How long is the ongoing correction of the cryptocurrency market going to last?

Bulls could not hold the bears' pressure and the majority of the top 10 coins have followed the drop of Bitcoin (BTC). Solana (SOL) is the only exception to the rule, rising by 0.30%.

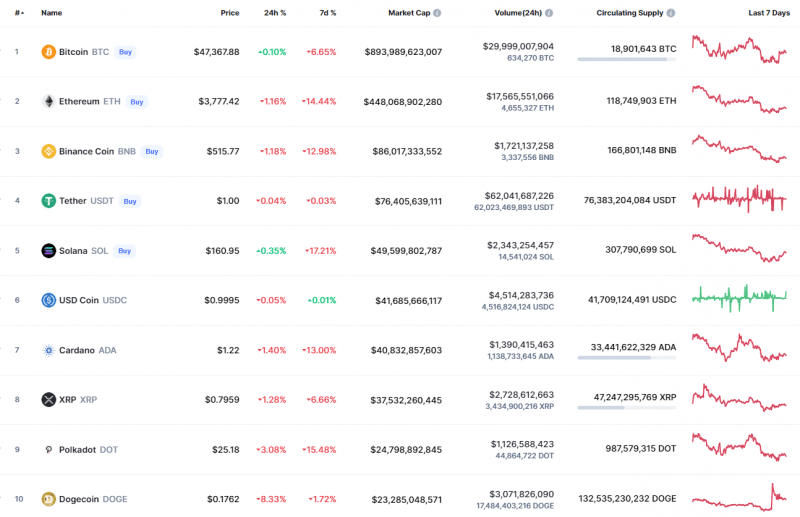

Top coins by CoinMarketCap

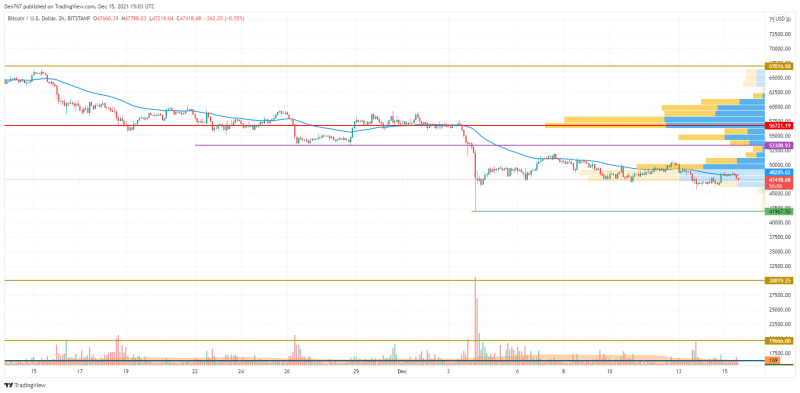

BTC/USD

Yesterday, the Bitcoin (BTC) price moved mainly in a side channel, the upper border of which was the $47,745 level. During the day, the price pierced this resistance but managed to gain a foothold above it only tonight. Buyers were able to form a weak bullish momentum that faded around the two-hour EMA55.

BTC/USD chart by TradingView

For more than a month now, bulls have not been able to truly gain a foothold above this level of average prices. Each time, the bears control weak breakout attempts and pull the BTC price back below the EMA55 moving average. It seems that, at the end of November, the pair was able to securely gain a foothold above the average. But at the beginning of this month, a strong bearish momentum pushed the price back into the September lows zone—to the $42,447 support level.

If the level of average prices again works out for a reversal of the pair, then by the end of this week the BTC price can return to the support of $42,447.

Bitcoin is trading at $47,200 at press time.

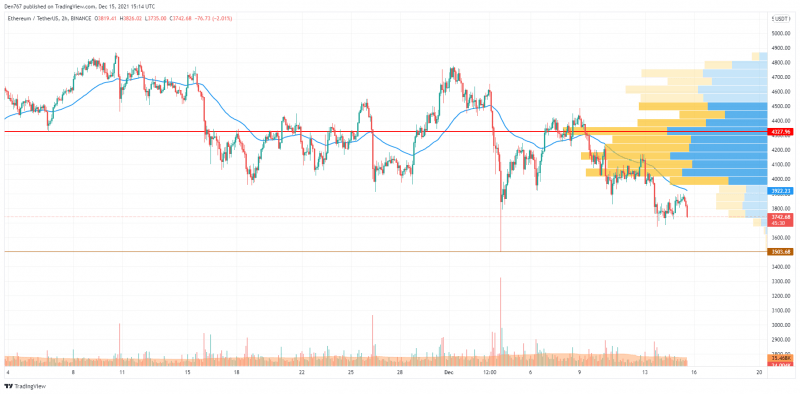

ETH/USD

Over the past day, the Ethereum (ETH) price managed to gain a foothold above the level of $3,800 but still has not been able to recover above the level of the two-hour EMA55. A weak recovery is not supported by large volumes.

ETH/USD chart by TradingView

If the bulls fail to break above the average price level, then by the end of this week, the Ether price can continue to decline toward the support of $3,400.

Ethereum is trading at $3,740 at press time.

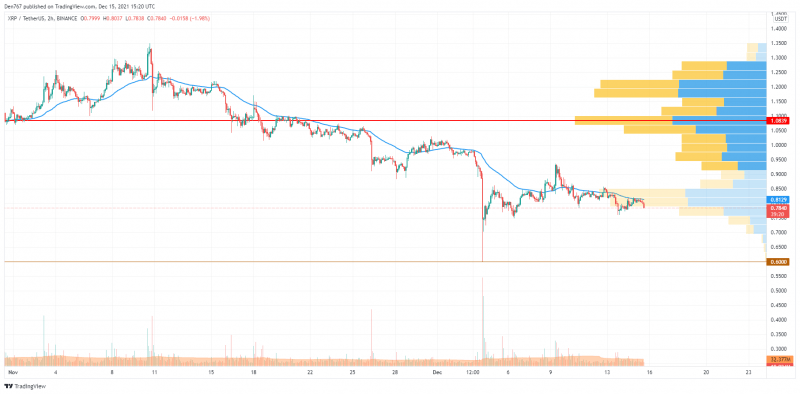

XRP/USD

Yesterday, the XRP price was trying to gain a foothold above the $0.80 resistance. By the end of the day, through the joint efforts of market participants, the price pierced the level of the two-hour EMA55, which keeps the pair in a local downtrend for a month.

XRP/USD chart by TradingView

If the XRP price recovers above the average price level with the support of a large buyer, then an increase to the resistance of $0.90 is possible.

If buyers fail to gain a foothold above the moving average EMA55, the monthly downtrend might continue below the support of $0.70.

XRP is trading at $0.7869 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.