Ethereum Classic Price Prediction: ETC positioned for 20% upswing

- Ethereum Classic price hit a dead end as it failed to shatter past the supply zone’s upper limit at $80.

- The inability of the bulls has led to a consolidation period before a potentially explosive move.

- A decisive daily candlestick close above $80 might trigger a 20% climb to $95.67.

Ethereum Classic price has seen an eye-catching rally since its swing low on May 23. This upswing has overcome multiple resistance barriers and pierced a tough supply zone. ETC needs to move above this resistance area to continue with this bullish run.

Ethereum Classic price prepares to blast off

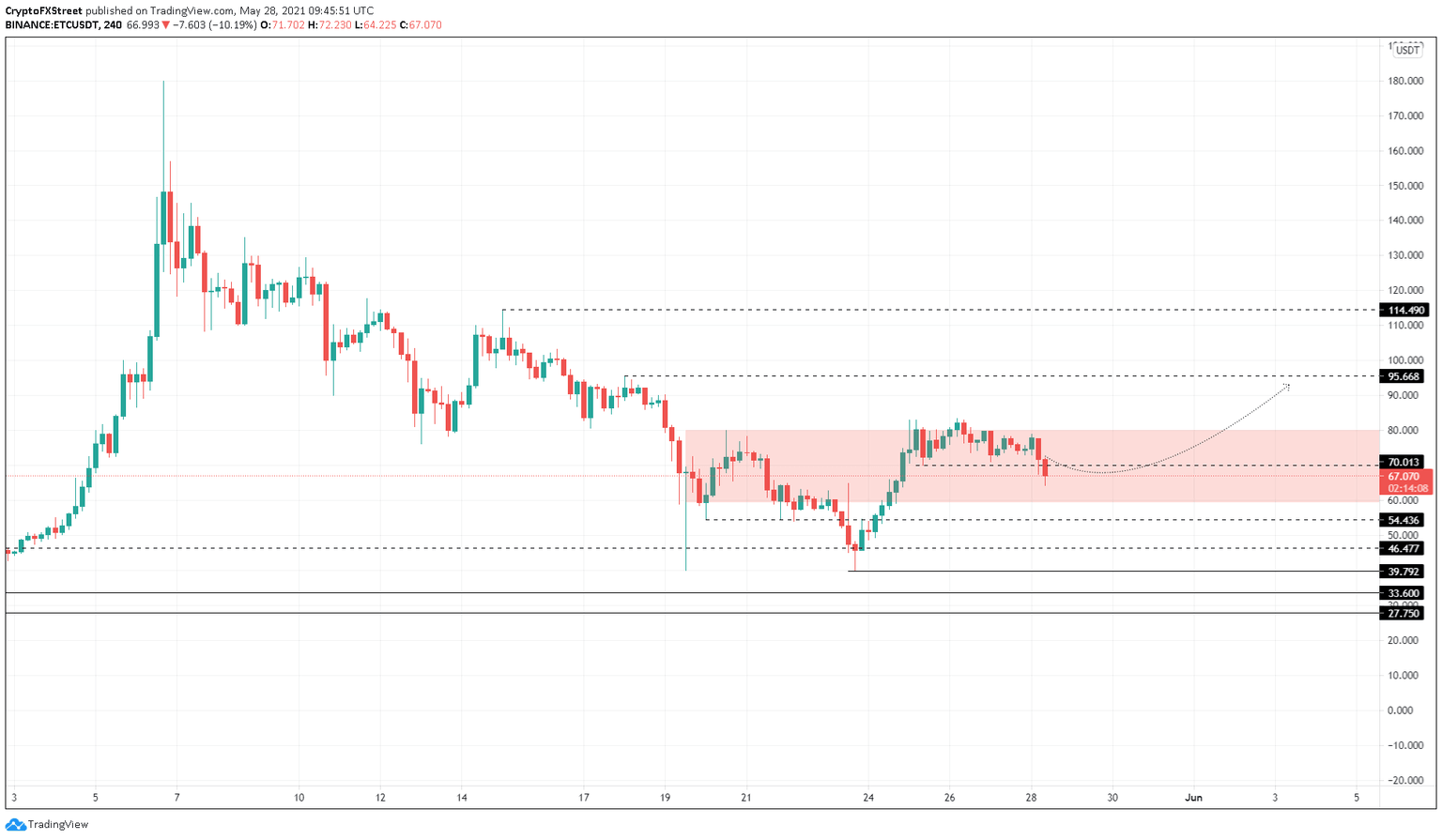

Ethereum Classic price is currently traversing a supply zone, ranging from $59.44 to $80 after rallying nearly 100% since May 23. The sideways movement that ETC is presently experiencing could see a minor pullback to $70.01, which is an 8% drop.

This retracement will allow the buyers or sellers to build up steam before a massive spike unfolds.

Therefore, a potential spike in bullish momentum that generates a decisive daily candlestick close above $80 will indicate that the bulls have emerged victorious. In that case, Ethereum Classic price would surge 20% to tag the immediate supply level at $95.67. If the bid orders then continue to increase, ETC price might shoot to 114.49, which is roughly 20% appreciation from $95.67.

Investors need to exercise caution since the confirmation of this upswing will arrive only after a convincing close above $80.

ETC/USDT 4-hour chart

While the scenario detailed above is logical, market participants should note that a flash crash or a sudden spike in selling pressure that pushes ETC below $70.01 will signal weakening buying pressure.

If this downtrend shatters the supply zone’s lower limit at $54.44, it will invalidate the bullish thesis and kick-start a 15% crash to $46.48.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.