Ethereum is coming into support, while finishing a correction

Ethereum with ticker ETHUSD is coming even lower as we have been warning in the past contents. We see ETH still in a deeper downward complex correction, ideally a flat correction, which can be now in final stages, as we see it trading in wave 5 of wave (C) of an (A)-(B)-(C) corrective decline. It means that there can still be a recovery from the near-term support.1500 area around the 61.8% certainly looks very interesting for completion of a five-wave drop in wave (C) wave. It's actually already in 5th of (C), so once current wave 5 of (C) fully unfolds, this is when support can be in place. A rise back above 1745 level would confirm the bullish turn.

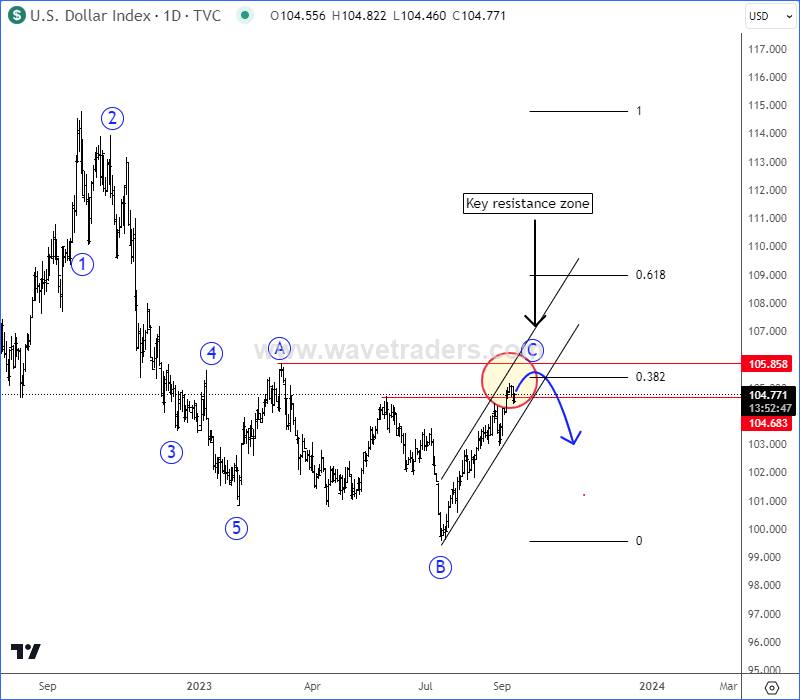

One of the main reason, why Ethereum may stabilize soon is also USDollar. If you know where USD is headed, you know everything. USDollar Index - DXY chart can be finishing an A-B-C irregular flat correction within downtrend, where wave C can be now in final stages with resistance around 105 – 106 area. So, once DXY hits strong resistance and goes back to bearish mode, this is when Ethereum and other cryptocurrencies could start recovering.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.