Dogecoin price might head south for the Winter as whales consider offloading

- Dogecoin consolidates at the lower end of a trading range after a 50% decline.

- A bearish death cross has been spotted while on-chain metrics continue to display bearish signals.

- Invalidation of the bearish outlook is a breach above $0.103.

Dogecoin price could be hinting that another move south is on the way. As the third trading week of November commences, the technicals leave sparse signals for the bulls to believe in. Key levels have been defined to determine DOGE's next potential move.

Dogecoin price looks dicey

Dogecoin price shows concerning technicals that the notorious meme coin investors should be aware of on November 14. DOGE consolidates within a pennant-looking formation, 50% below the Novembers monthly high.

Dogecoin price currently auctions at $0.085. The bulls have recently been denied entry to the $0.090 price level. Over the weekend, the 8-day exponential moving average produced a bearish death cross above the 21-day simple moving average. The DOGE price has witnessed a minuscule reaction to the cross, which is peculiar in its own right. If the coiling pennant does break out to the downside, a strong downtrend move could resolve the congestive pattern. Bearish targets are likely near the summer lows at $0.049 and potentially new yearly lows near $0.040.

DOGEUSDT 1-Day Chart

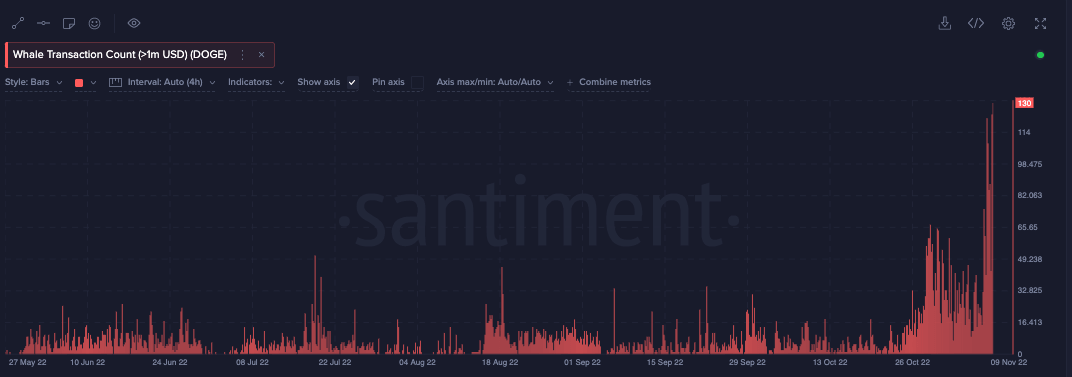

On-chain metrics continue to highlight the bearish possibility as whales behind the scenes seem to be preparing for a move. Santiment's Whale Transactions Count >1M shows a considerable influx in the movement of the Dogecoins. The indicator hints at the underlying sentiment that DOGE Whales are experiencing, Perhaps booking short-term profits is more favorable than hodling for long-term gains in such a volatile market environment.

Santiment's Whale Transaction Count (>1M USD)

Considering these factors, the DOGE price may be in for some troublesome days ahead.

Invalidation of the bearish thesis requires a bullish retaliation spike hurdling above the $0.103 liquidity levels. If the level is breached, DOGE could produce a bear trap rally targeting the November monthly high at $0.150. Such a move would result in a 90% increase from the current Dogecoin price.

In the following video, our analysts deep dive into the price action of DOGE, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.