Cryptocurrencies Price Prediction: SUI, Bitcoin & Crypto – European Wrap 2 June

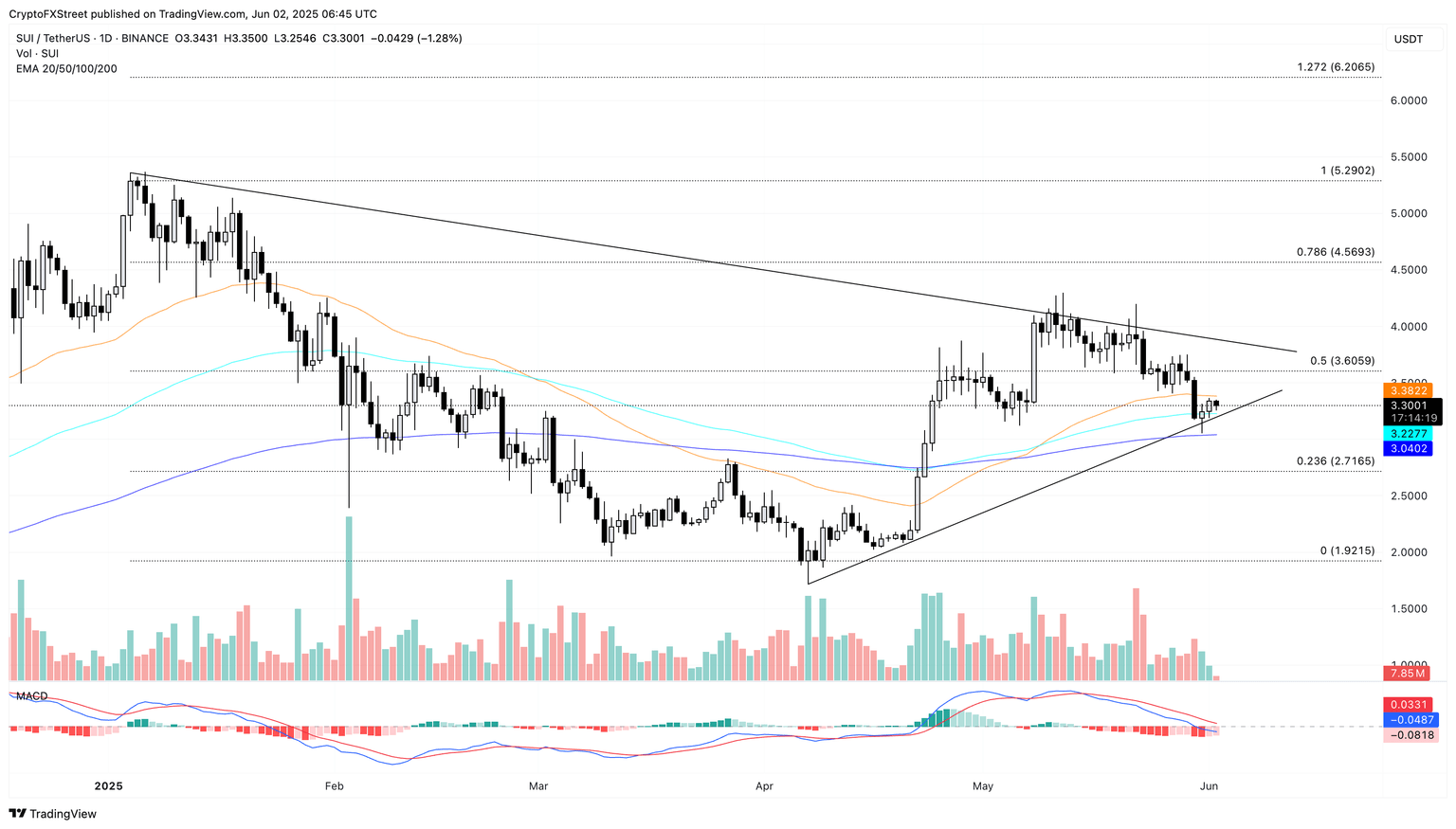

SUI Price Forecast: Fallout from triangle pattern could lead to further losses toward $2.70

Sui (SUI) is down over 1.50% at press time on Monday after three consecutive weekly closings on a bearish note. As Sui survives the 58.35 million tokens unlocked on Sunday, avoiding a panic sell-off, a potential fallout from a triangle pattern could extend the losses to $2.71.

Bitcoin price rebound hinges on clearing Fibonacci and EMA confluence near $105,800

Bitcoin price began Monday’s European session by staging a mild rebound at $105,500, after last week’s 5.5% drop from $109,000 to $103,200.

That retracement pulled price below the 0.786 Fibonacci level of the rally that ended at the all-time high of $112,000, signalling profit-taking into month-end.

Crypto Today: Market sentiment weakens amid Russia-Ukraine tensions; Bitcoin ETFs see first weekly outflow since mid-April

The cryptocurrency market is showing early signs of weakness at the start of this week on Monday as risk-off sentiment escalates amid rising tensions in the Russia-Ukraine war.

Bitcoin (BTC) spot Exchange Traded Funds (ETFs) recorded their first weekly outflow since mid-April, signaling a pause in institutional inflows. Traders should keep a watch on three altcoins: Ethena (ENA), Taiko (TAIKO), and Neon (NEON), which are set to undergo upcoming token unlocks worth over $5 million each, potentially adding sell-side pressure.

Author

FXStreet Team

FXStreet