Hedera Hashgraph rallies 150% in a week as its ecosystem expands

New partnerships, NFT integration and a market-wide surge in altcoin prices back HBAR’s recent 150% rally.

Real-world adoption and blockchain integration is the ultimate goal of any serious fintech protocol looking to offer workable solutions to some of the biggest challenges in finance and data transmission.

Hedera Hashgraph, a public network that uses a distributed ledger technology known as Hashgraph to increase scalability and lower transaction costs.

HBAR/USDT 4-hour chart. Source: TradingView

Two of the main reasons for the recent rise in HBAR include a growing list of ecosystem partners and the introduction of NFT minting capabilities to the network.

Hedera partnerships expand HBAR's availability

The Hedera partnership program is an offshoot of the Hedera community that aims to roll more integrators, technology partners and enterprise applications to Hedera’s blockchain.

A scroll through the project's Twitter feed shows that the partnership program lured new partners like the London School of Economics and Political Science and the Indian Institute of Technology Madras to the Hedera governing council.

Other recent partnership announcements include collaborations with Fobi, Dropp, and Filecoin, which has launched a $200,000 developer grant project in conjunction with Hedera designed to help advance Web3 interoperability.

NFTs come to the Hedera network

The second source of excitement for the Hedera protocol has been the introduction of nonfungible token (NFT) minting capabilities on the network.

The latest release of Hedera Service Code v0.17.4 on mainnet includes updates to the Hedera Token Service:

— Hedera Hashgraph (@hedera) September 2, 2021

NFTs

Custom Fees (including NFT royalties)

Metadata standards for tokens

Release notes: https://t.co/UzUbXtwCcxhttps://t.co/9nDv5a6c7v

The NFT sector has been one of the hottest trends in 2021 and while the price action and trading activity for NFTs have declined significantly from their August highs, the sector is likely to expand in the near future.

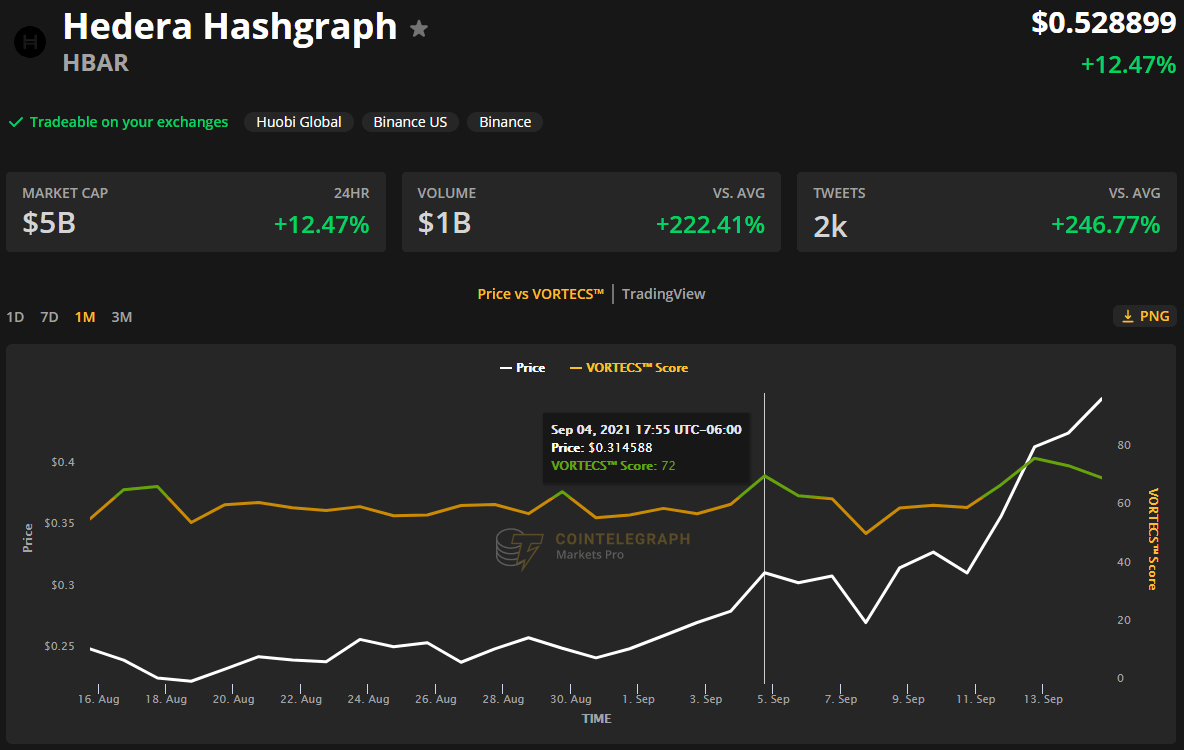

VORTECS™ data from Cointelegraph Markets Pro began to detect a bullish outlook for HBAR on Sept. 4, prior to the recent price rise.

The VORTECS™ Score, exclusive to Cointelegraph, is an algorithmic comparison of historical and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity.

VORTECS™ Score (green) vs. HBAR price. Source: Cointelegraph Markets Pro

As seen in the chart above, the VORTECS™ Score for HBAR climbed into the green zone on Sept. 4 and reached a high of 72 around 72 hours before its price increased 147% over the next seven days.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.