Litecoin Price Prediction: LTC jumpstarts uptrend as $160 beckons – Confluence Detector

- Litecoin sustains recovery to $150, but bulls have eyes on $160.

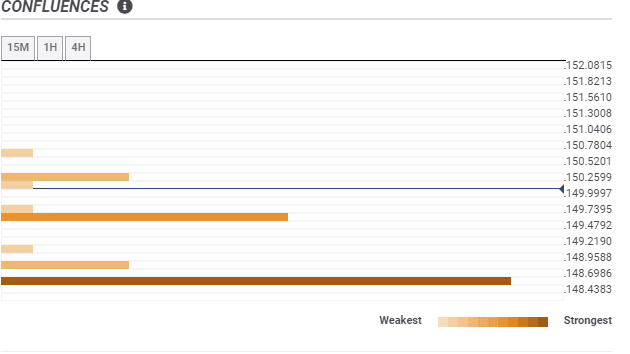

- The confluence detector tool reveals the absence of formidable hindrances to the anticipated rally.

Litecoin is up over 10% to exchange hands at $150. The bullish move comes after LTC/USD broke down to $110 on Monday. Recovery has been gradual but steady. Litecoin must close the day above $150 to validate the uptrend eyeing $160.

Litecoin battles the 50% Fibonacci level resistance

The $9.9 billion coin is fighting an uphill battle at the 50% Fibonacci retracement level, taken between the last drop from $185 to a low of $110. LTC must break the seller congestion at this level to advance higher.

Marginally below the current price level, Litecoin is supported by the 50 Simple Moving Average. Therefore, this support must be defended to avoid a correction to $140 (38.2% Fibo).

The moving average convergence divergence, or MACD, adds credence to the optimistic outlook. This technical indicator follows the path of a trend and calculates its momentum.

The MACD appears to be turning bullish, with a similar motion before the breakout in December. As the 12-day exponential moving average crossed above the 26-day exponential moving average, the odds for a bullish impulse increased significantly.

LTC/USD 4-hour chart

The confluence tool brings to light that Litecoin has no formidable hindrance as it advances higher. However, buyers must ensure that they hold onto the crucial $150 level as highlighted by the 1-hour Bollinger band upper boundary.

On the downside, Litecoin is fashioned with robust support levels at $149.7 and $148.7. The 4-hour previous high identifies the former support while the latter, which is also the strongest, is highlighted by the one-day previous high.

LTC/USD confluence levels

The bullish outlook would be sabotaged on the bearish side if Litecoin closed the day under $150. Moreover, if the support at $150 fails to hold, massive losses to $140 may come into the picture.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520(23)-637462092301976214.png&w=1536&q=95)