Cryptocurrencies Price Prediction: Maker, Cardano & Litecoin – American Wrap 1 October

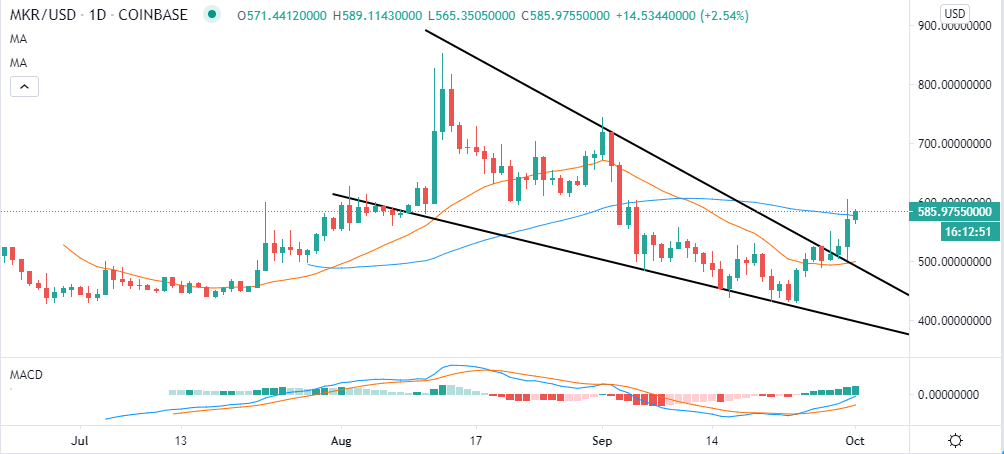

Maker Price Prediction: MKR’s utility explodes, kick-starting a massive rally aiming for $700

Maker is up over 30% in the last seven days and 15% in the previous 24 hours. The token is the second-largest in terms of value locked in the decentralized finance (DeFi) ecosystem. At the moment, Maker boasts of $1.9 billion in total value locked. It comes second after UniSwap, with $2.2 billion. Meanwhile, Maker is doddering at $588 amid a bullish building momentum. The biggest question is, does Maker have what it takes to continue going up?

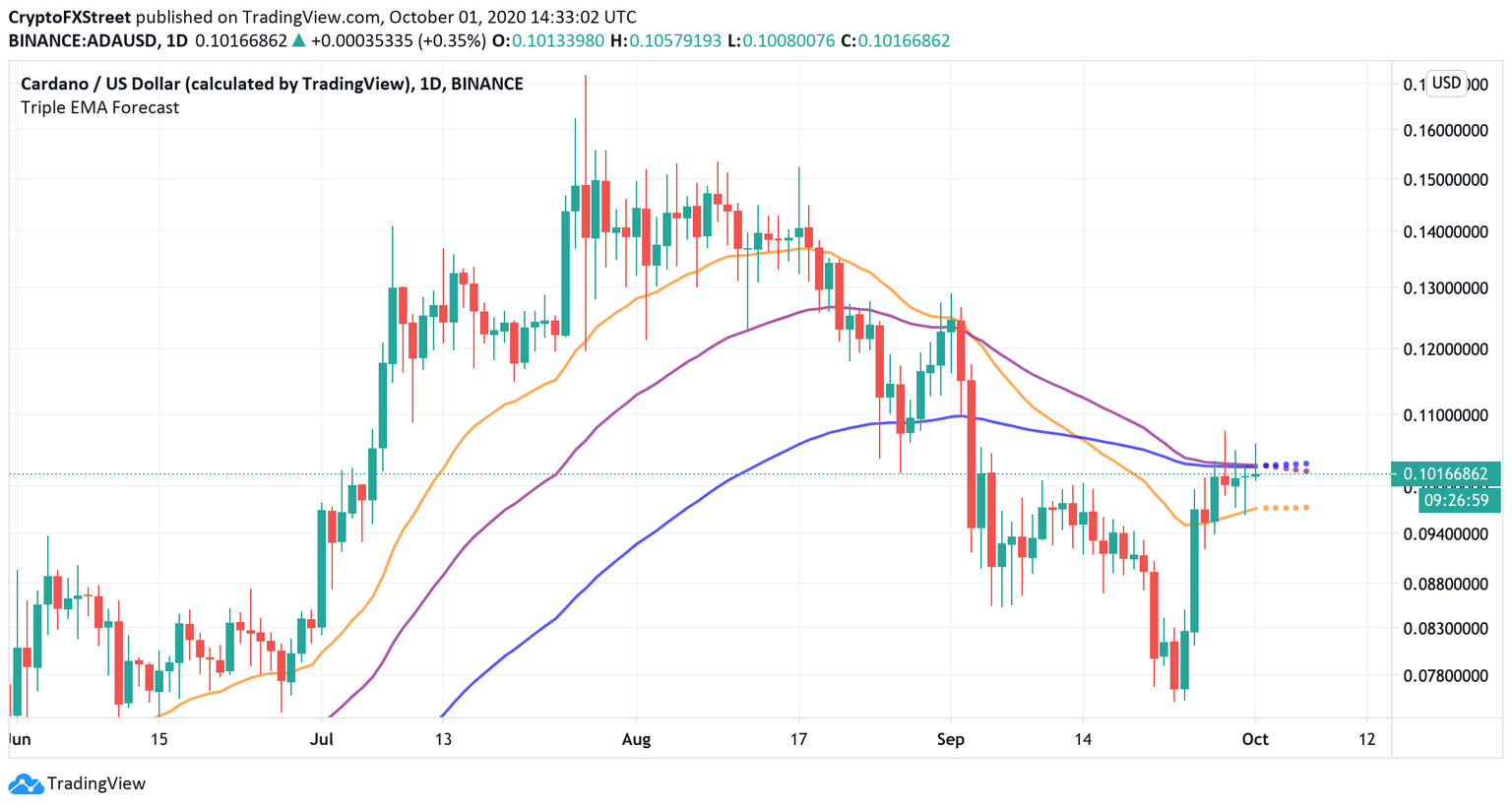

Cardano Price Analysis: ADA prepares to breakout as fundamentals turn bullish

Cardano's ADA had been range-bound with the bullish bias recently; however, the digital asset may be ready to resume the recovery amid the steady flow of positive fundamental developments.

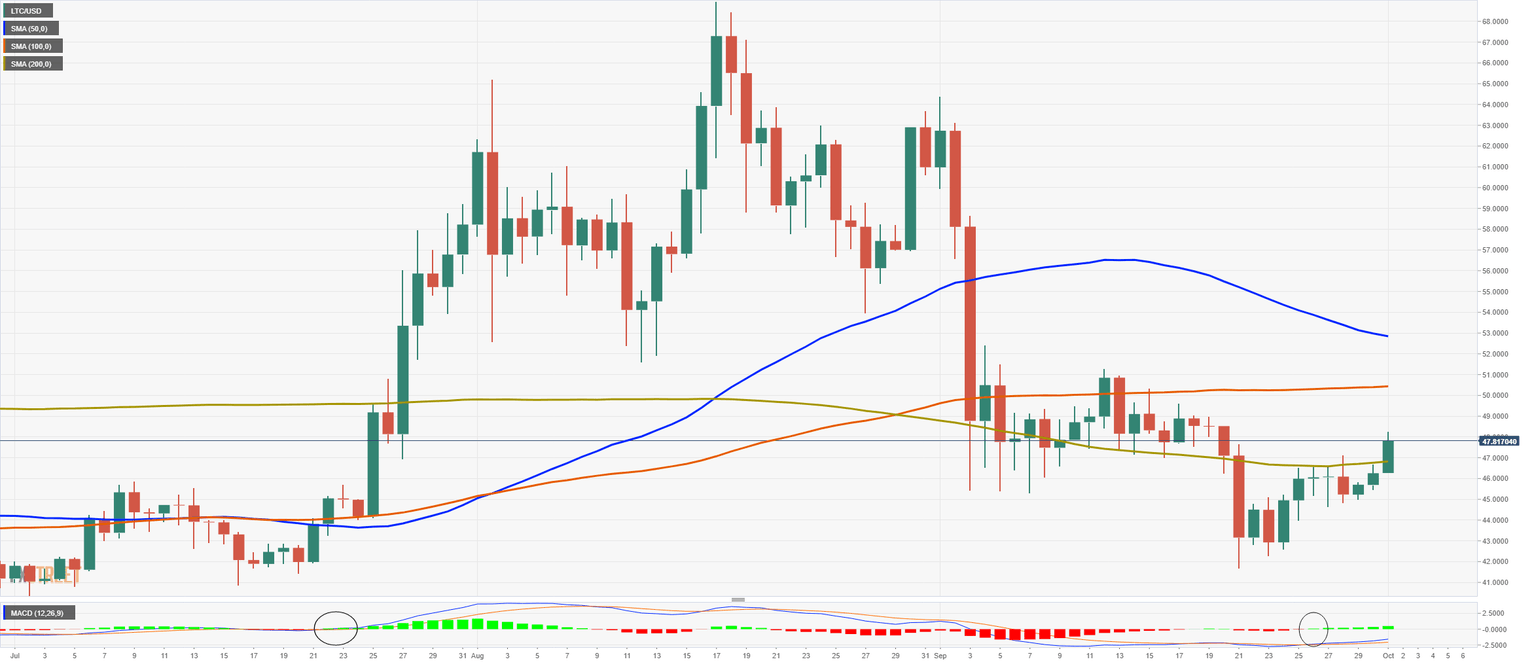

Litecoin prepares for Mimblewimble privacy launch, but investors raise concerns

Mimblewimble is a protocol designed to achieve various improvements like greater scalability or privacy. The founder of Litecoin, Charlie Lee, has been designing a Mimblewimble add-on block for quite some time. The initial testnet launch was set for September 30.

Author

FXStreet Team

FXStreet