Dogecoin Price Prediction: Expect a Wall Street discount

- Dogecoin price coils near the lower end of a range.

- The strongest bullish candles within the range have been reversed.

- An additional 10% drop is expected to occur in the coming days.

Dogecoin price shows suppressive price action, which could lead to a further decline.

Dogecoin could fall soon

Dogecoin price could be setting up for liquidation of the September lows. Since the middle of August, DOGE has lost 30% of its market value. The bulls have failed to promote a retaliation lasting longer than a few hours. The suppressive manner suggests the world's notorious dog coin is on a tight leash. Breakout traders are likely trapped, and an additional decline is on the horizon.

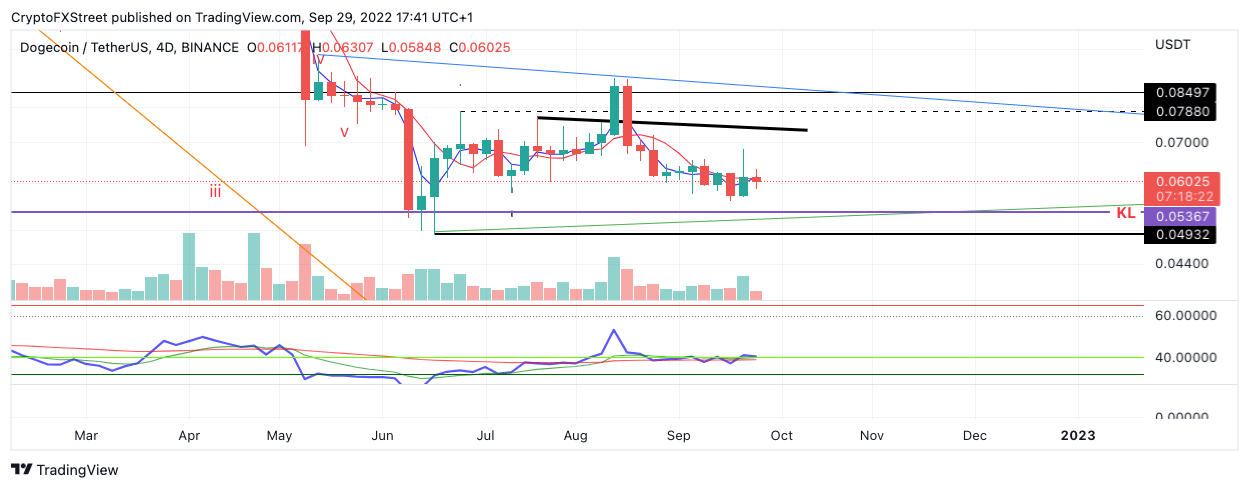

Dogecoin price currently auctions at $0.059 as the bears reject access to the $0.06 barrier reinforced by the 8-day exponential moving average. The Relative Strength Index has lost supportive grounds upon the recent downswing to $0.053. Although there has been an uptick in volume during green days within the range, the majority of the candles have been fully reversed, which is a bad sign for the overall trend.

DOGE USDT 4-Day Chart

If market conditions persist, a Wall Street liquidstion event targeting $0.053 could occur. If the bulls cannot hold support at this level, an additional fall of $0.04 might be imminent. Invalidation of the bearish thesis is a breach above the swing high at $0.089.

In the following video, our analysts deep dive into Dogecoin's price action, analysing key market interest levels. - FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.