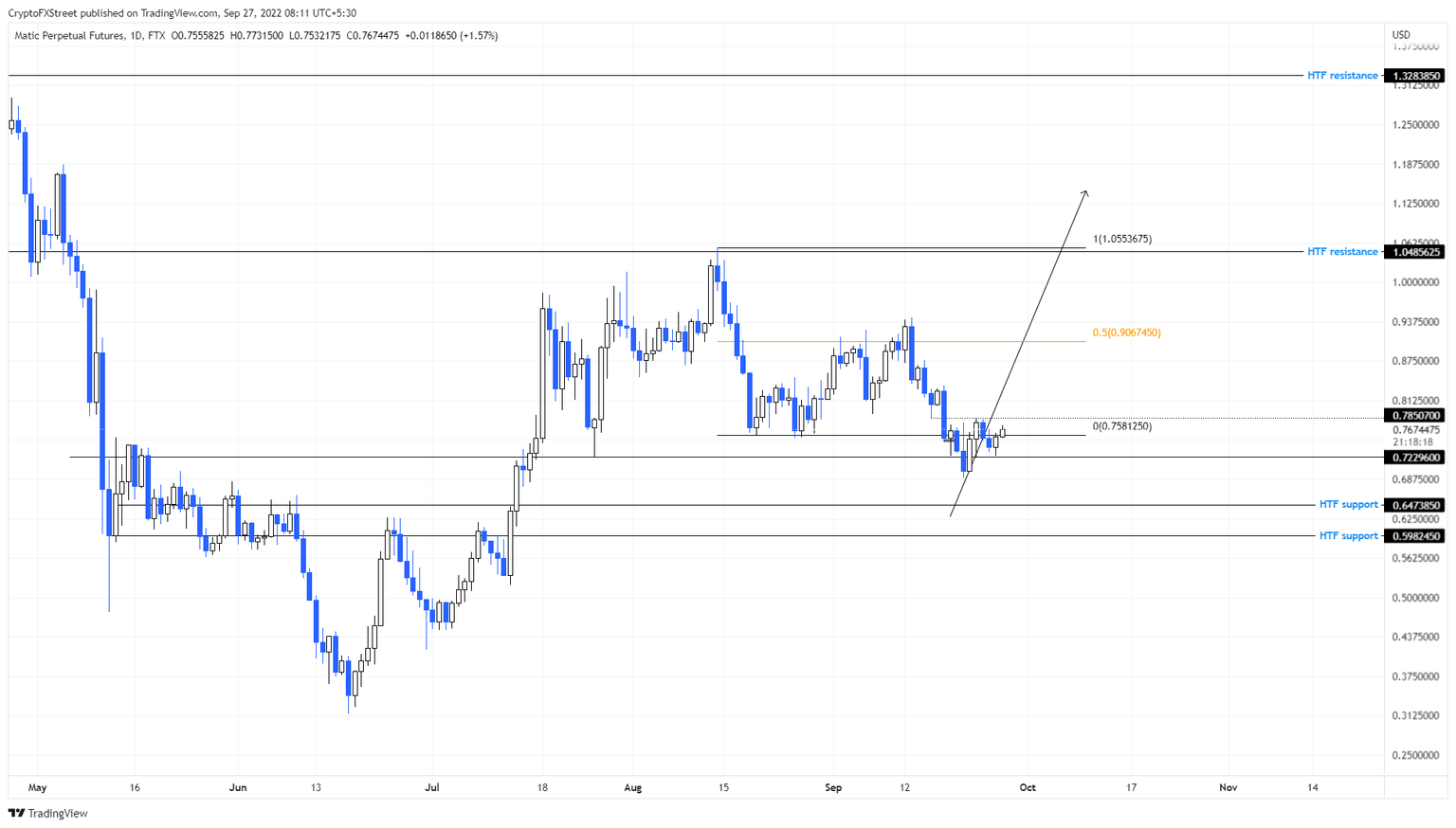

- MATIC price has been indecisive for the last week as it consolidates around the range low at $0.758.

- A resurgence of buyers followed by a successful flip of $0.758 could result in a 20% run-up to $0.906.

- A daily candlestick close below $0.722 will create a lower low and invalidate the bullish thesis for Polygon.

MATIC price continues to consolidate around the range low for more than a week and shows no signs of breaking out. Investors should pay close attention and anticipate the bullish resurgence, which could trigger an explosive move.

MATIC price ready to make some noise

MATIC price crashed 26% between September 13 and September 21 and slipped below the range low at $0.758. Since then, Polygon bulls and bears have been in a fight to take control. So far, there are no discernable signs of an explosive move.

If buyers step up and push MATIC price higher to successfully flip the range low at $0.758 into a support level, it will be the first bullish signal.

The second sign that investors need to pay close attention to is for Polygon bulls to produce a higher high above the recent swing high at $0.784. These developments will indicate a willingness from the buyers’ camp and could be the key to triggering a 20% run-up to the range’s midpoint at $0.906.

Although unlikely, investors should watch for an extension of this move to the range high at $1.05, especially if the market conditions are right. This move by MATIC price would constitute a 40% gain and is likely where the upside is capped for Polygon in the short term.

MATIC/USDT 1-day chart

On the other hand, if MATIC price fails to move past the range low at $0.758, the consolidation might continue until Bitcoin price comes to the rescue. If MATIC price produces a daily candlestick close below the $0.722 support level, it will create a lower low and invalidate the bullish thesis for Polygon. In such a case, the altcoin could crash 10% to retest the $0.647 support level.

Note:

The video attached below talks about Bitcoin price and its potential outlook, however, this is still relevant as it is likely to influence MATIC price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.