First Mover Asia: Bitcoin plummets, dashing hopes of a quick return to its record high

But short-term indicators suggest limited downside at the onset of Asia trading hours; ether also suffers a big price drop.

Good morning, Here’s what’s happening this morning:

Market Moves: Crypto traders were licking their wounds – and looking for explanations – after bitcoin’s biggest single-day price decline in almost four weeks.

Technician’s Take: Short-term indicators suggest limited downside into Asian trading hours.

Prices

Bitcoin (BTC): $60,643 -5.16%

Ether (ETH): $4,264 -6.77%

Market moves

Bitcoin on Tuesday suffered its worst daily loss in almost four weeks, all but upending any near-term hopes of a return to last week’s all-time high near $69,000. The bitcoin price was down more than 5% over the past 24 hours.

“Overall, we’ve turned quite neutral after this awaited leverage washout,” the cryptocurrency trading firm QCP Capital wrote Tuesday in a market update on its Telegram channel. “We expect some gravity around this [$]60,000 level.”

In trying to explain the latest sell-off, traders cited U.S. President Joe Biden’s signing this week of an infrastructure bill containing a controversial cryptocurrency tax-reporting requirement, as well as a drop-off in enthusiasm after last weekend’s Taproot upgrade on the Bitcoin blockchain, the network’s first major enhancement in four years.

“There was some expectation that this would be a catalyst for a leg higher in price,” QCP Capital wrote. “The lack of reaction caused a ‘buy the rumor, sell the fact’ effect.”

The debut Tuesday of a new bitcoin futures exchange-traded fund – the VanEck Bitcoin Strategy ETF, stock ticker XBTF – did little to generate much enthusiasm.

In traditional markets, stocks rose after a report of higher-than-expected U.S. retail sales in October, seen as an indicator that consumers remain ebullient despite the fastest inflation rate in three decades.

But there’s some speculation that higher inflation might prompt the U.S. Federal Reserve to accelerate tightening its monetary policy. Such a move could put downward pressure on investment assets considered risky, such as bitcoin and other cryptocurrencies.

“Bitcoin may continue to attract inflation hedges, but if pricing pressures trigger rapid rate-hiking action from the Fed, that could trigger a massive wave of risk aversion that would penalize cryptos,” wrote Edward Moya, senior markets analyst for the foreign-exchange broker Oanda.

Technician’s take

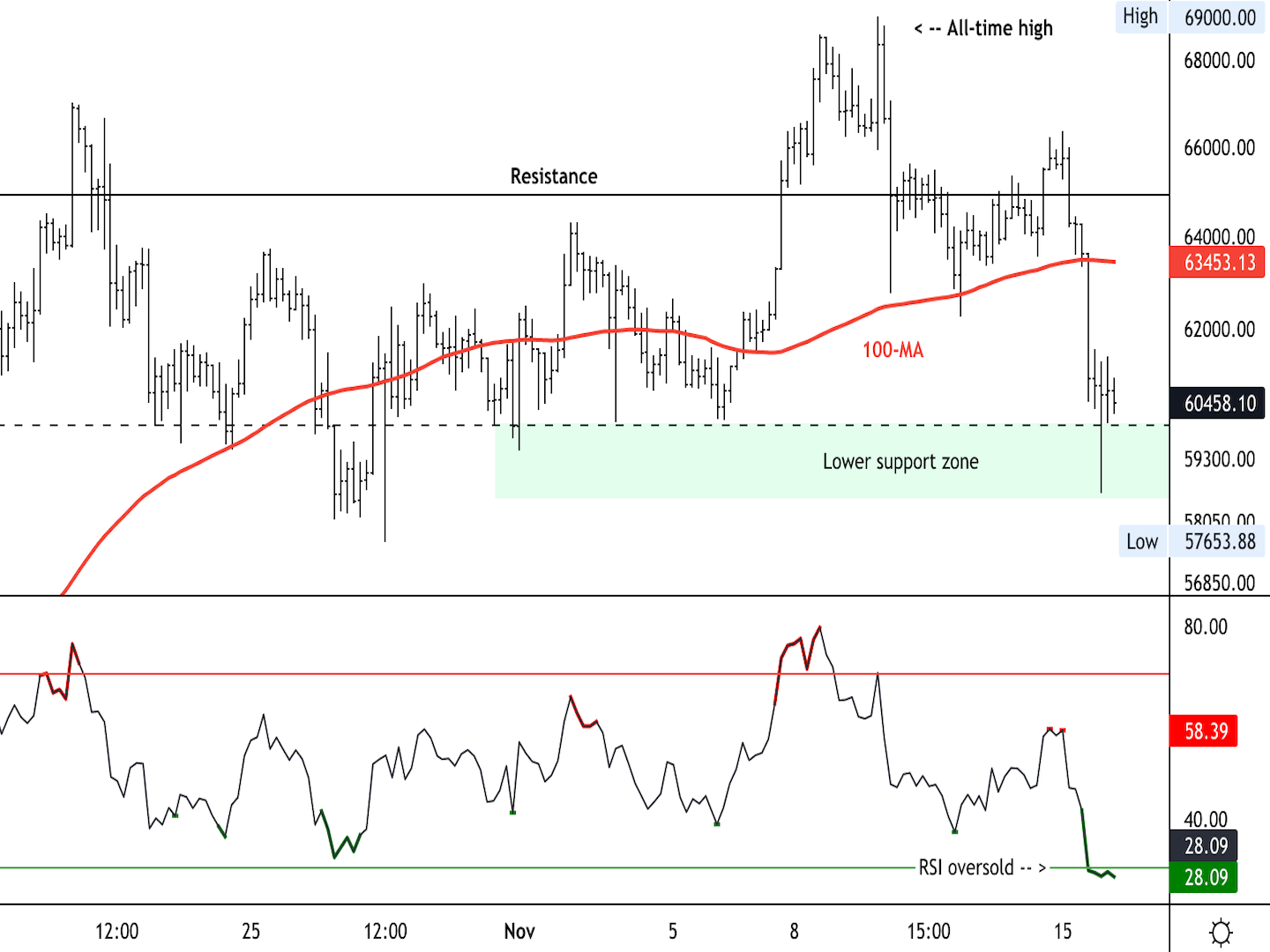

Bitcoin (BTC) is down about 5% over the past 24 hours after sellers became more active than buyers around the $65,000 resistance level.

The cryptocurrency was stabilizing around $60,000 support and appeared to be oversold on intraday charts.

For now, short-term indicators suggest limited downside into Asian trading hours. For example, the relative strength index (RSI) on the four-hour chart is the most oversold since Oct. 27, which preceded a near 10% price bounce.

Still, the RSI on the daily chart was neutral as upside momentum continues to wane. This suggested intraday buyers will be quick to take profits around the $63,000-$65,000 resistance zone.

A period of consolidation could persist over the next few days before BTC establishes a stronger footing around the $60,000 support zone.

Important events

3 p.m. HKT/SGT (7 a.m. UTC): UK Consumer Price Index (Oct. YoY/MoM)

4 p.m. HKT/SGT (8 a.m. UTC): European Central Bank Stability Review

21:30 p.m. HKT/SGT (1:30 UTC): U.S. Housing Starts (Oct./MoM

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.