Dogecoin price at risk of continuing lower, despite breakouts

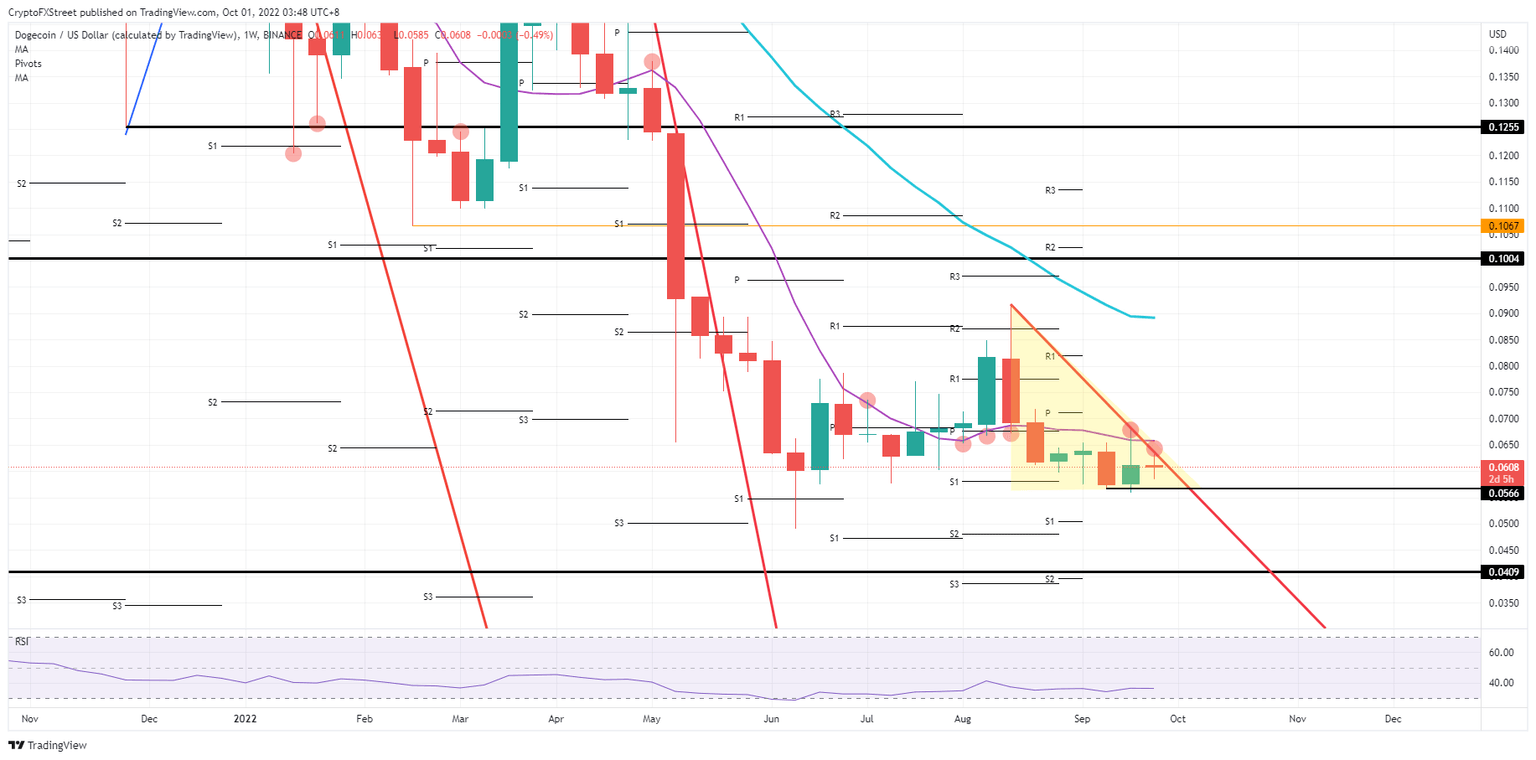

- Dogecoin price trades within a descending triangle with the additional technical cap on the topside.

- DOGE price, even with a few breakouts to the upside, still looks bearish.

- Seeing this week's developments in the other asset classes of the markets, the outlook for next week looks to be a break towards $0.050 to the downside.

Dogecoin (DOGE) price is trading within narrow boundaries as although a few breakouts happened to both the upside and the downside, the body of the candle between the opening and the close is becoming smaller by the week. Risk is a consolidation on a weekly basis and could see a break to the downside as a result. This would mean that every break to the upside is a simple bull trap and results in more pain in the pullbacks for those bulls.

DOGE price to provide more pain to the downside

Dogecoin price is playing a dangerous game with traders as a few breakouts these past few weeks give the false illusion that more upside is to be at hand. The real situation is rather on the contrary as the weekly opens and closes show the less big difference between one another, even if it is a profit or a loss for the week. This points to consolidation and a strong breakout anytime soon, where the weekly close will tell much.

DOGE price rather looks at risk of breaking firmly to the downside, back to $0.050, pushing through the floor of the bearish triangle that has been formed for a few weeks. With healthy respect this week against the 55-day Simple Moving Average and the descending trend line of the triangle, a weekly close below will be a good indicator of that possible breakout next week should it not occur over the weekend. The close on Sunday will thus be key, depending on whether the close will happen within the triangle or below the base.

DOGE/USD Weekly chart

As mentioned above, one scenario is left on the table: a weekly close above the red descending trend line of the triangle and the 55-day SMA. That close on Sunday evening would see a handover in the Asian session on Monday and could well see a rally going into next week towards $0.0900. Depending on the stock markets, if those can move away from the bear market territory, this could create tailwinds for cryptocurrencies in the coming weeks.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.