Ethereum Classic Price Prediction: ETC targets $500 next

- Ethereum Classic price has been locked in a bearish trend, following an explosive surge in early May.

- ETC is building a bull flag pattern with a resistance trend line at $100.

- Retesting of the all-time high level could potentially push ETC to new record highs.

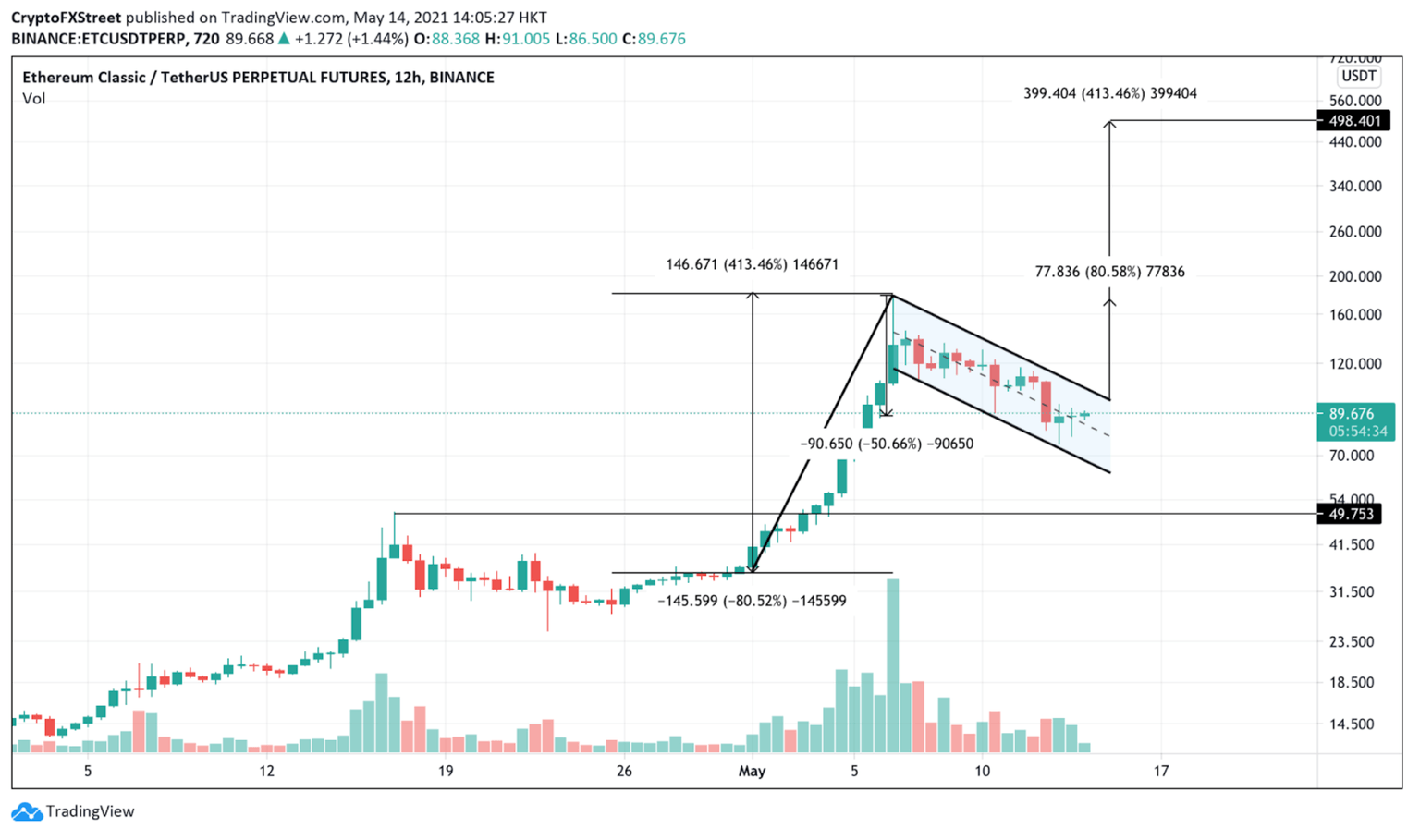

Ethereum Classic price surged by over 400% during the first week of May, creating a new all-time high at nearly $180. ETC has retraced since then by over 50% and is currently trading at $89. Now, this cryptocurrency seems prime to resume its uptrend as it tries to break out from a continuation pattern.

Ethereum Classic price consolidates before next major push

Ethereum Classic price is forming lower highs and lower lows on the 12-chart. Joining these pivot points using a trendline creates a bull flag, where the 413% upswing that preceded this act seems to have formed the flagpole. Such a bullish pattern indicates that ETC uptrend is expected to continue soon.

A breakout above the flag’s resistance trend line at $100 could increase the odds for an 80% upswing to retest the recent all-time high of nearly $180. This conservative target is measured by adding the length of the flag pole to the breakout point.

If Ethereum Classic price manages to break through its all-time high and flips this level into support, ETC could be driven towards $500, representing a 413% rally as calculated by the flagpole’s height.

ETC/USDT 12-hour chart

Ethereum Classic price action must remain above the critical support zone at $74.81 to add credence to the optimistic outlook. Otherwise, the bulls would lose control and ETC could break below the flag’s lower trendline at $60.

The downswing might result in further selling, pushing Ethereum Classic price toward $50. This price hurdle acted as stiff resistance from mid-April until May 3, suggesting that it may serve as strong support in the event of a correction.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.