Is Avalanche price on its way back to $30?

- Avalanche price have not shown bearish divergence on the Relative Strength Index.

- AVAX price has successfully hurdled the 8- and 21-day simple moving averages.

- Invalidation of the uptrend scenario is a breach below $16.42.

Avalanche price has risen 25% over the weekend. The recent bearish candles should be viewed as a profit taking rather than a sell-off.

Avalanche price has more upside potential

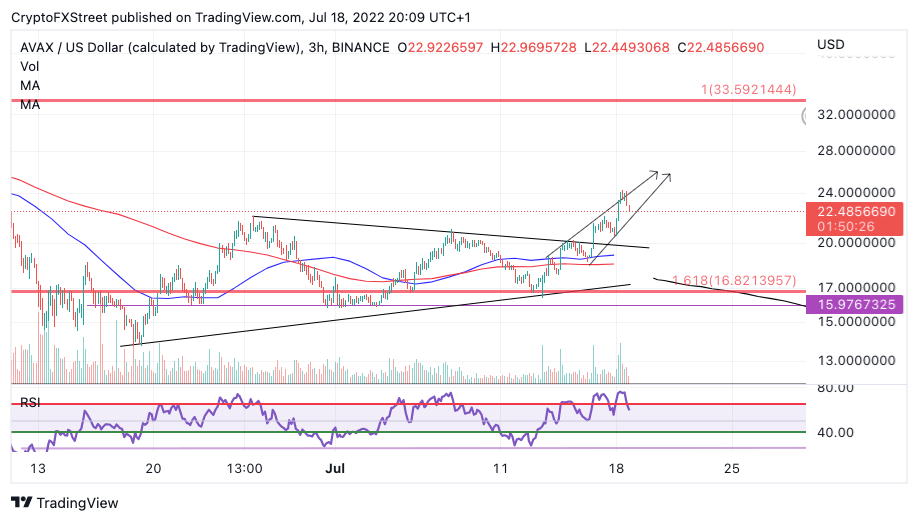

Avalanche price currently trades at $22 as the bears are taking advantage of the influx of liquidity during the New York trading session. Since July 14, the bulls have established a wedging-like ascension with a newfound monthly high at $24.29. The wedge pattern does not come with any bearish divergence on the Relative Strength Index (RSI); thus, it is best to stay with the trend. What many pattern traders may be reading as a leading diagonal could also be a classical 1-2-1-2 pattern before an explosive rally targeting the $30 price zone occurs.

Avalanche price was able to break and retest above both the 8- and 21-day moving averages. When combined with the missing RSI divergence, AVAX has more upside potential. Avalanche price could end up retracing into the $19 price zone to grab liquidity before the next move up. Traders looking to enter the market should consider waiting for a retest of the $24 barrier before placing an entry.

Invalidation of the bullish scenario is a breach below $16.42. If the bears can reconquer the invalidation point, they may be able to reroute south and target $11, resulting in a 50% decrease from the current Avalanche price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.