Litecoin (LTC) Price Analysis: LTC/USD bears set eyes on $45.00

- LTC/USD has dropped below SMA50 4-hour amid strong bearish sentiments.

- The initial support is located on the approach to psychological $45.00.

Litecoin (LTC), the sixth-largest digital asset with the current market capitalization of $2.9 billion, has recovered from the Asian low of $45.25and recovered to $45.90 by the time of writing. The coin has lost 1.7% on a day-to-day basis and 3.6% since the beginning of Monday. While the coin managed to recover from the intraday low, the upside momentum has yet to gain traction.

Litecoin's technical picture

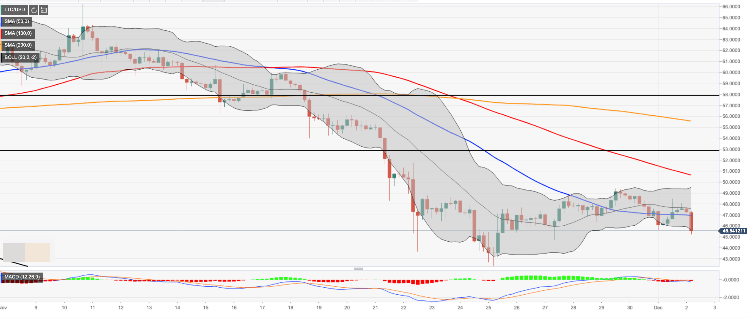

From the intraday perspective, we will need to see a sustainable recovery above SMA50 (Simple Moving Average) 4-hour on approach to $47.00 to mitigate the immediate bearish pressure and allow for an extended upside move. The next resistance is created by $49.50 ( the upper line of 4-hour Bollinger Band) and psychological $50.00 above this handle for the upside to gain traction.

On the downside, a sharp decline towards the intraday low of $45.25 will signal that the bearish trend is resumed and bring November 25 low of $42.35 back into focus. This area is likely to slow down the sell-off; however, once it is cleared, a psychological $40.00 will come into focus.

LTC/USD, 4-hour chart

Author

Tanya Abrosimova

Independent Analyst