Ethereum Classic Price Prediction: ETC looks to continue its descent

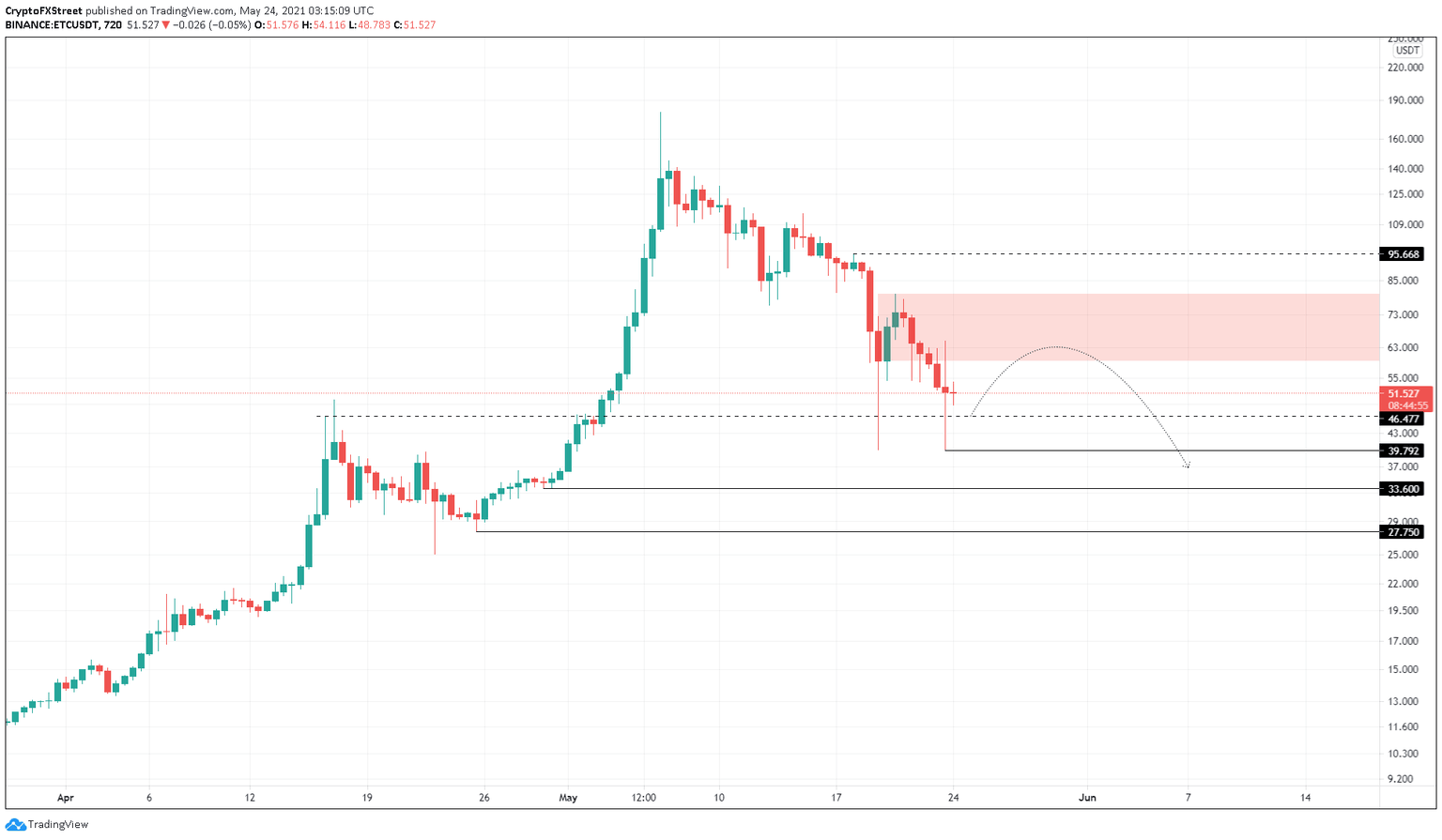

- Ethereum Classic price sliced through a supply zone, stretching from $59.43 to $80, signaling weakness.

- A retest of $59.43 leading to a 35% downswing seems likely.

- If the buyers produce a decisive close above $80, it will invalidate the bearish thesis.

Ethereum Classic price is overrun by sellers that pushed it to slice through a pivotal resistance area. Now, ETC might continue to head lower as bullish momentum seems to have vanished.

Ethereum Classic price continues to bleed

Ethereum Classic price has dropped 72% from its all-time high at $179.83 and hints that this crash could continue. During this massive sell-off, ETC formed a demand zone that extends from $59.43 to $80. However, the bears disregarded the support and sliced through it, flipping it into a supply zone.

The next course of action for Ethereum Classic price is to either test the lower boundary of the resistance area at $59.43 and head lower or continue to free fall from its current position at $51.52. Assuming a retest of $59.43, ETC could stand to depreciate 20% to tag the immediate support at $46.47. A breakdown of this barrier will serve as a confirmation of the downtrend.

In that case, the altcoin could slide 15% to tag the subsequent support floor at $39.79. If the bearish momentum continues to pour in, $33.60 and $27.75 are the following areas of interest.

ETC/USDT 12-hour chart

While things look grim for Ethereum Classic price, if the bid orders pile up to pierce the supply zone ranging from $59.43 to $80, it will signal the presence of interested buyers.

Additionally, a decisive 12-hour candlestick close above $80 will invalidate the bearish outlook and indicate the start of an uptrend. In that case, if the sidelined investors jump on the bandwagon, ETC could rise 20% to test the resistance barrier at $95.66.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.