Ethereum Classic price to retest $40 as ETC bulls get hammered

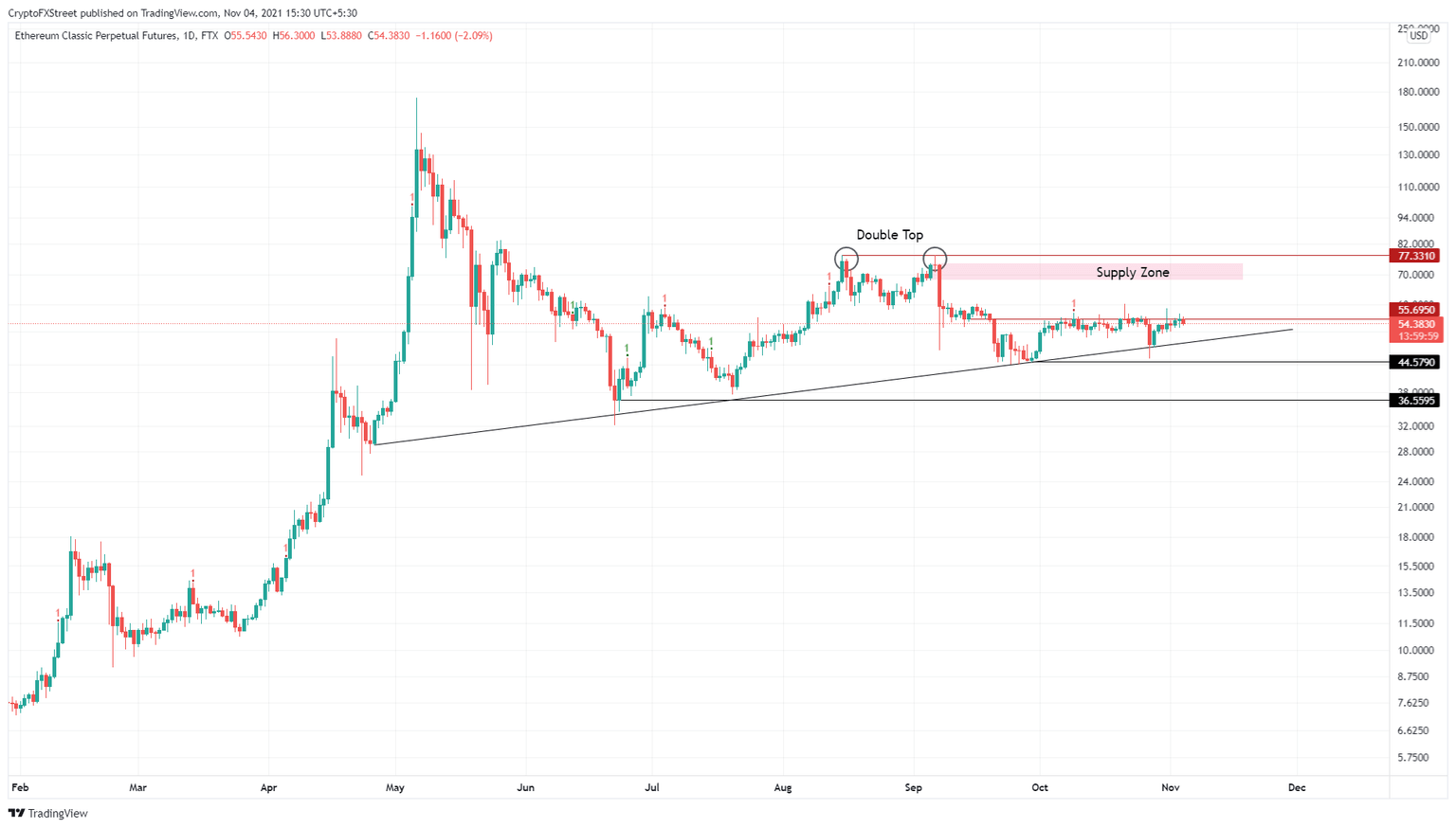

- Ethereum Classic price has been stuck under the $55.69 resistance barrier for over a month.

- A break below the inclining trend line will signal the start of a downtrend to $44.58 or lower.

- A decisive close above $74.12 will signal the start of an uptrend.

Ethereum Classic price shows that bulls are losing control and that a drop might arrive soon. However, there is one support trend line that will decide if ETC slides lower or stays put.

Ethereum Classic price at an inflection point

Ethereum Classic price has seen multiple higher lows since April 26. However, ETC has already produced a string of lower highs, suggesting price congestion. Additionally, Ethereum Classic price is also struggling to set up higher highs since October 2 as it grapples with the $55.69 resistance barrier.

This move suggests that bulls do not have the strength to move ETC. Considering the short-term bearish outlook on the big crypto, a breakdown of the inclining trend line could spell disaster for Ethereum Classic price and trigger a downswing to $44.58.

Breaching this foothold will knock Ethereum Classic price down to $40, constituting a 25% correction from its current position. The Ethereum Classic price could slide toward the $36.56 support floor in a bearish case, where ETC could form a double bottom and give the uptrend another try.

ETC/USDT 1-day chart

Regardless of the short-term bearish outlook for the Ethereum Classic price, a decisive daily close above $55.69 will indicate that the bulls are back. In such a case, ETC could climb 22% and encounter the $68.14 to $74.12 supply zone.

A daily close above this barrier will confirm the start of a new uptrend and likely propel ETC to $100.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.