Ethereum Classic Price Forecast: ETC correction presents new opportunity to profit

- Ethereum Classic price declines to the 61.8% Fibonacci retracement in four days.

- Daily volume shows no signs of panic selling.

- Social media mentions aggressively decline to prior average.

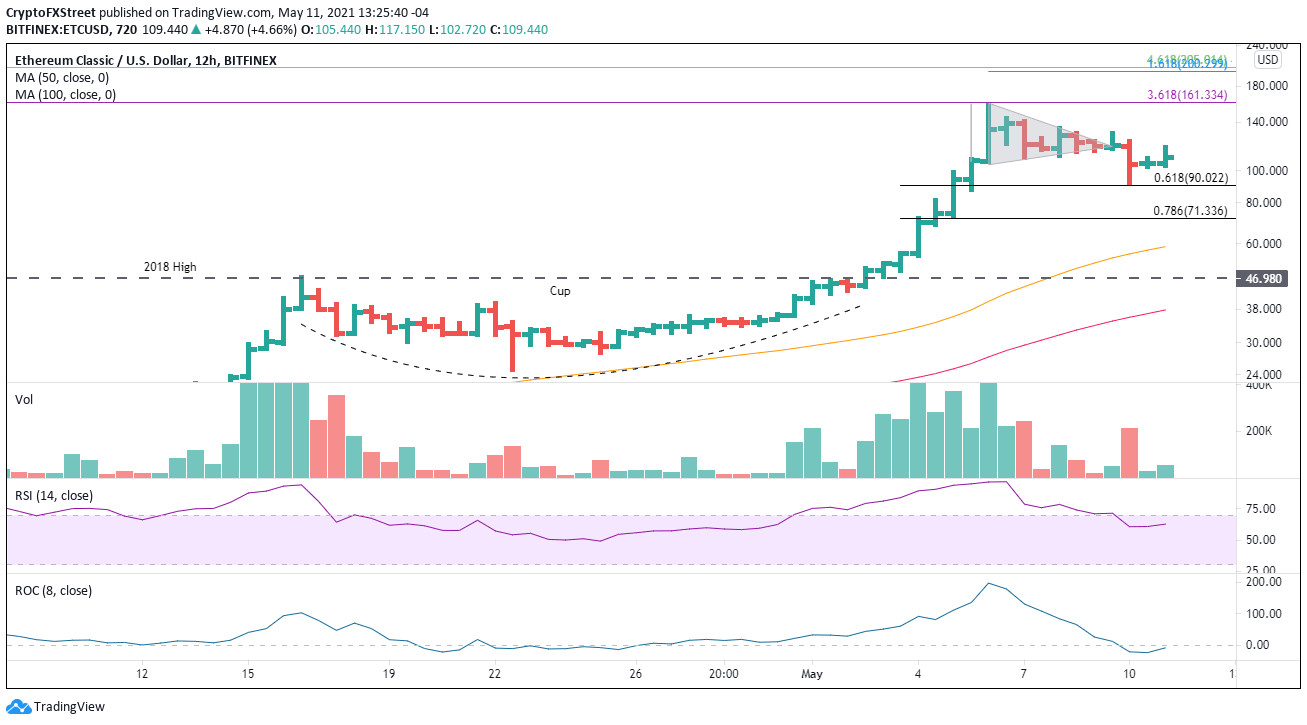

Ethereum Classic price resolves pennant continuation pattern to the downside on relatively light volume following three consecutive inside days on the bar chart. Residual selling pressure may dampen rebound attempts, but if a new low is printed, it should be marginal.

Ethereum Classic price quietly solves overbought condition

From May 2 to May 6, Ethereum Classic price rallied 200% from a cup continuation pattern, easily the best 4-day gain since trading began in 2016. At the same time, the rally nearly tagged the 361.8% Fibonacci extension of the 2018 decline at $161.33.

The depth of the pullback at 40%, combined with the minimal accompanying volume, pinpoints a relative calm among the investor ranks and attributes the decline more to a function of a technically overbought condition rather than an aggressive exit.

Moving forward, Ethereum Classic price will experience some gyrations as bottoming processes tend to do. Still, a rally above $129.64 will confirm a firm low and a renewal of the larger bullish trajectory.

A rally above $129.64 should ignite an acceleration of the rebound that will carry Ethereum Classic price to the May 6 high at $158.76. Speculators should anticipate some resistance just above the 361.8% extension of the 2018 decline at $161.33 before a push into new highs. Additional resistance will be exposed at the confluence of the 161.8% extension of the current decline at $200.29 and the 461.8% extension of the 2018 decline at $205.01.

ETC/USD 12-hour chart

The bottoming process remains intact unless the May 10 low at $91.54 is undercut on a daily closing basis. It would signal that a more complex bottom is being formed, or worse, a deeper retracement, possibly to the 78.6% retracement of the early May rally at $71.33.

Beware of a collective sell-off, an event that will negatively affect Ethereum Classic price, particularly if the origin of the decline extends from Ethereum price weakness.

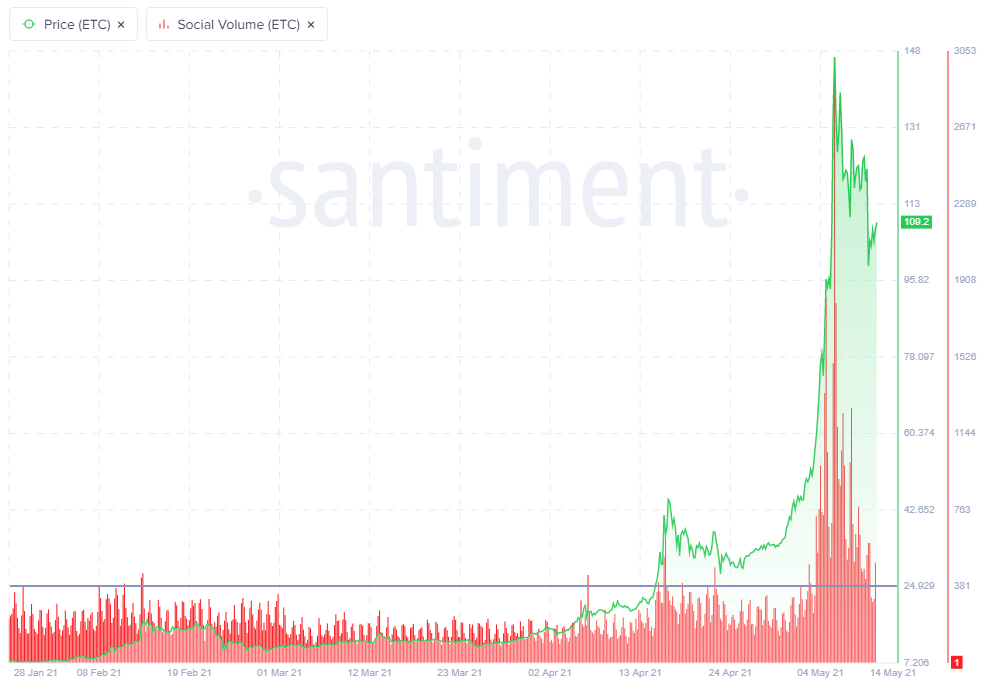

The Santiment social volume metric tracks the number of mentions of ETC on over 1000 cryptocurrency social media channels, ranging from discord groups, crypto subreddits, Telegram groups and private traders chats. At the May 6 high, there were over 3000 mentions on social media from a low of 182 on May 2, the day Ethereum Classic price broke out from a cup base. It was a 1500% spike in four days.

Since the May 6 high, social media mentions have returned to 501, representing an 83% decline and placing it close to the average level of around 380.

ETC related mentions on social media

Social media volume spikes consistently align with local tops or even significant highs. Still, the quick descent for ETC suggests speculators have already moved on from the cryptocurrency, thereby providing a new source of buying pressure should Ethereum Classic price target new highs.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.