Justin Sun stakes Ether with Lido, says TRON Protocol offers six times higher yield at nearly 25%

- Justin Sun says he uses Lido to stake Ether and earns a 4% risk-free return.

- Sun says Tron staking protocol offers six times the return at 24.84%.

- TRON eyes nearly 7% gains and $0.14 target.

Justin Sun, founder of TRON and crypto expert compared the staking yield on Ethereum and TRON in a recent tweet. Sun stakes his Ethereum with Lido Protocol and earns a 4% yield on his holdings.

TRON staking offers six times higher yield than Ethereum

In a recent tweet on X, Justin Sun compared the yield from staking the second largest cryptocurrency and TRON. Sun disclosed that he stakes Ether holdings with Lido, a DeFi staking protocol. Sun gets 4% on staking his Ether with Lido.

Sun said that staking TRON offers over 24% yield within the TRON protocol.

I use Lido to stake my ETH, currently earning a stable 4% risk-free return. What is the risk-free #TRX staking product within the TRON protocol? The answer is sTRX, with an annual yield of 24.84%, more than six times that of the Ethereum. Stake here: https://t.co/AUs5W7M1r4 pic.twitter.com/abYstPbFkC

— H.E. Justin Sun 孙宇晨 (@justinsuntron) August 15, 2024

TokenTerminal data shows that TRON protocol revenue exceeds that of Ethereum by 50%. According to Sun, if this trend continues TRON could surpass $2 billion in 2024, making it the most profitable blockchain in crypto.

In the past 30 days, according to @tokenterminal, TRON's protocol revenue has exceeded Ethereum's protocol revenue by 50%. If this trend continues, TRON's protocol revenue could even surpass $2 billion this year, making it the most profitable blockchain on Earth! pic.twitter.com/kbzjU5zM5O

— H.E. Justin Sun 孙宇晨 (@justinsuntron) August 15, 2024

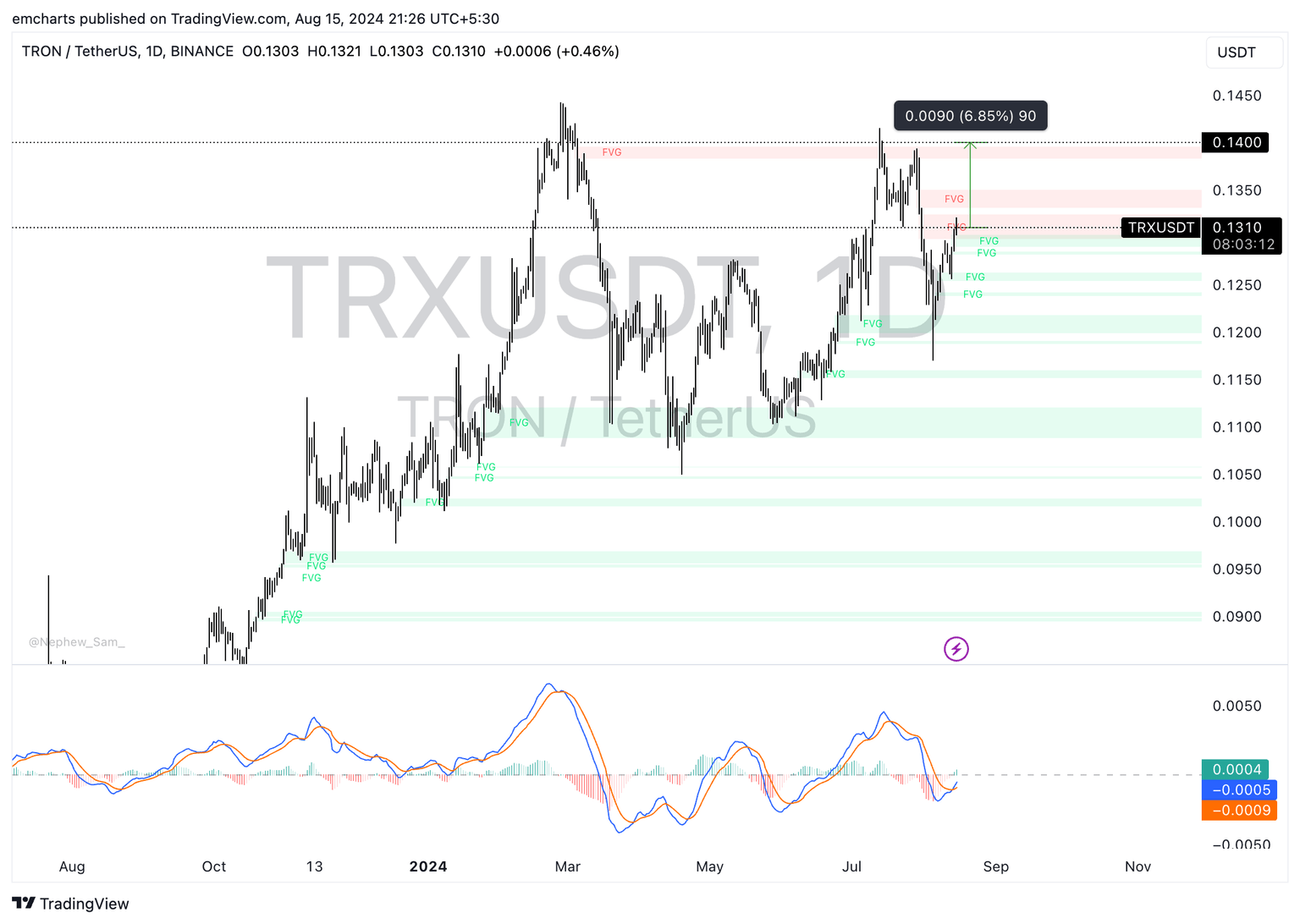

TRON eyes rally to $0.14

TRON trades at $0.1310 at the time of writing. The token could extend its gains by nearly 7% and target $0.14, a key level for TRON. The $0.14 level has acted as resistance since March 2024. TRON could face resistance in the Fair Value Gap (FVG) between $0.1330 and $0.1350.

The Moving Average Convergence Divergence (MACD) indicator shows underlying positive momentum in TRON’s price trend.

TRX/USDT daily chart

TRON could find support at $0.1290 in the event of a correction.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.