Maker price uptrend could face headwinds as on-chain metrics flash warning signs

- Whales are accumulating the Maker token, but these wallets are sitting on unrealized profits.

- MKR on-chain metrics are flashing bearish signals, increasing the likelihood of a correction in the token's price.

- MKR price yielded nearly 7% gains for holders on the day, and 6% weekly gains.

Maker (MKR), a smart contract token, is being accumulated by large wallet investors that scooped up MAKER in the past day. These addresses are sitting on unrealized profits, according to an on-chain data provider.

On-chain metrics of Maker are supporting a bearish thesis for the asset in the short term.

Also read: Ethereum price rally could extend, riding on bullish on-chain metrics

Whale wallets hold estimated profits of more than $500,000

Crypto on-chain intelligence provider SpotOnChain identified the Maker token as the sixth largest asset in terms of smart money inflow in the past 24 hours. Smart money is capital invested by people with expertise or knowledge on the market’s condition. Two notable whales accumulated MKR tokens in the past 12 hours.

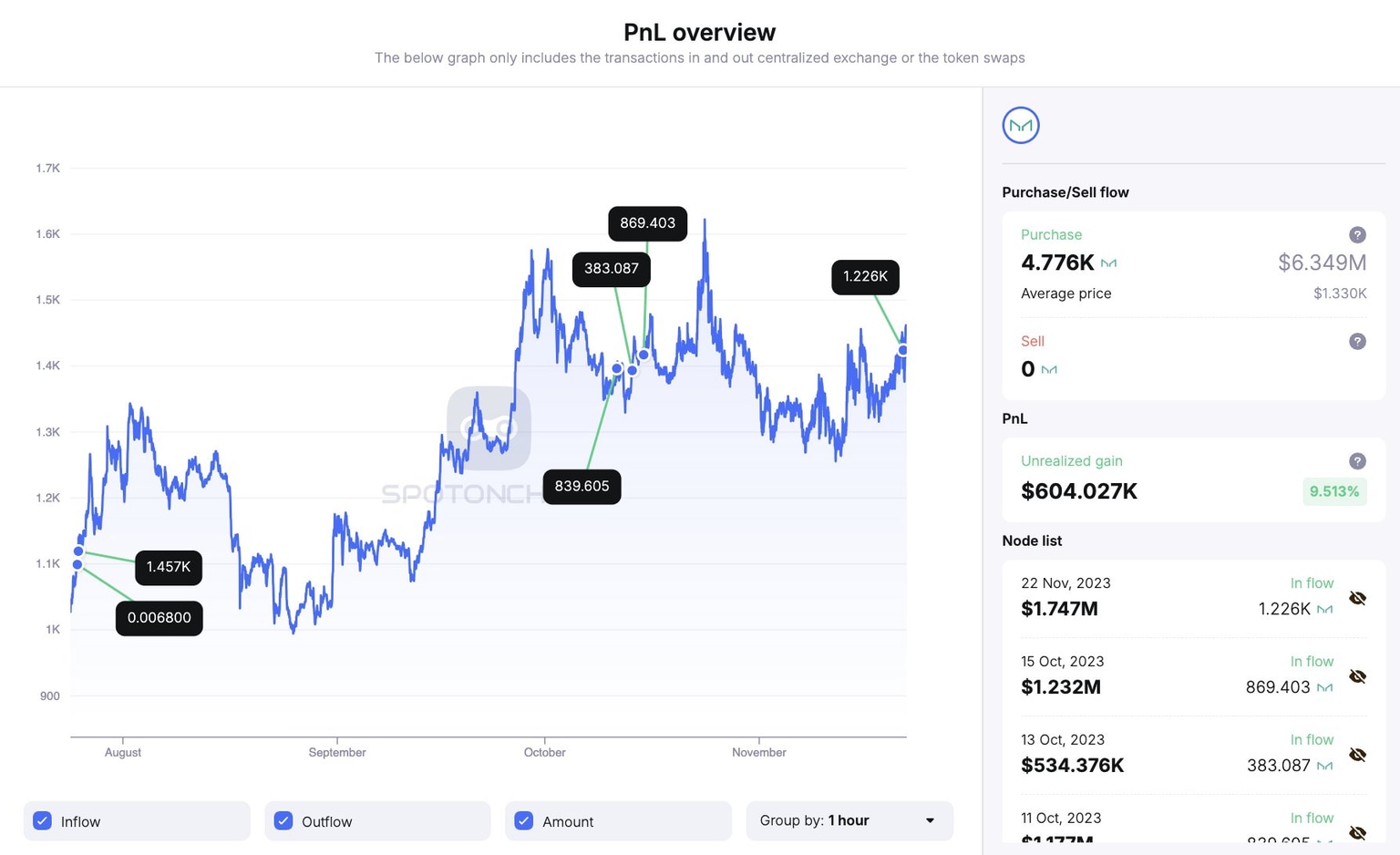

@Maven11Capital, a large wallet investor and VC, added MKR to their token holdings for the first time in two years. The firm bought 899 MKR on Binance at a price of $1,450. Meanwhile, another whale wallet (0x9e7) scooped up 1,226 MKR worth $1.75 million, at an average price of $1,424, on Binance. Both transactions occurred within the past 24 hours, with one of these investors sitting on an unrealized profit of $609,000.

0x9e7 Profit and Loss overview

On-chain metrics support bearish thesis for MKR

Based on data from crypto intelligence tracker Santiment, the supply of MKR on exchanges as a percentage of the token’s supply signals a rise in selling pressure on the asset. MKR supply on exchanges climbed from 7.01% on September 5 to 9.49% early on Wednesday. Higher supply tends to increase the selling pressure on the asset.

MKR price is therefore likely to crumble under pressure from climbing exchange reserves.

MKR supply on exchanges and price

Network realized profit/loss (NPL) is a metric used to identify the average profit or loss of all coins that moved on the chain on a daily basis. As seen in the chart below, MKR holders realized massive profits on October 24, when the asset’s price was $1,500. Since then, there has been profit-taking activity in short amounts. A large spike in profit-taking is typically followed by a decline in the asset’s price.Therefore, MKR price is likely headed towards a correction.

NPL and price

MKR price is $1,455 on Binance at the time of writing.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B16.56.55%2C%252022%2520Nov%2C%25202023%5D-638362517200180519.png&w=1536&q=95)

%2520%5B16.20.17%2C%252022%2520Nov%2C%25202023%5D-638362517494764602.png&w=1536&q=95)