Ethereum price prediction: ETH/USD collapses below $170.00 – Confluence Detector

- ETH/USD is vulnerable to further losses as the price slips below critical support.

- A sustainable move below $167.00 will open up the way to September low.

ETH/USD surrounded $170.00 support amid massive sell-off on the global cryptocurrency market. ETH, the second digital coin has lost over 4% of its value in recent 24 hours to trade at $167.00 by press time. The coin tested int intraday low pf $164.34 during early Asian hours, which is the lowest level since September 27.

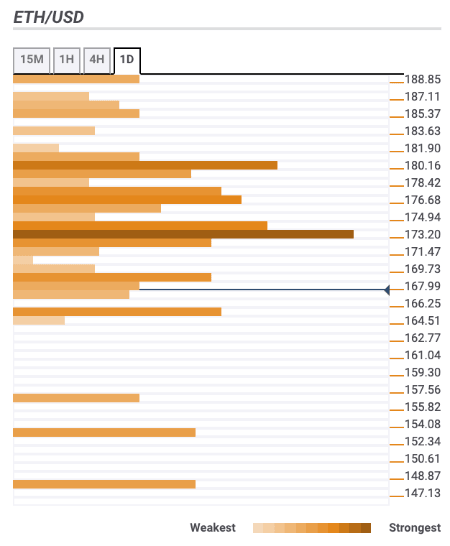

Ethereum confluence levels

During early Wednesday hours, ETH/USD tried to develop a recovery after a sharp sell-off; however, has faltered at $167.00. From the short-term perspective, the coin consolidates the recent losses and remains vulnerable to bearish pressure. Bull's inability to push the price above the resistance area bodes ill for the short-term forecasts.

Let’s have a closer look at the technical levels that may serve as resistance and support areas for the coin.

Resistance levels

$168.00 - the lowest level of the previous week, the lower line of four-hour Bollinger Band, SMA5 (Simple Moving Average) one-hour chart;

$173.50 - 23.6% Fibo retracement weekly, 38.2% Fibo retracement daily, SMA10 four-hour;

$180.0 - Pivot Point one-day Resistance 3, 61.8% Fibo retracement daily.

Support levels

$165.00 - Pivot Point one-day Support 3, Pivot Point one-week Support 1;

$157.00 - Pivot Point one-week Support 2;

$152.50 - the lowest level of the previous month.

Author

Tanya Abrosimova

Independent Analyst