Ethereum Classic Price Prediction: ETC gains threatened as market goes into tailspin

- Ethereum Classic price crashed nearly 30% as the cryptocurrency market entered a selling spree.

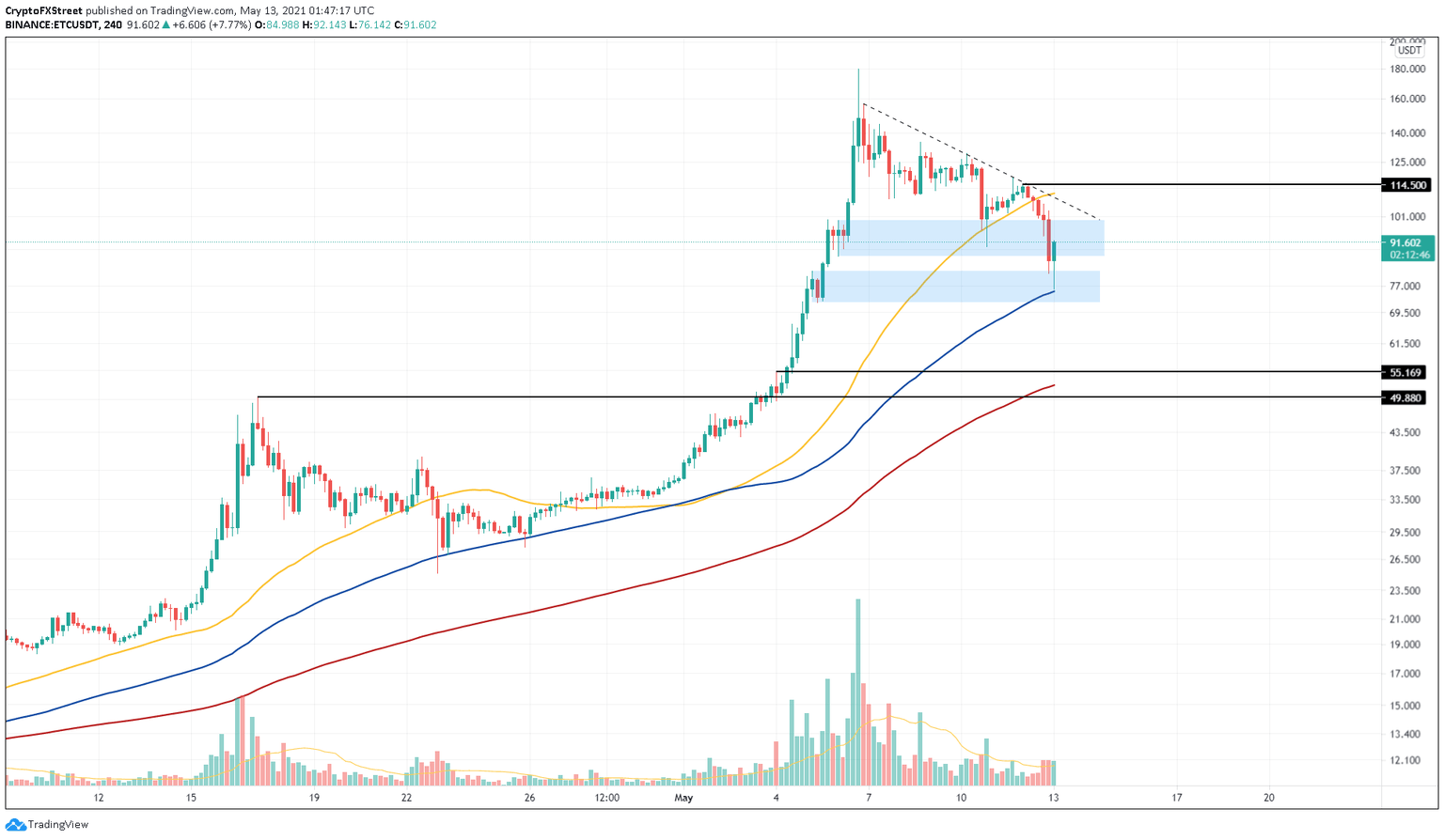

- A combination of the 100 SMA at $75.45 and a support barrier stretching from $72.31 to $81.67 provided a base for Wednesday’s crash.

- The downtrend scenario will go extinct if ETC produces a decisive close above $114.50.

Ethereum Classic price shows a quick run-up after a nasty crash in Wednesday’s trading session. ETC needs to climb past the demand levels and create a higher high to signal the start of a new uptrend.

Ethereum Classic gains in jeopardy

Ethereum Classic price has dropped a whopping 30% since May 7, undoing most of its gains as it created lower highs and lower lows, a classic sign of a downtrend. During this crash, ETC sliced through the immediate demand zone that extends from $86.27 to $99.50 and found a stable base as it pierced the next support area, ranging from $72.31 to $81.67.

Interestingly, the 100 four-hour Simple Moving Average (SMA) at $75.45 was pivotal in shouldering the downfall. Buyers scooped up Ethereum Classic at a discounted price, which has resulted in a 21% upswing so far.

Although the current setup for ETC price is bearish, investors can expect it to rally 20% to $110, coinciding with the 50 SMA. A decisive 4-hour candlestick close above $114.50 will signal an uptrend’s start. In such a case, ETC could surge another 12% to tag the swing high at $128.40.

ETC/USDT 4-hour chart

Until Ethereum Classic price closes above $114.50, market participants should consider it in a downtrend. The inability of buyers to push ETC beyond the level mentioned above will most likely result in a retest of the 100 SMA at $75.45.

A breakdown of that support will be extremely bearish and could trigger a 30% freefall to the 200 SMA at $52.31.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.