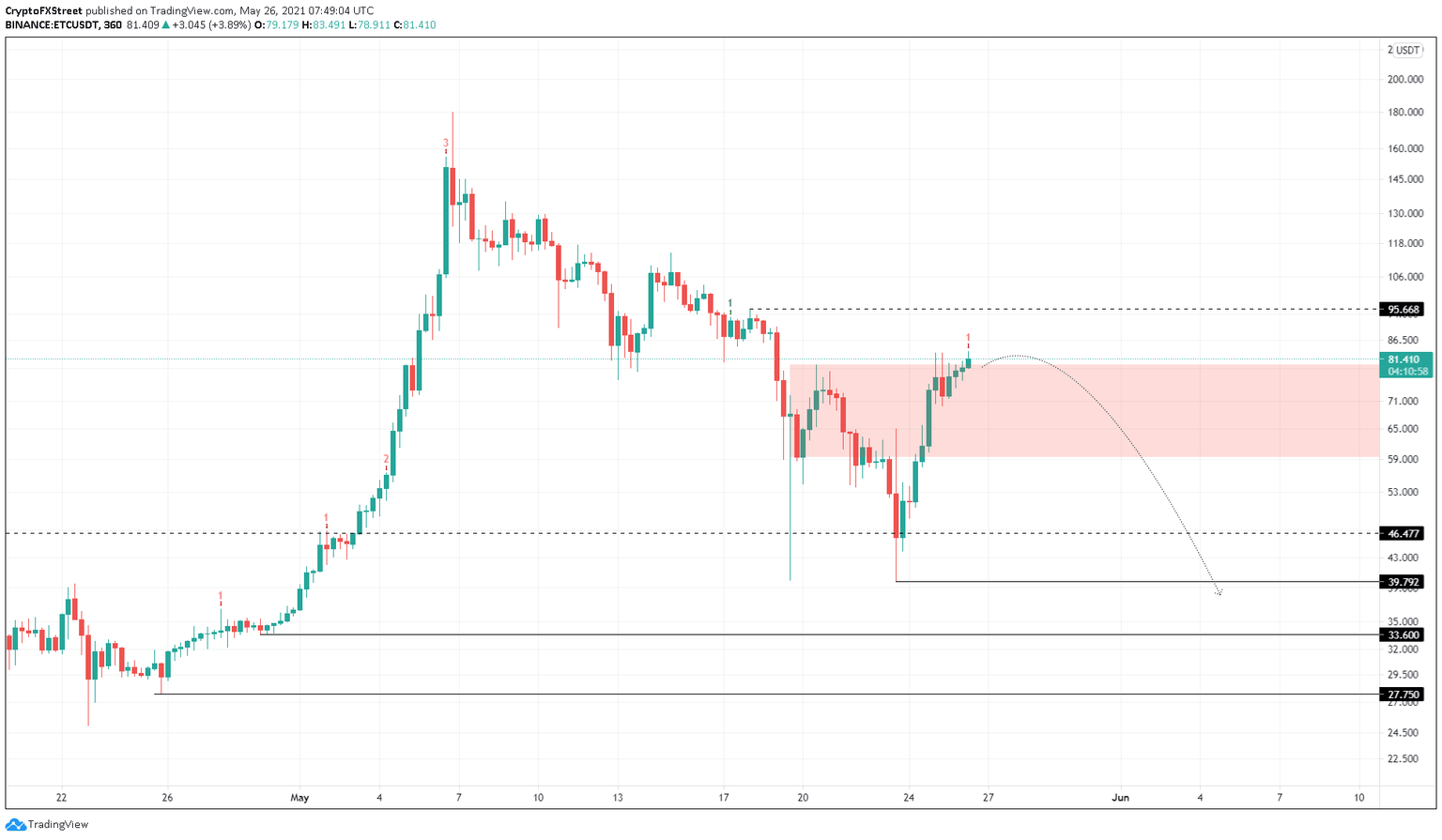

Ethereum Classic Price Prediction: ETC seems overextended, 40% crash incoming

- Ethereum Classic price has surged 17% in the past 24 hours, slicing through the supply zone’s upper limit at $80.

- The MRI has flashed a sell signal on the six-hour chart, indicating a sell-off might occur shortly.

- ETC could drop 27% to the support level at $59.44, roughly 40% to $46.48.

Ethereum Classic price has witnessed a stellar rally that has propelled it close to pre-crash levels. However, a technical indicator is suggesting that ETC might be due for a reversal.

Ethereum Classic price at crossroads

Ethereum Classic price is currently hovering above the supply zone that extends from $59.44 to $80. A decisive six-our close above $80 is a bullish signal, no doubt, but the Momentum Reversal Indicator (MRI) has flashed a reversal sign in the form of a red ‘one’ candlestick.

This technical setup indicates that the rally has reached its peak and that a one-to-four candlestick correction might ensue.

Therefore, investors need to exercise caution as ETC sits at this critical level. The likely course of action after a 109% rally since May 19 is for the buyers to book profits. If this were to happen, Ethereum Classic price would slide under the mentioned supply zone, delaying the upswing.

Under these circumstances, a potential spike in selling pressure could push ETC down by 27% to the support level at $59.44. If the sellers continue to persist despite this drop, Ethereum Classic price will head to $46.48, which is nearly 43% from the current level ($81.41 at the time of writing).

ETC/USDT 6-hour chart

Regardless of the bearish signals, if the buying pressure continues to build up and pushes Ethereum Classic price above $95.67, it would form a higher high, signaling the possible start of an upswing.

In that case, ETC could rally nearly 20% to tag the subsequent resistance level at $114.49.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.