Ethereum options data suggests the battle for $4K ETH is at least a week away

Traders are long on Ether, but derivatives data suggests that a $4,000 price tag is a long shot in the short term.

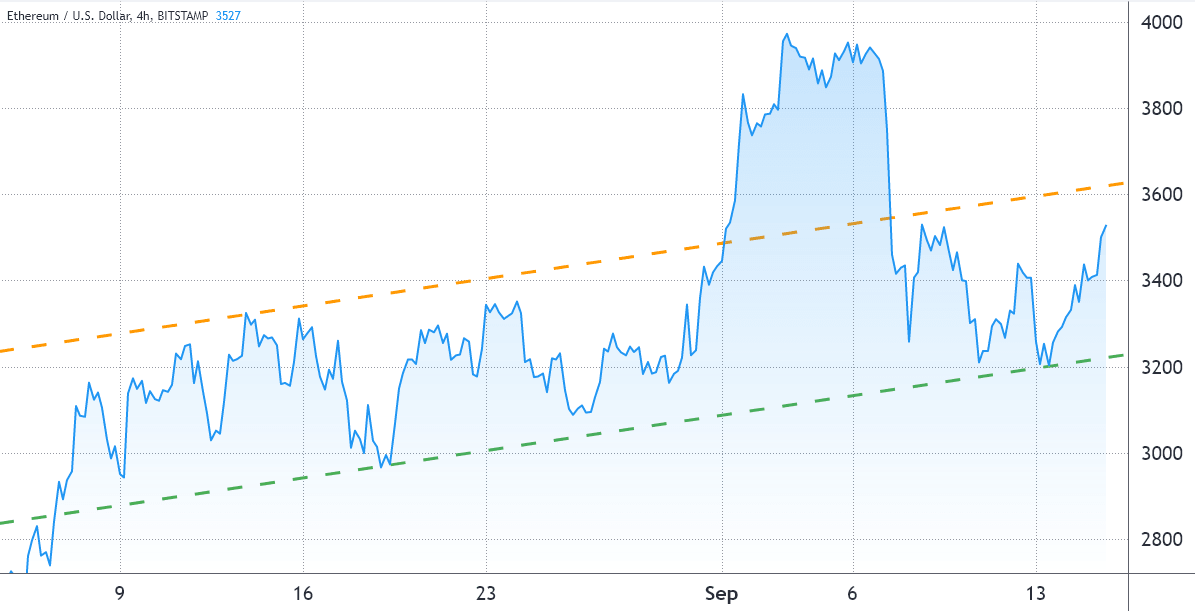

For the past 40 days, Ether (ETH) has trended modestly upward, respecting a narrow channel most of the time. It enjoyed a brief rally toward $4,000 in the first week of September, but a subsequent crash brought the price into the ascending channel.

Ether price at Bitstamp in USD. Source: TradingView

In August, nonfungible tokens posted record-breaking transactions, clogging the Ethereum network and causing average transaction fees to surpass $40 in early September. Although NFT trading volume has continued to subside, new items continue to be minted every minute regardless of whether they're being traded.

On Sept.13, Cathie Wood — CEO of Ark Invest, a $58 billion asset manager based in the United States — commented that Ark aims for a 60% Bitcoin (BTC) and 40% Ether allocation. Ark Invest holds relevant positions in Coinbase (COIN) and Grayscale Bitcoin Trust (GBTC) shares. Furthermore, Wood has been a long-time Bitcoin advocate.

Ether investors might have gotten lucky as one of the coin’s largest rivals, Solana (SOL), faced a seven-hour blackout on Sept. 14. A sudden surge in transaction volume flooded the transaction processing queue, which brought the network down.

Another incident happened on that same day after the Ethereum layer-two rollup network Arbitrum One went offline for 45 minutes. The team attributed the downtime to a massive batch of transactions submitted to the Arbitrum sequencer over a short period.

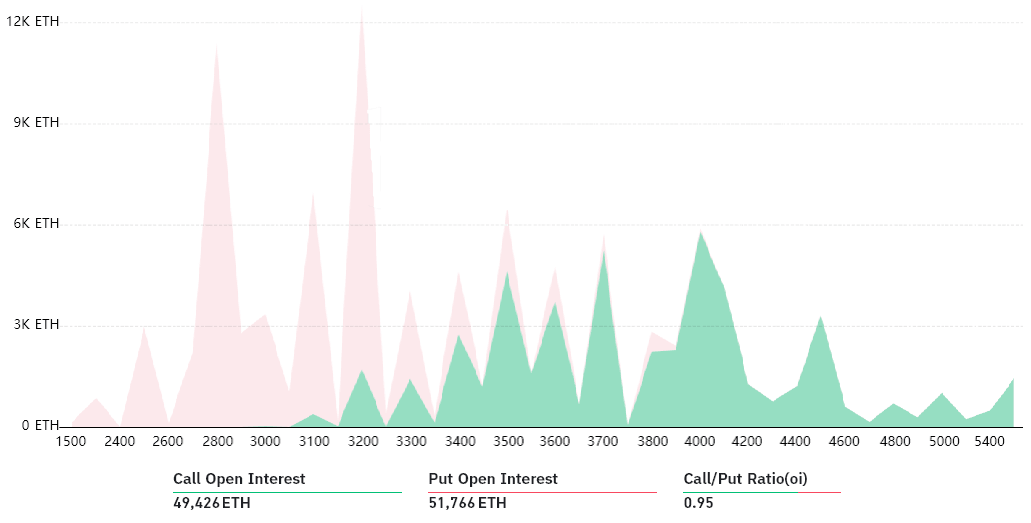

Bitcoin options aggregate open interest for Sept. 3. Source: Bybt.com

These events point toward the importance of the ETH 2.0 upgrade, which will bring parallel processing and drastically reduce transaction fees. Curiously, Ethereum also faced a large invalid block sequence from a malicious entity. However, the vast majority of network clients rejected the attack, making it unsuccessful.

As shown above, bears got caught by surprise, and 95% of put (sell) instruments were placed at $3,500 or lower. Consequently, if ETH remains above that price on Sept. 17, only $8 million worth of neutral-to-bearish put options will be activated on the expiry.

A put option is a right to sell Bitcoin at a predetermined price on the set expiry date. Thus, a $3,000 put option becomes worthless if ETH remains above that price at 8:00 am UTC on Sept. 17.

The call-to-put ratio reflects a balanced situation

The 0.95 call-to-put ratio represents the small difference between the $173 million worth of call (buy) options versus the $181 million put (sell) options. This bird's eye view needs a more detailed analysis that considers that some of the bets are far-fetched considering the current $3,500 level.

For example, if Ether's expiry price on Sept. 17 is $3,300, every call option above that price becomes worthless. There will be no value for a right to acquire ETH at $3,700 in that case.

Below are the four most likely scenarios considering the current Ether price. The imbalance favoring either side represents the theoretical profit from the expiry. The data below shows how many contracts will be activated on Friday, depending on the expiry price:

- Between $3,100 and $3,300: 2,100 calls vs. 20,300 puts. The net result is $58 million favoring the protective put (bear) instruments.

- Between $3,300 and $3,500: The net result is balanced between bears and bulls.

- Between $3,500 and $3,700: 17,600 calls vs. 2,300 puts. The net result is $55 million favoring the call (bull) options.

- Above $3,700: 17,600 calls vs. 2,300 puts. The net result favors the call options by $85 million.

This raw estimate considers call options being exclusively used in bullish strategies and put options in neutral-to-bearish trades. However, investors might have used more complex strategies that typically involve different expiry dates.

Minimal volatility is expected for this week

Buyers and sellers will face small gains from a moving Ether price to boost their returns on the weekly options expiry. Whether or not it achieves $3,500 will be interesting — things could go either way.

To put things in perspective, the ETH monthly options expiry on Sept. 24 currently holds a $1.6 billion open interest. Thus, both sides are likely concentrating efforts for the next week.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.