MATIC and MINA protocol ride the zk hype ahead of major Ethereum upgrade

- MINA protocol launched its multi-year roadmap, introducing a zk layer to boost scaling.

- Polygon capitalized on the hype surrounding zero-knowledge solutions, however it failed to capture over 2% of market share.

- zkSync dominates nearly 60% of all activity on zero-knowledge solutions, partly due to the hype surrounding its token airdrop.

MATIC network and MINA protocol are two projects that recently rolled out upgrades and a roadmap to boost scaling and decentralization through the zero-knowledge (zk) hype. A major Ethereum upgrade is slated to occur on April 12, this is a driver for narratives surrounding Ethereum scaling and the zk hype.

Polygon recently forayed into a zero-knowledge solution zkEVM and MINA protocol published its roadmap, boosting faster and low-latency transactions through zero-knowledge programmability.

Also read: Ethereum (ETH) price volatility increases with upcoming Ethereum token unlock

MINA protocol shares detail roadmap, proposes new zk solution

MINA protocol, one of the lightest blockchains in the world, announced its roadmap. The zero-knowledge Layer 1 blockchain MINA is focused on developing systems with trust minimization, ZK-Programmability, and enhanced performance.

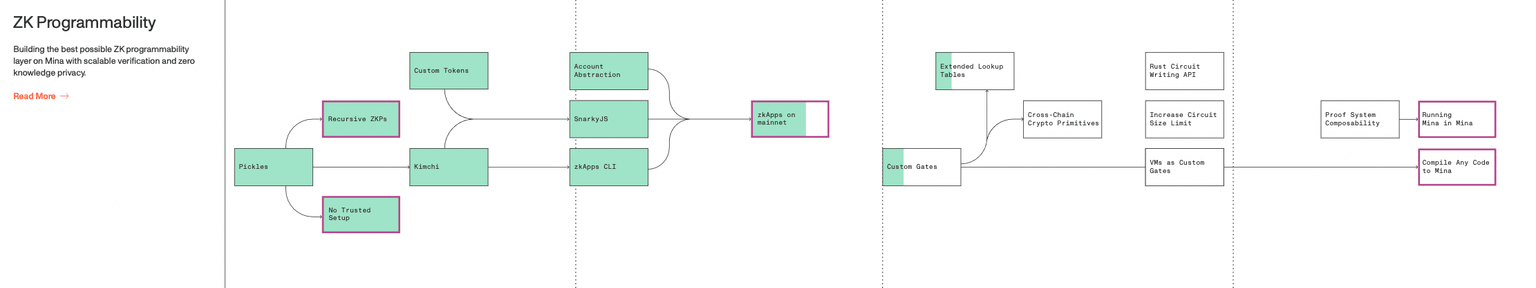

MINA’s roadmap for ZK Programmability is focused on boosting scalability and privacy for the project.

ZK Programmability

MINA’s roadmap launch failed to trigger a recovery in the protocol’s native asset. MINA is exchanging hands at $0.72, yielding 4% losses for holders over the past week.

The protocol intends to capitalize on the zk hype and bring their zk programmability solution to mainnet in 2023.

MATIC attempts to capture higher share of trading activities in zk

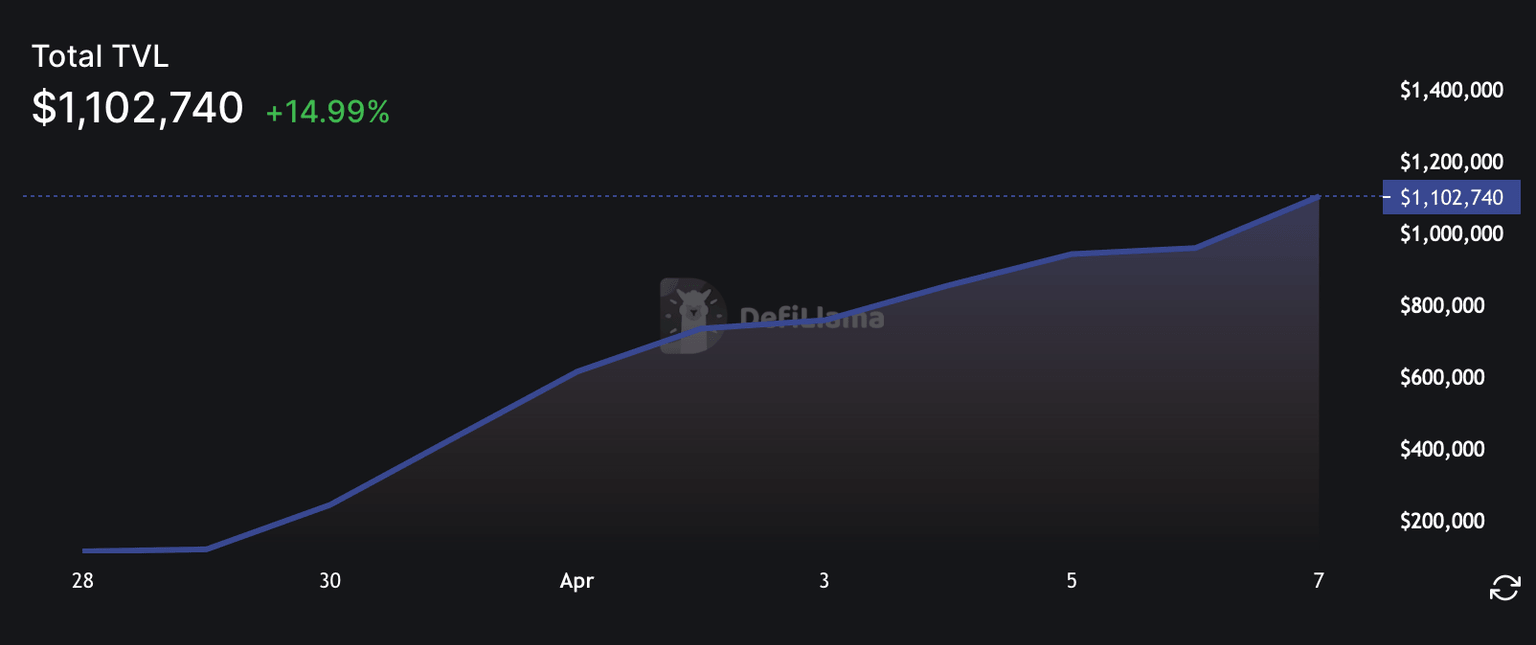

Polygon network recently launched zkEVM, the layer 2 protocol’s take on scaling the Ethereum blockchain with higher efficiency. Polygon’s zkEVM has a Total Value Locked (TVL) of $1.1 million, according to data from DeFi aggregator DeFiLlama.

Total TVL in Polygon’s zkEVM

Data from Nansen shows a consistent decline in the daily active users and activity on both Polygon’s zkEVM and zkSync. However, in terms of market dominance, zkSync controls 57.7% of all activity on zkEVM networks.

DAU and market share of zkSync, StarkNet and Polygon zkEVM

StarkNet is second to zkSync, coming in at second place with 25% of market share in the zk ecosystem. MATIC network lags behind and is limited to less than 2% of the zk market share.

The zk narrative hype

Crypto Twitter is filled with speculation from analysts predicting an airdrop in zkSync. The zk narrative has gained traction, driving users and higher TVL to the ecosystem, as noted above. Projects like MINA protocol are working on launching roadmaps and capitalizing on the zk narrative to gain higher market share and users. Ethereum's upcoming upgrade Shanghai hard fork has fueled the hype surrounding the altcoin blockchain's scalability. This supports the narrative of zk projects and scalability of the ETH blockchain.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.