Ethereum market update: ETH/USD bulls intimidated by DMA50

- Ethereum price recovery stalled on approach to strong technical level.

- A strong move above $185.00 will open up the way to $200.

ETH peaked at $185.30 on October 8 and retreated to $184.00 by the time of writing. The second-largest digital asset with the current market value of $19.6 has gained 2% both on a day-on-day basis and since the beginning of Wednesday. Ethereum’s average daily trading volumes dropped below $7 billion from $7.5 billion on Tuesday.

Ethereum’s technical picture

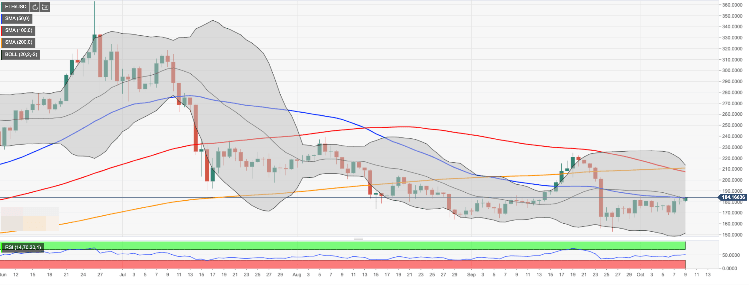

ETH bumped into stiff resistance on approach to $185.00. A confluence of technical indicators including SMA50 (Simple Moving Average) on a daily chart and the middle line of one-day Bollinger Band serves as a strong barrier that stopped the recovery for the time being. Once it is out of the way, the upside is likely to gain traction with the next focus on psychological $200.00 closely followed by SMA100 daily on $207.00.

On the downside, the selling pressure is likely to increase on a breakthrough below $180.00. This development will lead to an extended correction towards the next psychological area $170.00 closely followed by October 6 low of $168.83. A sustainable move above this handle may open up the way towards this week’s low of $164.50 and psychological $160.00.

ETH/USD, one-day chart

Author

Tanya Abrosimova

Independent Analyst