Litecoin is forming a bullish pattern

Litecoin is a peer-to-peer cryptocurrency created in 2011 by Charlie Lee as a faster and more lightweight alternative to Bitcoin. It uses the Scrypt hashing algorithm, which allows for quicker transaction confirmation times and lower fees. Often referred to as the "silver to Bitcoin's gold," Litecoin remains one of the most established and widely traded cryptocurrencies.

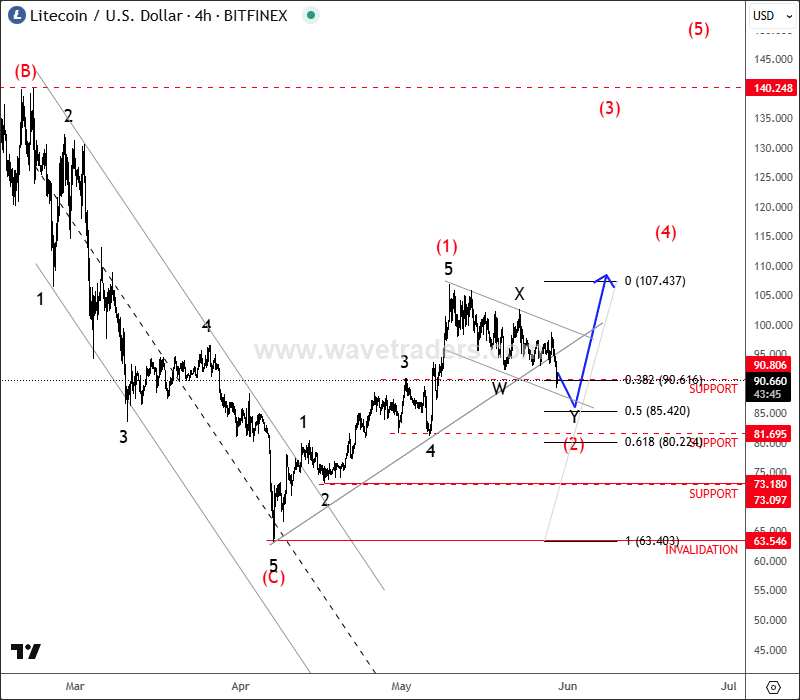

Litecoin with ticker LTCUSD made nice and clean five-wave recovery back to 100 area in the 4-hour chart, which confirms support in place and bullish reversal, so it can be a higher degree wave (1), thus more upside is expected for a higher degree wave (3) after current complex W-X-Y correction in wave (2) that can be in final stages. First support is here around 90-85 area, while second deeper one would be at 80 area.

LTC/USD four-hour chart

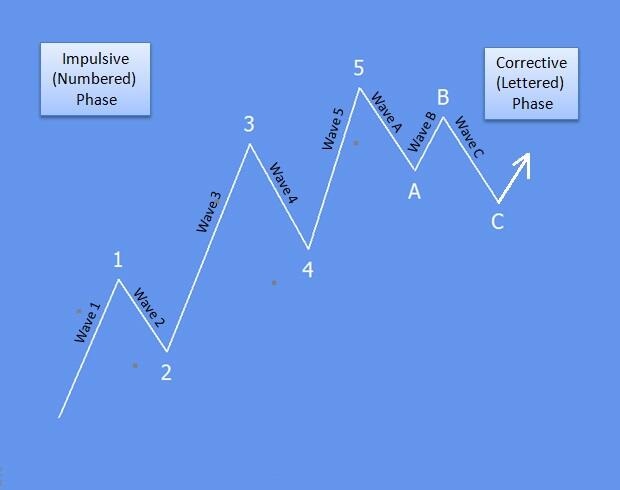

Basic Bullish Elliott Wave Pattern shows that after a five-wave impulse rally, followed by a three-wave corrective setback, we can expect a bullish continuation.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.