Ethereum Classic flash crash recovery in progress, ETC must reach $61 to move higher

- Ethereum Classic price lost as much as 22% during Wednesday's trading session.

- Despite gaining more than 20% from yesterday's lows, Ethereum Classic remains bearish.

- The road to a bullish breakout is long and complex.

Ethereum Classic price was hammered during broad cryptocurrency sell-off on Wednesday. While it has recovered most of that crash, Ethereum Classic struggles to maintain those gains and is barely holding on to the key $50 value area.

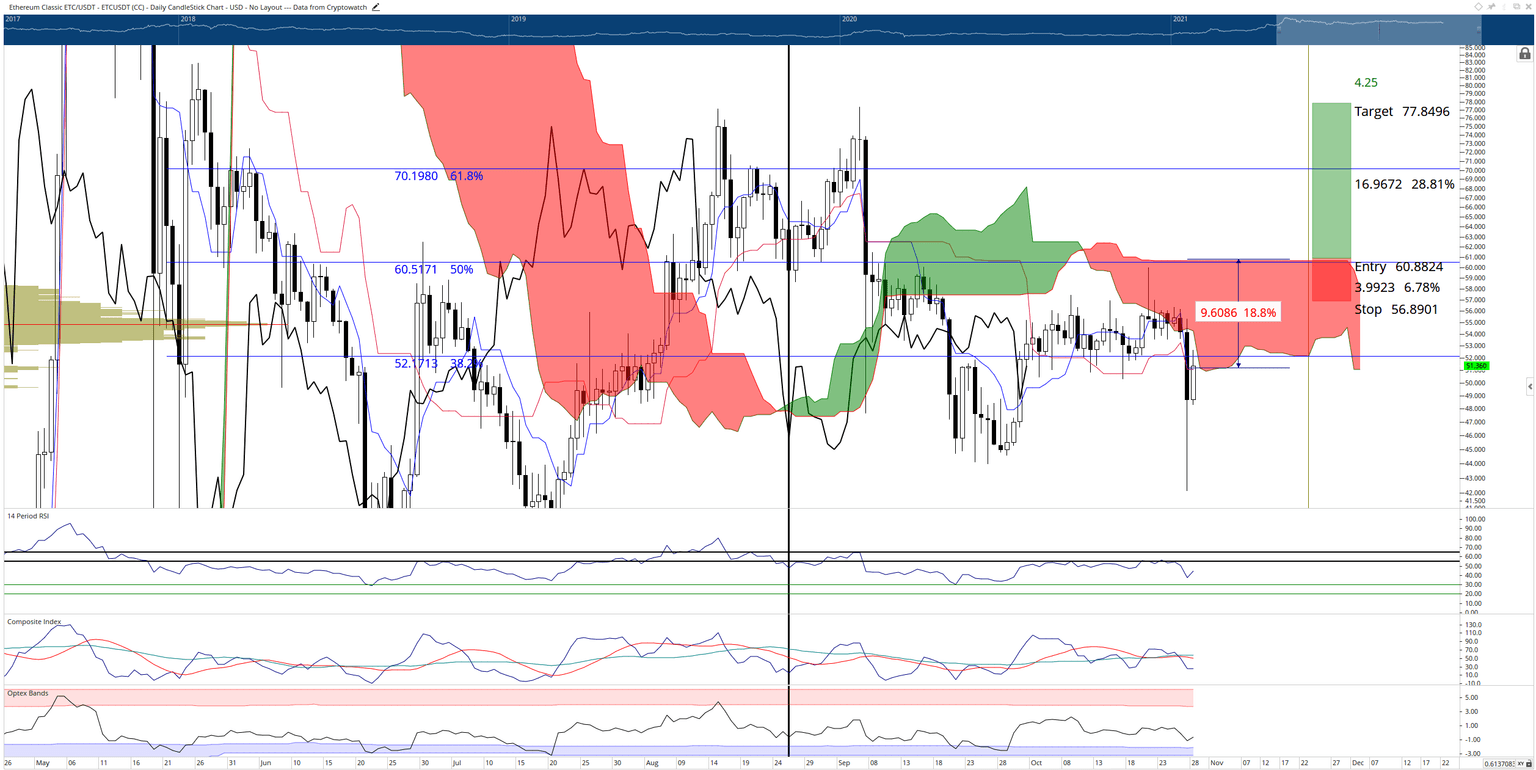

Ethereum Classic price requires an 18% rise to qualifying for a bullish entry

Ethereum Classic is almost pitiful in its present state. The sell-off Wednesday terminated any near-term bullish sentiment and has pushed Ethereum Classic into some significant danger zones. It is below all key Ichimoku levels: the Tenkan-Sen, Kijun-Sen, Senkous Span A and Senkou Span B. Adding to the bearishness is the Chikou Span in danger of closing below the candlesticks.

For Ethereum Classic to enter into a clear and indisputable bull market, it needs to close above all the Ichimoku levels and close above the Cloud at $61. From there, a new expansion phase can occur. The only piece of technical data on Etheruem Classic price is the position of the Optex Bands. The Optex Bands are near the extreme oversold level and indicate that further downside pressure will be more difficult for sellers to achieve. Additionally, the Relative Strength Index shows a rising hook off of the 40 level, hinting at some bullish divergence developing.

ETC/USDT Daily Ichimoku Chart

Buyers are at the precipice here. Any final hints of bullish support will likely be terminated if Ethereum Classic closes at or below $48. A close at $48 or below would position the Chikou Span below the candlesticks into open space, creating an Ideal Bearish Ichimoku Breakout, which could throw Ethereum Classic price back into the $20 value area.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.