Harmony partners with Terra to expand on DeFi initiatives, ONE price climbs 32%

- Harmony and Terra have revealed a full-stack partnership to focus on DeFi initiatives.

- Terra will integrate Harmony on its Shuttle Bridge platform, allowing users to send UST across supported blockchains.

- ONE price has seen a considerable climb since the announcement, painting a bullish outlook.

Harmony announced a new partnership with Terra for a “deep integration” initiative as part of the vision of a “multi-chain future.” ONE and LUNA prices witnessed a jump of 32% and 20%, respectively.

Harmony and Terra to work on initiatives focused on programmable money

Harmony has shared details of its full-stack partnership with Terra, the algorithmic blockchain protocol for stablecoins. Together, the joined forces will work on new decentralized finance (DeFi) initiatives aimed at programmable money.

According to Stephen Tse, the founder of Harmony, the two blockchains will bridge together to build a “vibrant cross-chain finance ecosystem with UST stablecoin and ONEAnchor fixed-rate lending.”

UST, also known as TerraUSD, is the first decentralized stablecoin that is scalable, yield-bearing and interchain.

Given the scaling issues with the popular decentralized stablecoin Dai, TerraUSD tackles the issue with its structure of minting, where $1 worth of LUNA is burned when minting 1 UST. Currently, TerraUSD is the fifth-largest stablecoin in the market.

Harmony aims to increase the adoption of its architecture, while its bridges can connect with any proof-of-work and proof-of-stake chains, which ensures minimal transaction costs. The platform will be integrated on the Terra Shuttle Bridge.

Harmony price surges on accelerated interest

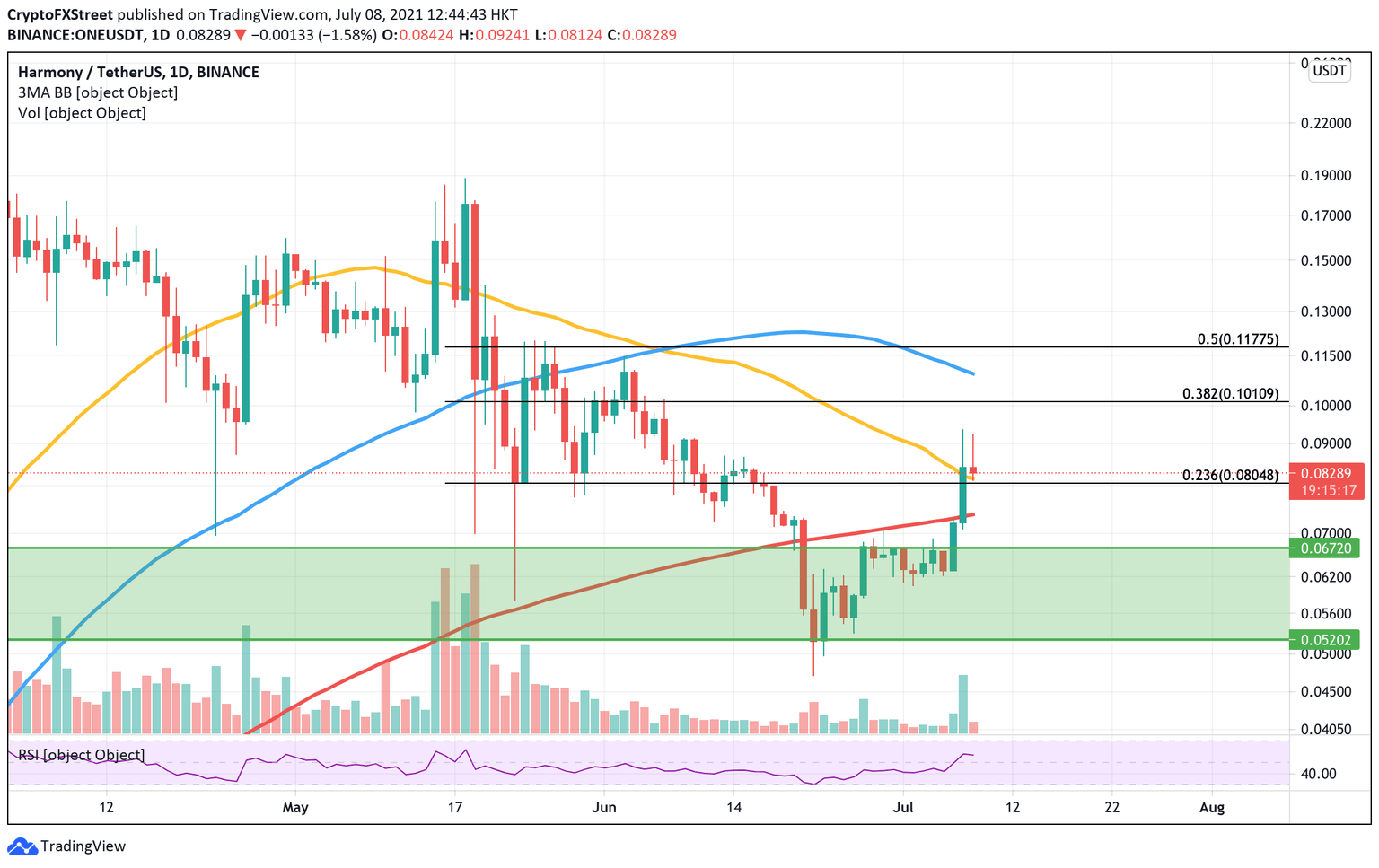

Harmony price has benefitted from the partnership announcement, adding fuel to bullish momentum, which propelled ONE to record a 32% surge accompanied by heightened trading volume. The asset has sliced through the 200-day Simple Moving Average (SMA) and, subsequently, the 50-day SMA.

Now, the 50-day SMA, which coincides with the 23.6% Fibonacci extension level, acts as immediate support for ONE price at $0.08. A daily close above this level for Harmony price could trigger bigger aspirations for the cryptocurrency, as it targets $0.101 next at the 38.2% Fibonacci extension level.

ONE/USDT daily chart

However, investors should be aware of the impending death cross that could be nearing when the 50-day SMA crosses below the 200-day SMA, which could invalidate the bullish outlook. Should ONE bears take control, Harmony price could see a drop back into consolidation in the demand zone starting at $0.067.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.