Cryptocurrencies Price Prediction: Lido DAO, Bitcoin & Ripple– American Wrap 26 April

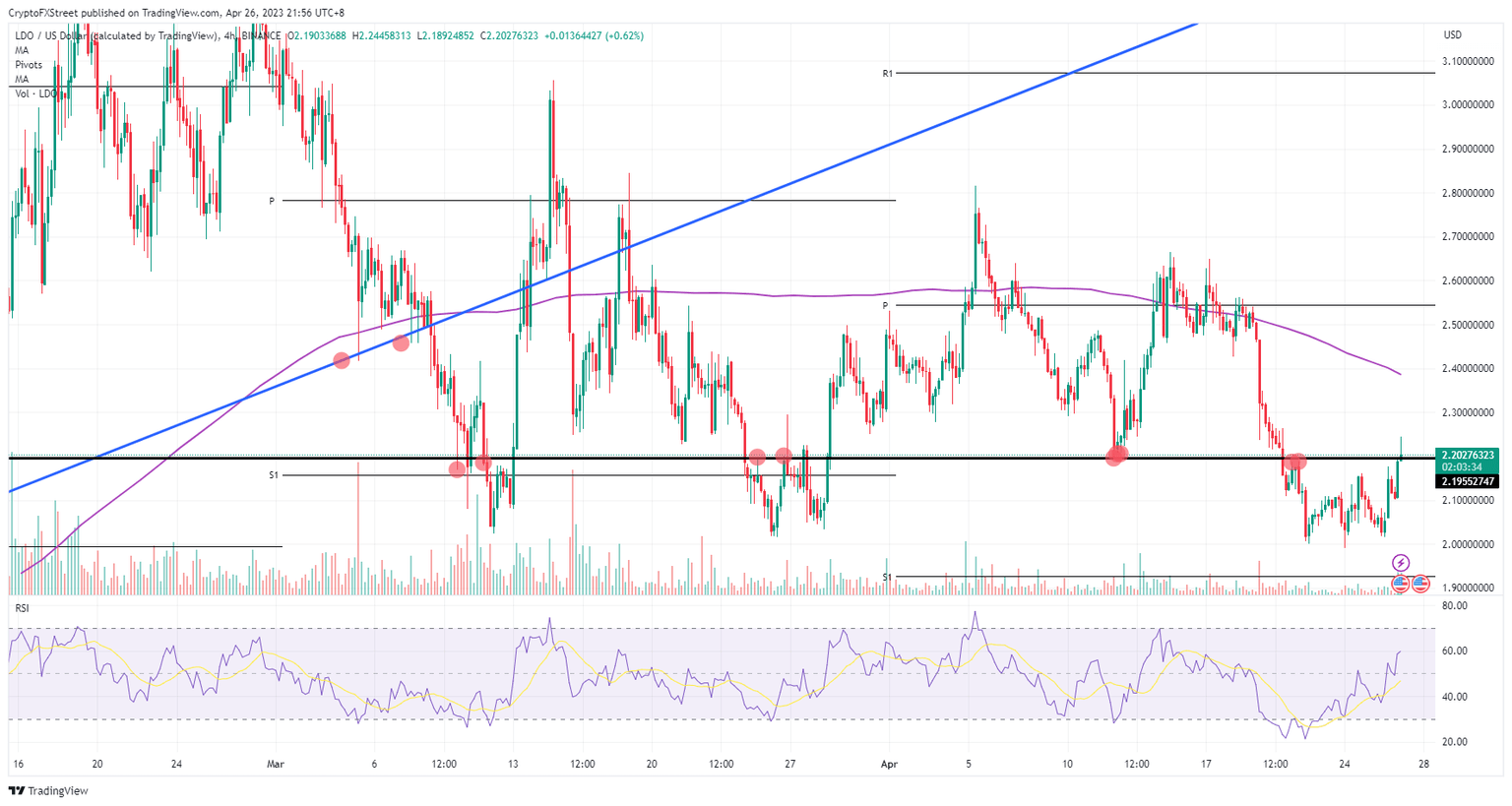

Lido Dao price favors a 30% uptick, with LDO to print $3 on the quote board

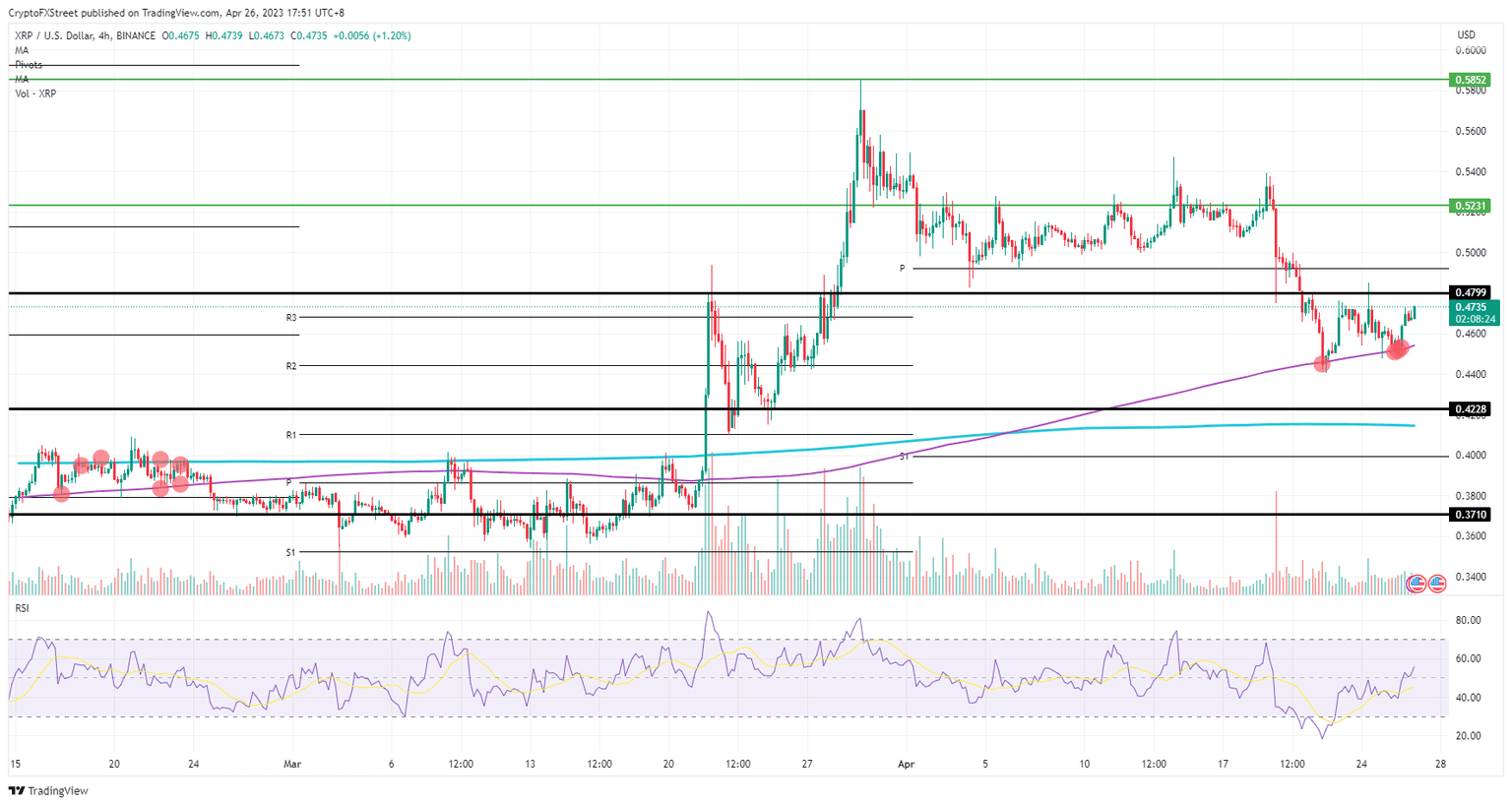

Ripple (XRP) price saw bears attempting to stage a coup on the price action as they tried to run price action below the 55-day Simple Moving Average (SMA). Expect a few false breaks; bulls kept their act together and did not hand bears the room to head towards $0.42. With some shifts in tailwinds coming from tech stocks, cryptocurrencies are on the front foot, and XRP signals an imminent bullish breakout that values Ripple price 25% higher.

Author

FXStreet Team

FXStreet