Ethereum Price Forecast: ETH flashes buy signal

- Ethereum price seems primed to rebound.

- The MRI indicator has turned bullish.

- A spike in buying pressure could see ETH rise to $2,800.

Ethereum price has flashed a buy signal on its daily chart, which could have the strength to lead to a 15% upswing.

Ethereum price hints at a reversal

Ethereum price seems to be following Bitcoin as it has depreciated roughly 25% since May 19. However, the Momentum Reversal Indicator (MRI) recently flashed a buy signal in the form of a green 'one' candlestick on the daily chart.

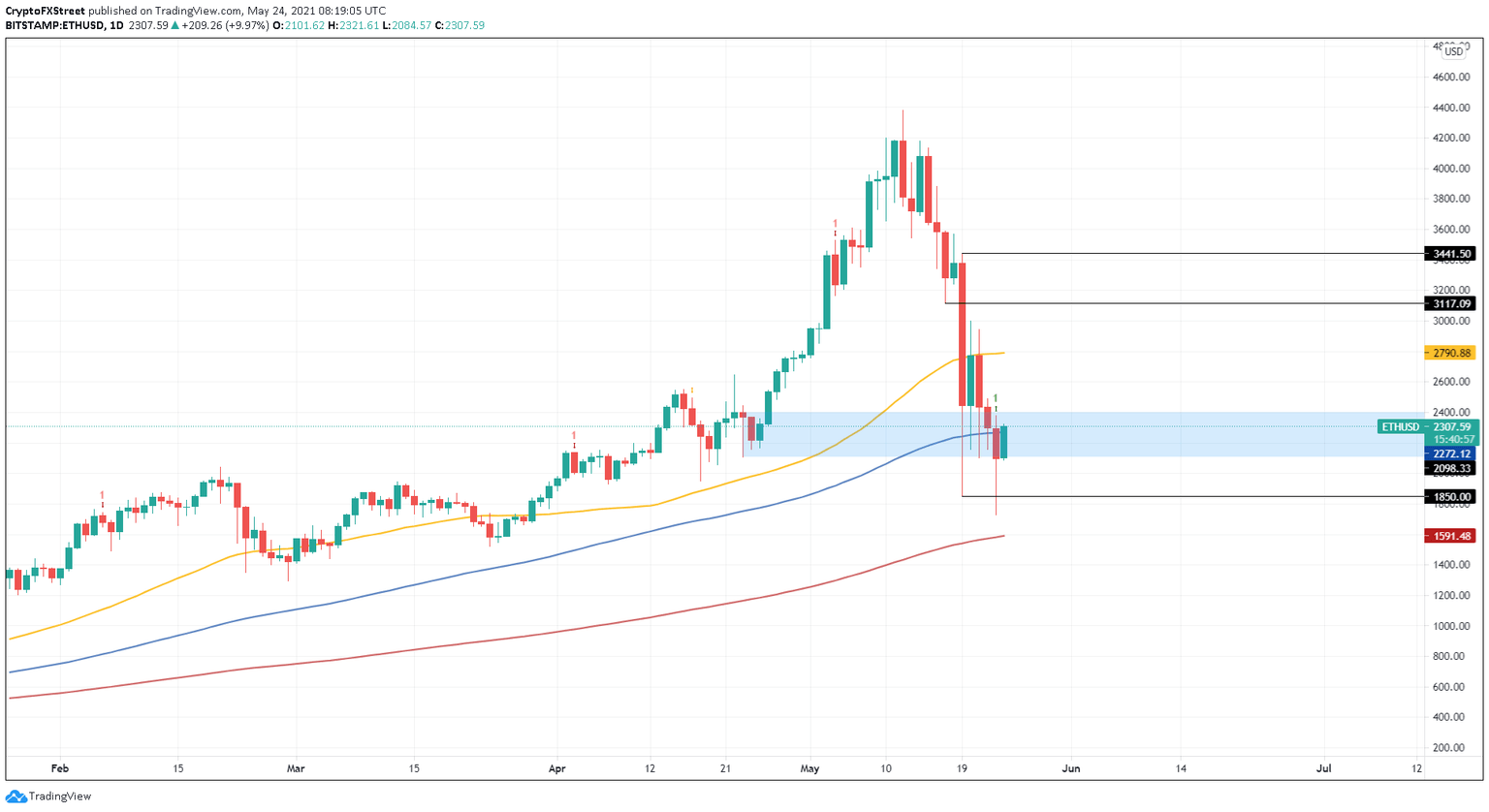

The bullish setup forecasts a one to four candlestick upswing before the downtrend resumes. Interestingly enough, the MRI's buy signal comes when ETH trades in the demand zone ranging from $2,106 to $2,397.

A decisive close above $2,400 will confirm the optimistic scenario. Further buying pressure around this level could propel the Ethereum price by 15% to tag the 50-day moving average at $2,789.

If the bid orders continue to pile up, Ethereum price might rise another 7% to tag the swing high formed on May 20 at $3,000. Other critical resistance areas include $3,117 and $3,442.

ETH/USD 1-day chart

On the flip side, Ethereum price will put an end to the optimistic narrative if it slices through $2,098, producing a daily candlestick close below. In that case, ETH could kick-start an 11% sell-off to $1,850.

Author

FXStreet Team

FXStreet