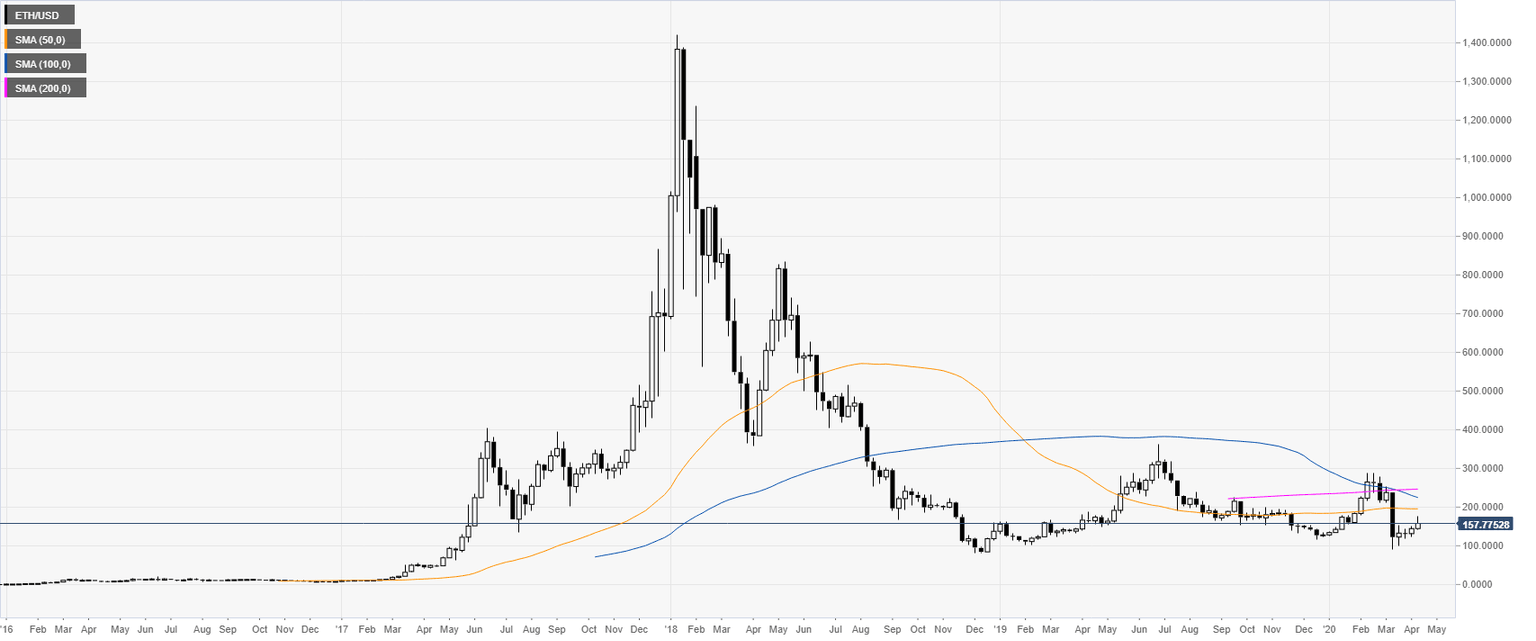

ETH/USD Price Analysis: $10 Ethereum will still be considered expensive in the future

- ETH/USD has been in a downtrend since the crypto-bubble burst in early 2018.

- ETH/USD bear trend remains intact as sellers are eyeing a break below $100.

ETH/USD weekly chart

Additional key levels

Author

Flavio Tosti

Independent Analyst