IOTA Market Update: IOT/USD is set to continue the downside correction

- IOT/USD is set to continue the downside correction.

- Siemens files patterns with multiple reference to Iota technologies.

IOTA is the 24th largest digital asset with the current market value of $665 million and an average daily trading volume of $15 million. The coin is changing hands at $0.2380, mostly unchanged both on a day-to-day basis and since the beginning of Monday. Currently, the coin is moving within a short-term bearish bias within a tight range.

Siemens bets on IOTA technology

The German technology company Siemens may use IOTA technology in the future developments, according to a new patent. The company has already mentioned that IOTA had versatile application possibilities. Recently, the company submitted ten new patent applications where IOTA is mentioned on several occasions, according to the data from Espacenet Patent Research platform.

According to the patent, IOTA technology can be used for creating a distributed database system that will be able to process, store and evaluate large amounts of data and information. It will focus on the needs to large industrial companies. The company noted that IOTA is a high-performance and powerful “block-less distributed database system” suitable for the needs.

As the FXStreet reported recently, IOTA released Hornet node software upgrade.

IOT/USD: Technical picture

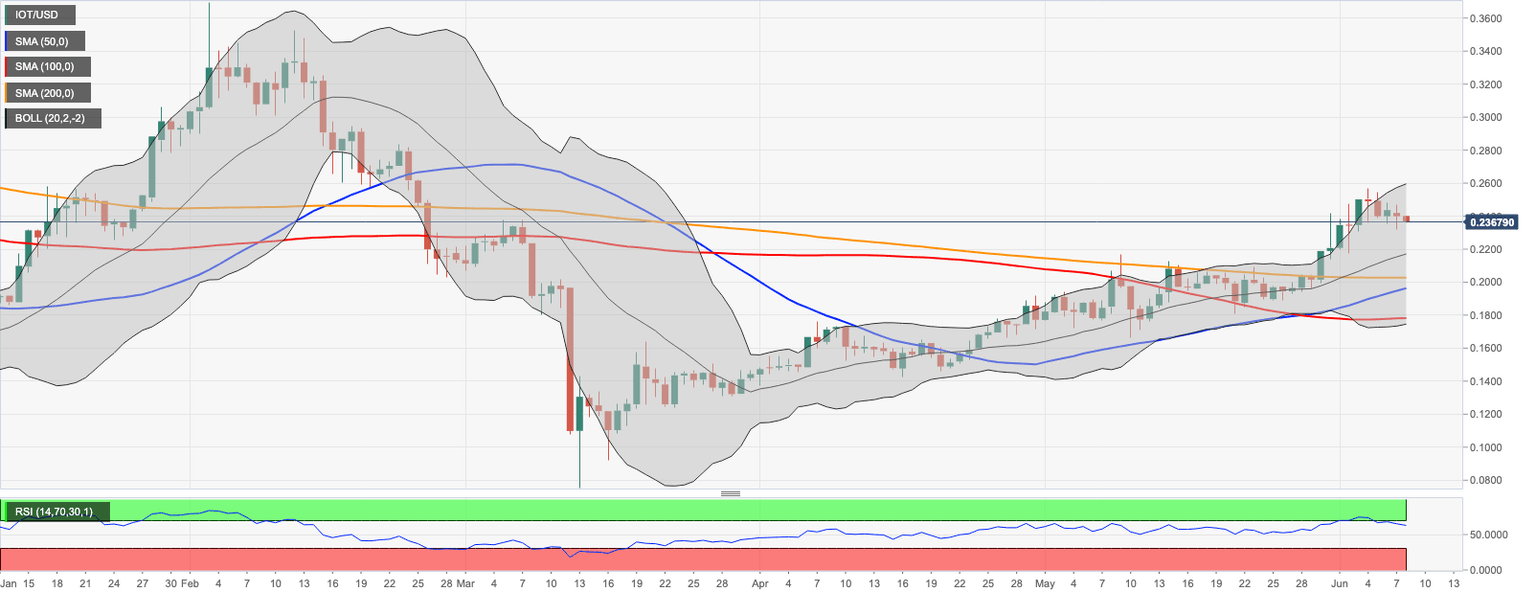

IOTA retreated from the recent high of $0.2570 hit on June 4 amid technical correction. On the daily chart, the price has returned inside the Bollinger Band and may continue the decline towards the middle line of the daily Bollinger Band, which is also an upper boundary of the previous consolidation channel. If it is broken, the sell-off may be extended towards daily SMA200 located on approach to psychological $0.2000.

On the upside, the initial target is created by Sunday's high at $0.2470. This barrier is followed by the upper line of the above-said Bollinger Band at $0.02400 and the recent recovery high.

IOT/USD daily chart

Author

Tanya Abrosimova

Independent Analyst