Altseason draws nigh, but first technicals point to a steep correction

- The altcoin market cap is at a healthy level, the next bull run eyes new all-time highs.

- Altcoins such as Ethereum, Ripple, and Litecoin need to decouple from Bitcoin for an independent altseason.

The cryptocurrency market capitalization recently crossed the $1 trillion level for the first time in history. However, the market value has dived to the current $910 billion following the massive retracement in Bitcoin price from highs above $40,000 to intraday lows of $33,344.

While Bitcoin takes up the larger chunk of the market value, altcoins have also performed relatively well. Notably, Bitcoin's dominance has been maintained under 70%. At the time of writing, altcoin's market value stands at $280 billion, leaving Bitcoin with the larger $628 billion.

Altcoin market capitalization still impressive

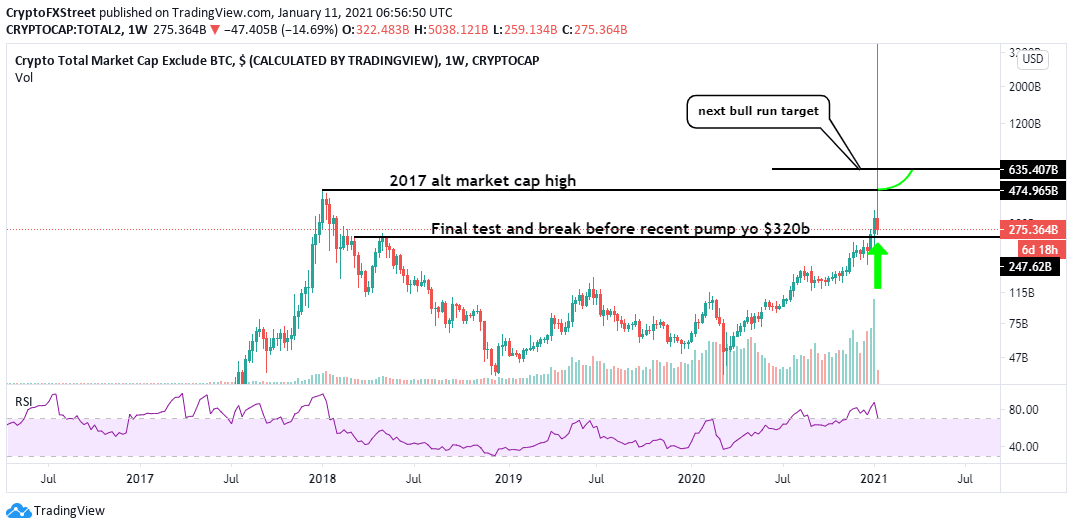

During the ongoing bull run, the altcoin initial impulse wave hit $320 billion. A retreat has been embraced, but if the market value is to hold above $225 billion, the next bull cycle will likely elevate the altcoin market capitalization nearer to the new all-time highs.

Altcoin market cap

Altcoins, especially the major ones like Ethereum, Ripple, and Litecoin, is still massively correlated to Bitcoin. Over the last 24 hours, Bitcoin has plunged, losing nearly 20% of its value following a rejection from $40,000.

Similarly, Ethereum tumbled in tandem with Bitcoin losing over 20% of its value to exchange hands at $1,040. Consequently, Ripple is down 25% and is currently trading at $0.26, while Litecoin has dropped to $136 on losing 25% of its value.

This proves the altcoins' correlation to Bitcoin is perhaps due to Bitcoin's enormous market share. Therefore, the altcoin season is possible, but investors have to pay more attention to the tokens, which could diversify their investments. Breaking from Bitcoin will allow the tokens to chart their path while ignoring Bitcoin swings (consider the recent volatility to $42,000 and back to $33,000).

According to a famous cryptocurrency trader, NebraskanGooner, it is essential to keep in mind possible technical corrections, conceivably sharp ones, before the altcoin season fully kicks in.

Moreover, it may not be wise to go all-in on any entry because, as an investor, you need some extra funds to add on a dip. On the other hand, adding more during confirmed breakouts tends to yield fast and stress-free gains.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren