MakerDAO Price Analysis: MKR looks poised to jump up

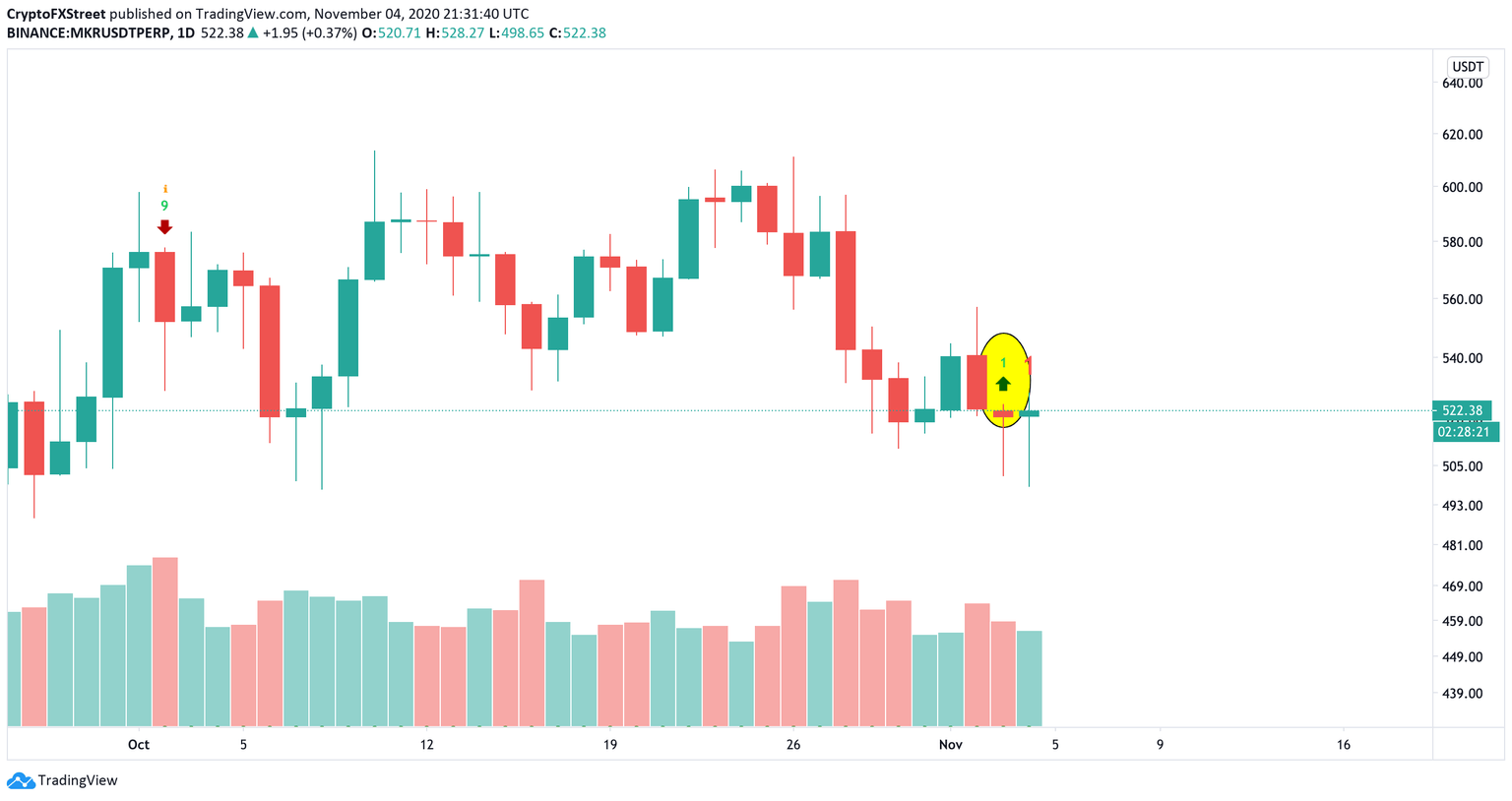

- MKR has flashed the buy signal in its daily price chart with a green-one candlestick.

- Price faces immediate resistance obstacle between $524 and $538.50.

Since September 29, MakerDAO has been trending between $520 and $595. The price has been struggling to consolidate its position above $600. However, technical analysis suggests that the price may enter a bullish upswing soon.

MKR looks to recover lost ground

Looking at the daily price chart, it seems like the TD sequential index has flashed a buy signal with a green-one candlestick. This will prompt the price to jump up by one to four daily candlesticks or begin a new uptrend. By riding this wave, MKR should be able to break above $600 effectively.

MKR/USDT daily chart

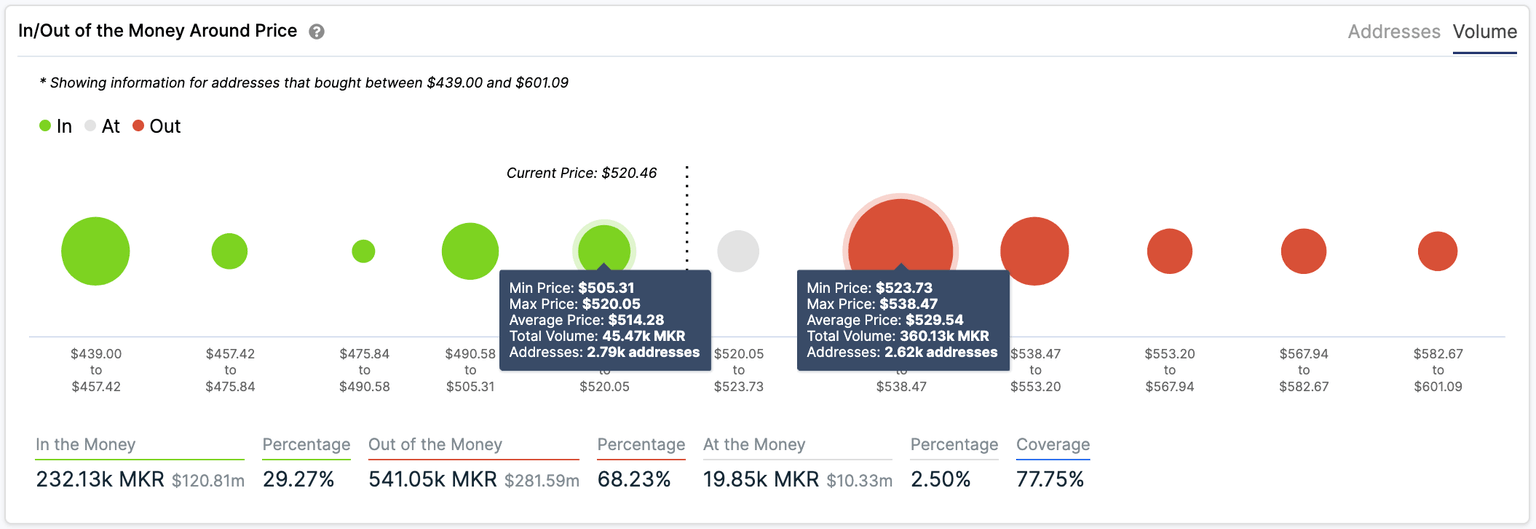

This bullish outlook holds when observing the daily price chart. It looks like the price is rebounding from the lower boundary of a parallel channel that developed within the same time frame. Looking at IntoTheBlock’s In/Out of the Money Around Price (IOMAP) will help us better determine possible resistance barriers on the way up.

MKR/USDT daily chart

Maker's IOMAP suggests that there is an immediate obstacle between $524 and $538.50. It looks like 2,600 addresses had previously purchased 360,000 MKR tokens at this level. If the buyers manage to do so, the lack of strong resistance walls upfront could push it into the $600-level.

Maker IOMAP

While the overall outlook is bullish, it should be noted that the top-35 cryptocurrency is currently sitting on top of weak-to-moderate support walls. The IOMAP shows that the price could potentially drop to the $445-$465 range before it encounters moderate support. As such, the sellers could take advantage of the weak support walls to invalidate this bullish outlook.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

-637401296756243734.png&w=1536&q=95)