MakerDAO Price Prediction: MKR aims at a potential price target of $700

- MKR is trading inside an ascending triangle pattern.

- Several on-chain metrics have turned bullish in favor of MKR, which is eying up $700.

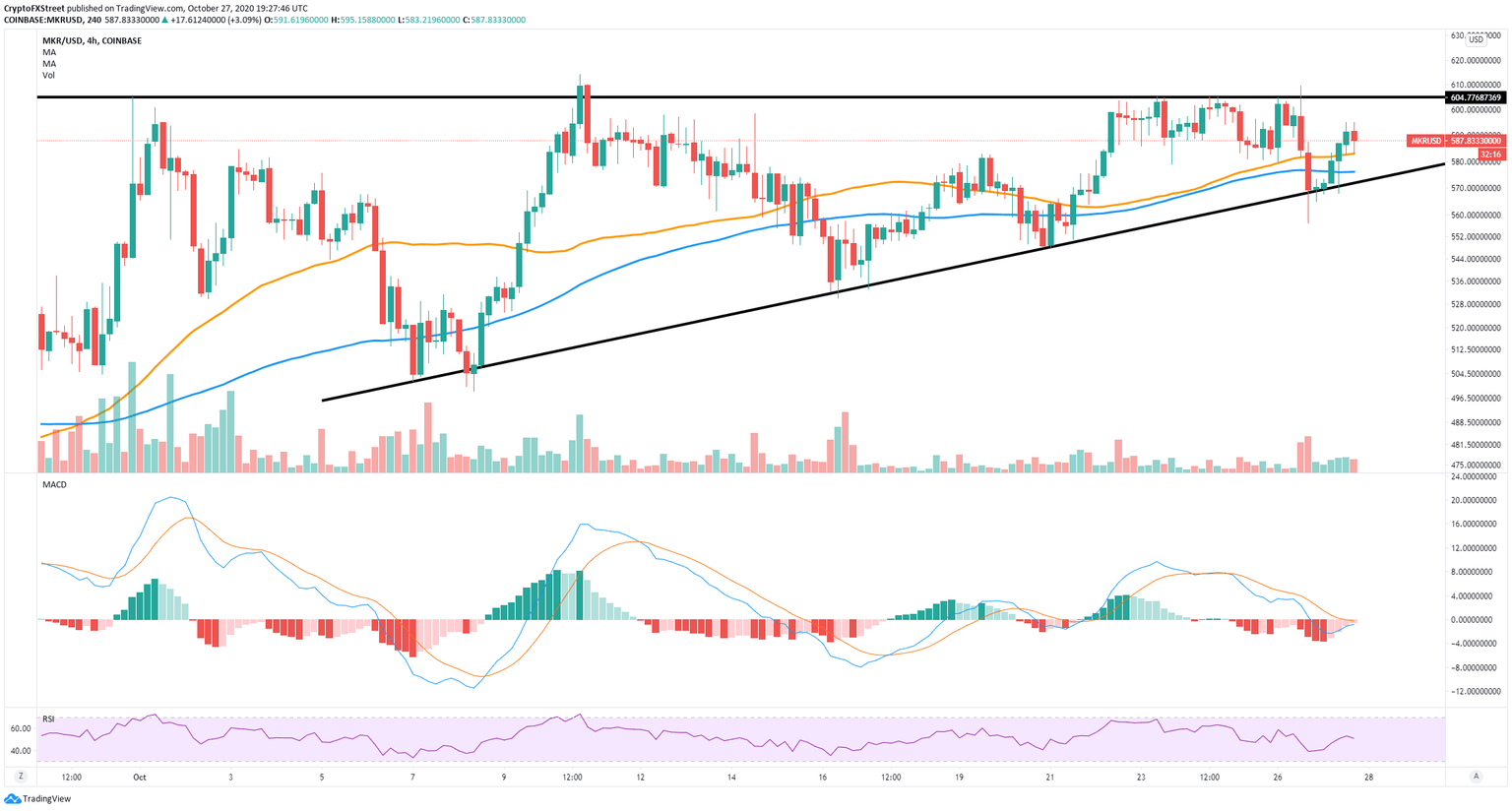

MKR has been trading inside an ascending triangle for around 20 days, currently at $589, with a precise resistance level located at $604. The price got rejected several times from this upper boundary, but the support trendline below was held.

A breakout above $604 can drive MKR towards $700

On the 4-hour chart, MKR's price got rejected several times from the upper boundary of the triangle. However, the price has climbed above the 50-SMA and the 100-SMA, turning both into support levels. Most notably, the MACD is on the verge of turning bullish.

MKR/USD 4-hour chart

The last time this happened, the price of MKR rose by 6% within the next 24 hours. A bullish breakout above the resistance level at $604 can drive the digital asset towards a price target of $700.

MKR New Addresses chart

The number of new addresses joining the MakerDAO network is increasing significantly at 47% over the past week. This rise suggests that new investors are highly interested in the digital asset, which translates into buying pressure.

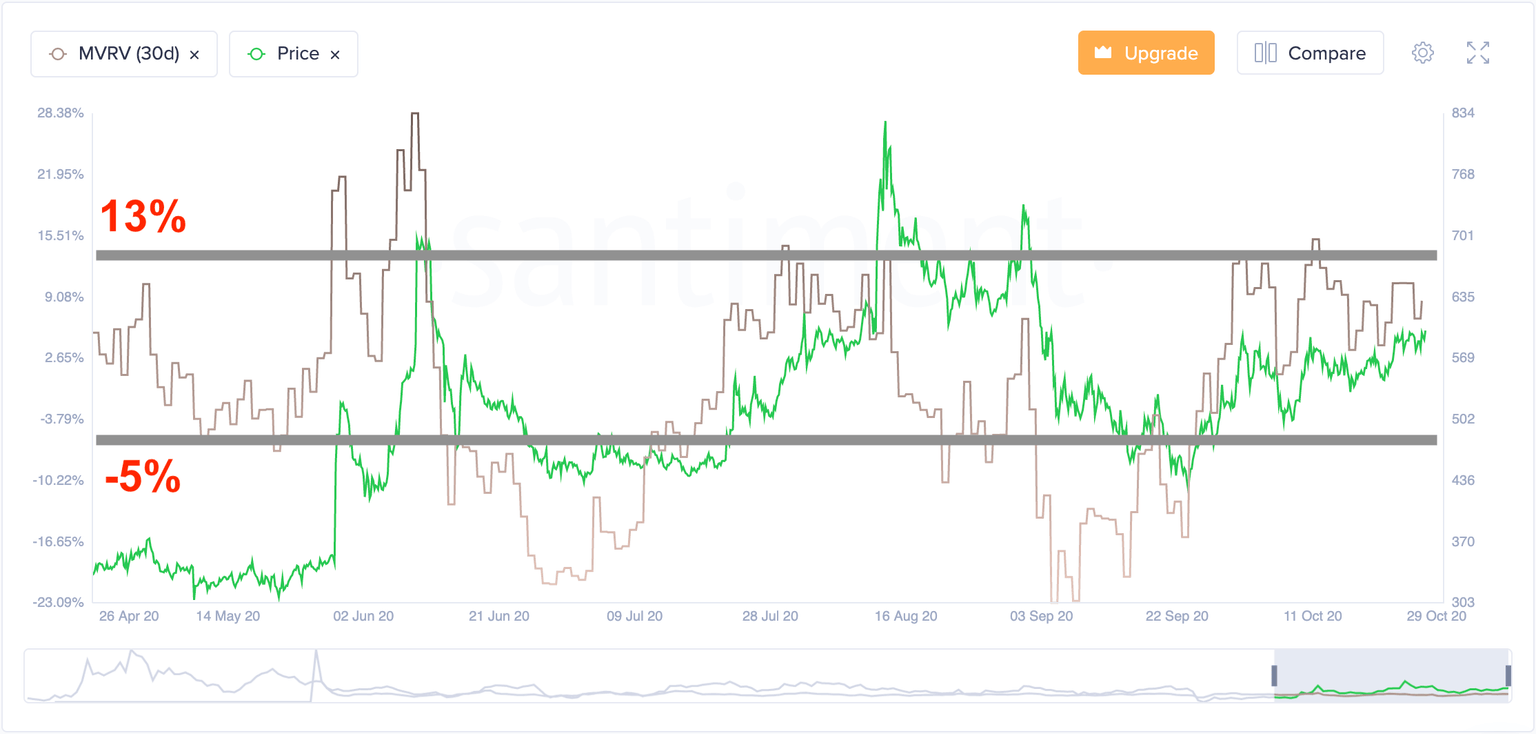

MKR MVRV chart

The Market-Value-to-Realized-Value (MVRV) ratio shows that bulls have a lot of room upside until it hits the 'danger zone,' which is above 13%. This area is currently located at around $700, which is the bullish price target for MKR.

Bears can push MKR down to $500

Nonetheless, failure to hold the 50-SMA and the 100-SMA on the 4-hour chart would shift the odds in favor of the bears. Breaking below the lower boundary of the ascending channel, presently around $575, can drive MKR down to $500.

MKR IOMAP Chart

This theory is further confirmed by the In/Out of the Money Around Price chart, which shows very little support until the area between $501 and $520 with a total volume of 342,000 MKR tokens. Inside this range of prices, a lot of investors bought a large sum of MKR tokens.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.