Ethereum Classic Price Forecast: ETC readies itself for another 24% advance

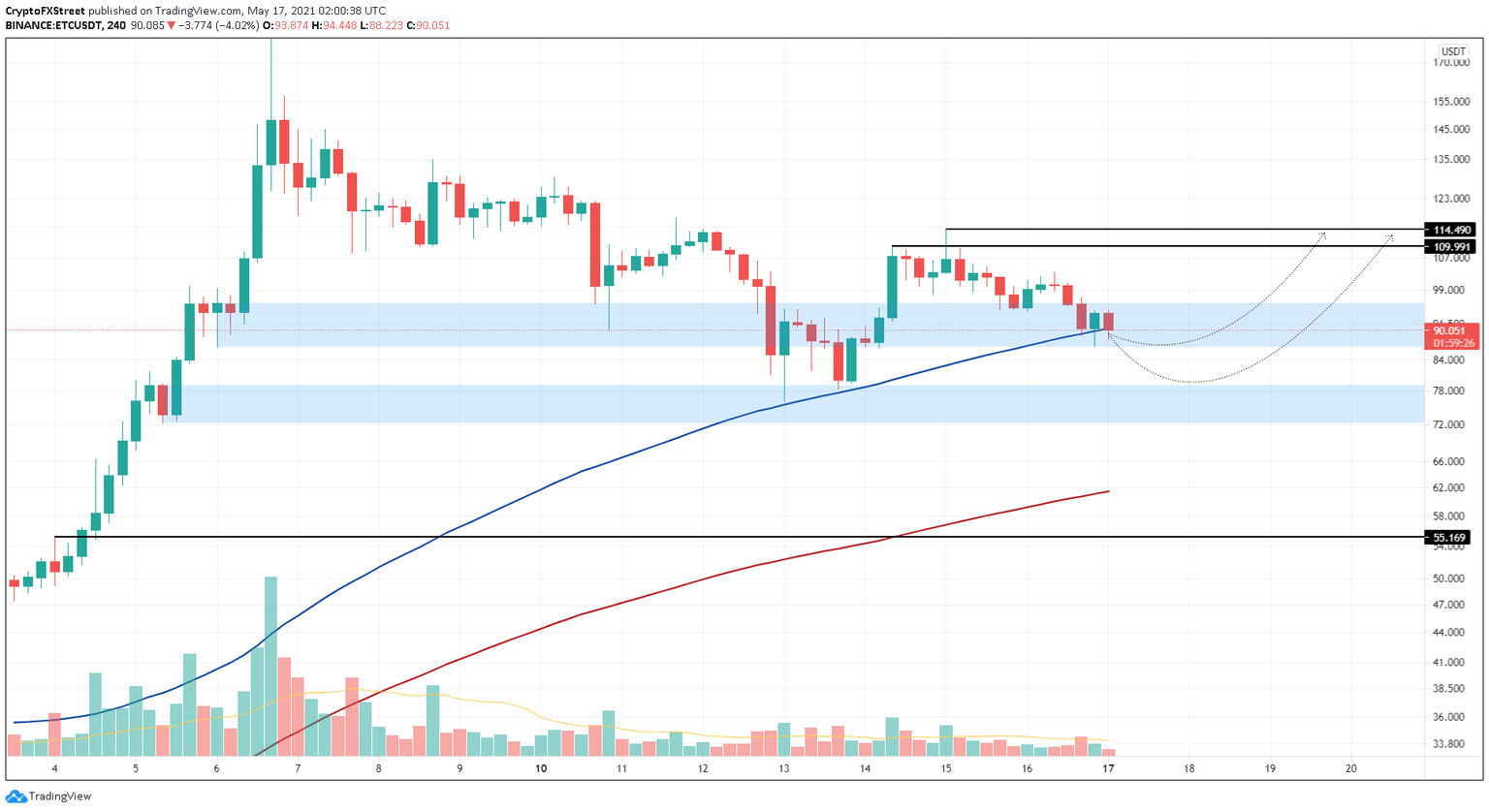

- Ethereum Classic is currently eyeing a quick 24% bounce from the 100 four-hour SMA at $90.07.

- Adding credence to this bullish outlook is the immediate demand zone extending from $86.26 to $96.

- A breakdown of the 200 four-hour SMA at $61.52 will invalidate this upswing narrative.

Ethereum Classic price is currently in a downtrend but shows potential for a quick bull rally. ETC needs to bounce out of the immediate demand zone to set up another lower high.

Ethereum Classic continues to descend

Ethereum Classic shows the formation of lower highs and lower lows since May 6. This downward move accelerated on May 12 as ETC slid nearly 28% in a single day. Ethereum Classic price is currently trading inside the immediate demand zone, stretching from $86.26 to $96. Considering the overextended state of the cryptocurrency market, a minor upswing in ETC seems likely.

Therefore, investors can expect another swing high at $109.91, roughly 24% from the current price level. In some instances, Ethereum Classic price could retest the recent local top at $114.49.

Market participants should note that this bullish thesis depends on buyers being able to fish out ETC from the demand zone after a bounce from the 100 four-hour Simple Moving Average (SMA) at $90.07. Failing to do so could result in a downswing to the next support area that runs from $72.31 to $78.96.

While this move would not invalidate the optimistic outlook, it could provide buyers another opportunity to set up yet another lower high at the levels mentioned above.

ETC/USDT 4-hour chart

Although the downswing is apparent, a sudden spike in selling pressure that pushes Ethereum Classic price to shatter the support area’s lower bounds at $72.31 will jeopardize the upswing narrative. Such a move would expedite the bearish descent.

However, a decisive 4-hour candlestick close below the 200 four-hour SMA at $61.52 will invalidate the uptrend. In such a case, ETC might slide 10% to tag a support barrier at $55.17.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.