Ethereum FUD returns as ICO whale offloads another $47M

Ethereum fear, uncertainty, and doubt may be seeping back into the market as Ether prices tank and an Ethereum whale offloaded another chunk of ETH accrued from the blockchain’s initial coin offering in 2014.

On Oct. 3, onchain transaction analytics platform Lookonchain observed that an Ethereum ICO participant had been aggressively offloading the asset over the last week.

It noted that over the past two days, the entity had sold 19,000 Ether ETH $2,377.32, worth around $47.5 million.

Selling by the previously dormant entity began in late September when more than 12,000 ETH, worth $31.6 million at the time, was sent to the Kraken exchange.

Lookonchain said that the entity obtained 150,000 ETH during the ICO in mid-2014. The stash was worth around $46,500 at the time but is now valued at almost $400 million.

Ethereum ICO participant selling. Source: Lookonchain

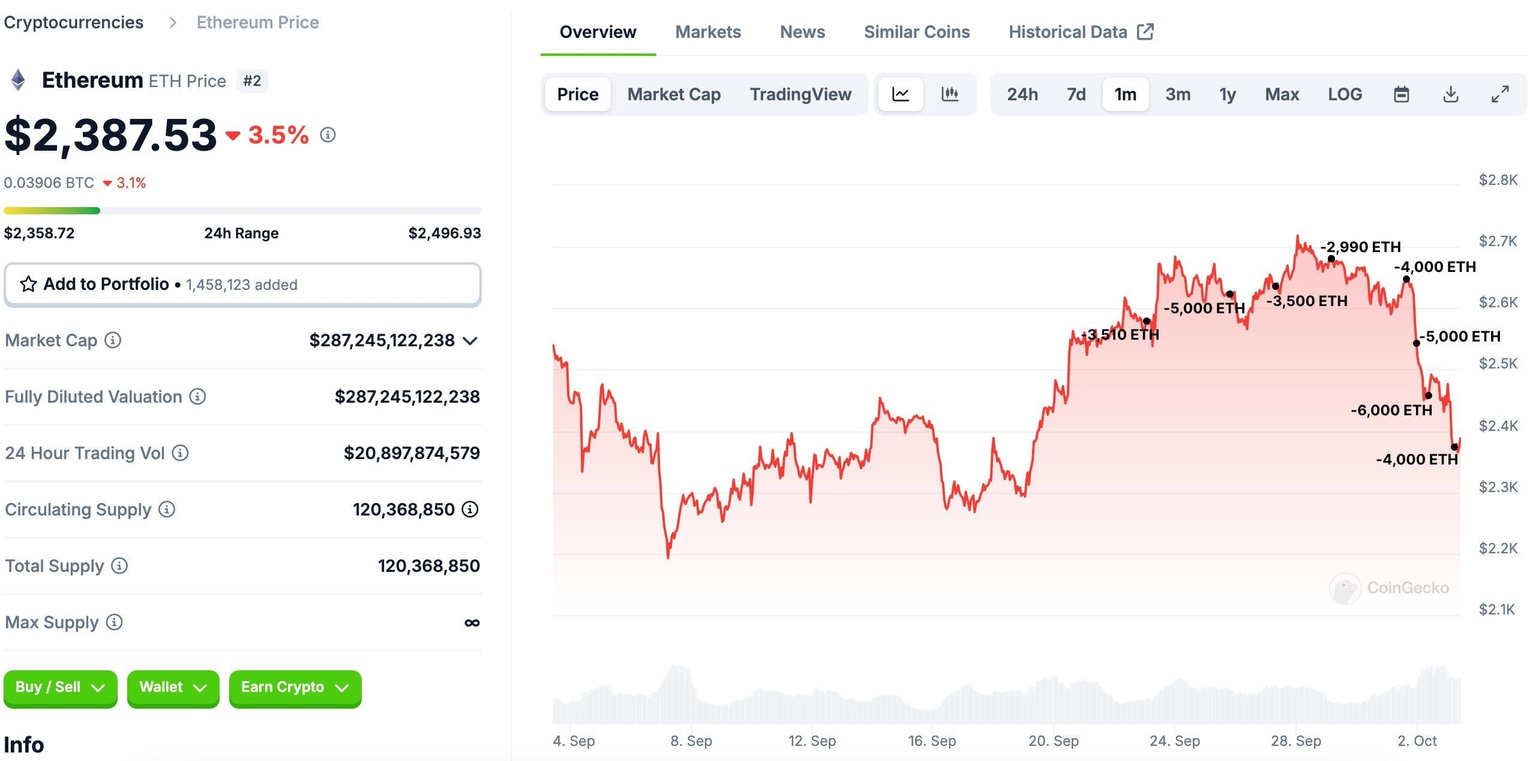

ETH prices have tanked almost 10% since the beginning of October, barely three days ago.

The asset was trading at $2,650 on Oct. 1 but had slumped to an intraday low of $2,365 by Oct. 3, down 3.7% on the day — a greater decline than the broader crypto market, which declined 2.6% on the day, in terms of market cap.

Additionally, the ETH/BTC ratio has fallen back to 0.039, levels not seen since the mid-September market slump, according to TradingView.

The drop has seemingly revived Ethereum’s critics and FUD toward the asset, which has largely underperformed this year.

“Yikes, even day zero ETH OG’s are jumping ship,” quipped crypto trader “Bluntz” to his 278,000 followers on X on Oct. 3, referring to the ICO participant’s recent transfers.

Solana maximalist “Cozy The Caller” added to the FUD on Oct. 3, saying “Ethereum doing nothing these days but dragging crypto even lower.”

Nevertheless, Ethereans have continued to support the network. Ethereum educator Anthony Sassano said on Oct. 3 that “the FUD is neverending, and most people in this industry don’t actually care about the truth.”

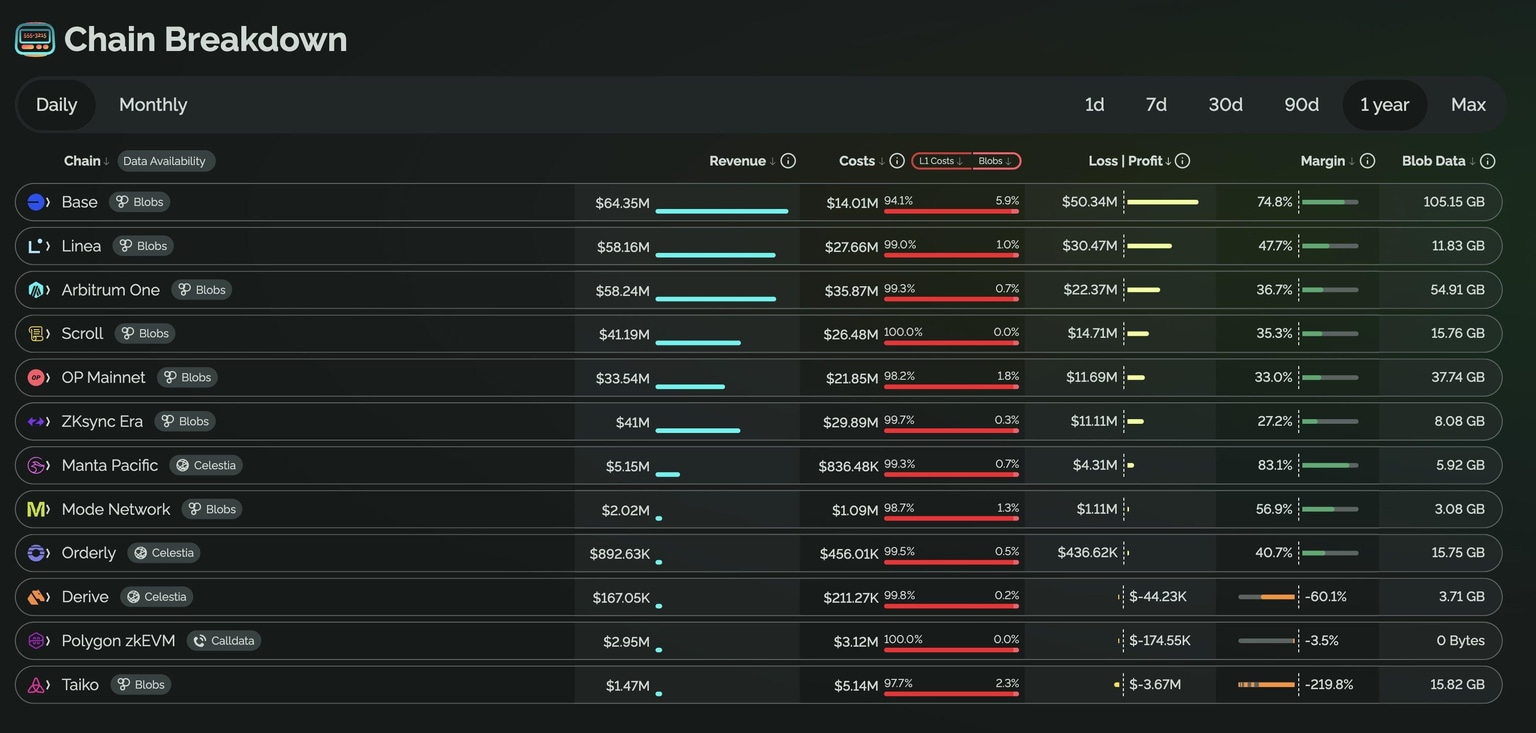

On Oct. 2, Ryan Sean Adams from Bankless said that Ethereum has already produced nine chains with gross profit totaling more than $140 million over the past 12 months.

“Each chain is an economy. Ethereum is a federated union of economies with ETH as money. Bullish Ethereum.”

Source: Ryan Sean Adams

Meanwhile, former Sushi chief technology officer Joseph Delong said that Ethereum was “preparing to onboard the next billion users,” in reference to planned network upgrades for account abstraction and authentication.

On the other side, institutional investors also appear to be warming to the asset again, with the nine spot Ether ETFs recording an inflow of almost $20 million on Oct. 2, driven primarily by BlackRock.

According to Farside Investors, it was the largest inflow in a week and came a day after the largest outflow since the funds launched.

Conversely, spot Bitcoin ETFs saw their second day of aggregate outflows, with $53 million exiting the products.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.