Litecoin Price Forecast: LTC seems poised to retreat to $70

- Litecoin encounters resistance at $90, delaying price action to $95 and $100, respectively.

- LTC/USD could get into a consolidation period based on the IOMAP model.

Litecoin recently closed in on $100 but hit a barrier at $95. The cryptoasset led other altcoins such as Ethereum into the bull cycle, as extensively covered earlier. A reversal appears imminent, notably if LTC drops below the ascending wedge pattern.

Litecoin under significant risk of losses towards $70

LTC/USD is trading at $87 after confirming short term support at $85. The immediate upside has been capped at $90, thus delaying recovery to $95 and $100, respectively. If the price fails to close the day above $90 again, selling pressure may surge, triggering declines towards $70.

The daily chart brings to light the formation of an ascending wedge pattern, which shows that the Litecoin uptrend is nearing exhaustion and a correction is around the corner. In other words, buying pressure has reduced significantly and a reversal seems imminent. Trading below the wedge may reinforce the selling pressure, pulling LTC back to $70.

LTC/USD daily chart

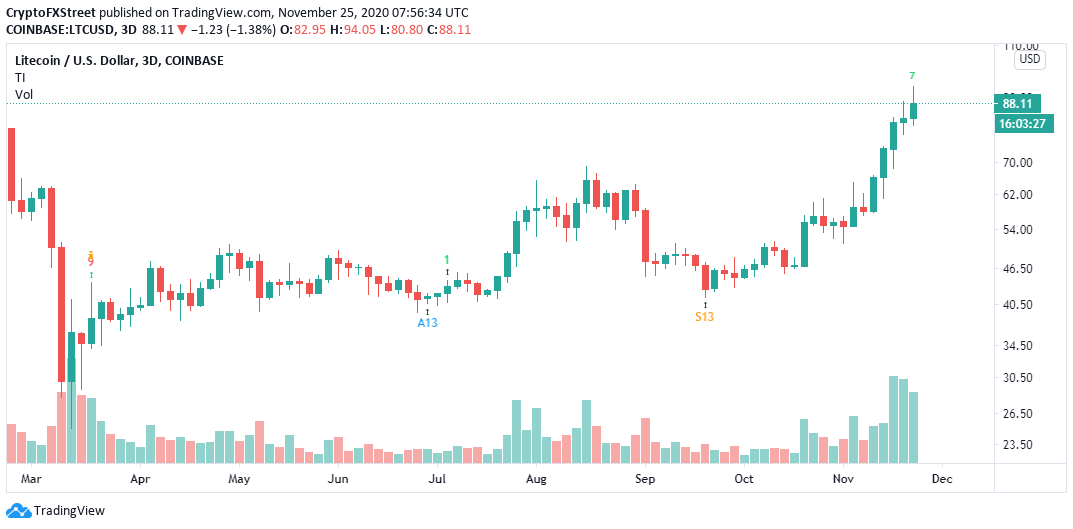

The TD Sequential indicator is likely to present a sell signal on the 3-day chart in the coming few days. This signal will take the form of a green nine candlestick. If validated, it may lead to declines in one to four daily candlesticks, thereby validating the bearish narrative.

LTC/USD 3-day chart

Santiment, a leading provider of on-chain metrics, shows that the transaction volume within the Litecoin network has gone down incredibly. The metric shows the aggregate of the tokens and all daily transactions taking place.

Usually, a spike in the volume is succeeded by growth in the value of the token. On the other hand, low volumes point towards falling prices or consolidation. In this case, Litecoin could drop following the significant decrease in the transaction volume.

Litecoin transaction volume chart

LTC trapped between big support and resistance areas

IntoTheBlock’s IOMAP model reveals that Litecoin is stuck between immense resistance and support zones. On the upside, the price movement has been capped by the seller congestion between $88 and $90. Here, nearly 47,000 addresses had previously purchased roughly 1.8 million LTC.

Litecoin IOMAP model

On the flipside, Litecoin is sitting on immense support zones, starting with the range between $85 and $87.8. Here, approximately 71,200 addresses had previously bought around 1.4 million LTC. The support area is also resting on top of other massive buyer congestion zones. Therefore, it is doubtful that LTC will drop to $70, thus invalidating the bearish outlook.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%20(10)-637418876433244515.png&w=1536&q=95)

%20%5B10.31.07%2C%2025%20Nov%2C%202020%5D-637418876846536270.png&w=1536&q=95)

-637418877406071410.png&w=1536&q=95)