Cryptocurrencies Price Prediction: Ethereum, Dogecoin & Ripple — Asian Wrap 01 May

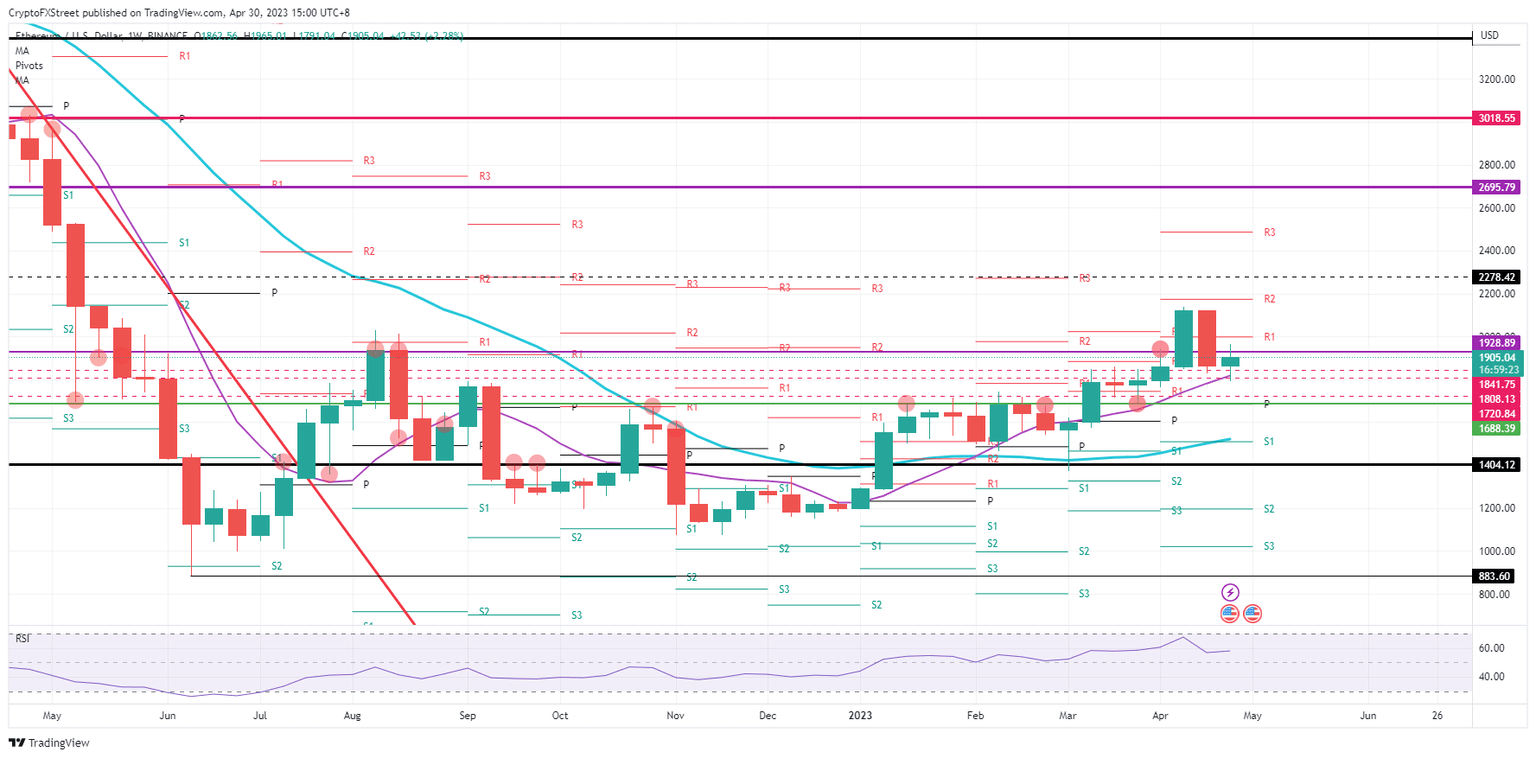

Where the Ethereum price will close on Sunday night will be vital to avoid a 25% price correction in ETH

Ethereum (ETH) price is at a crucial level as it could mean either more upside or downside to come for the month of May. This a very binary view or outlook, thus, as it makes total sense to look for where the Ethereum price is currently trading at. A weekly close below $1,930 means that bulls have lost the power to push ETH towards $2,000 and instead could see bulls vacating the premises with Ethereum price tanking to $1,400.

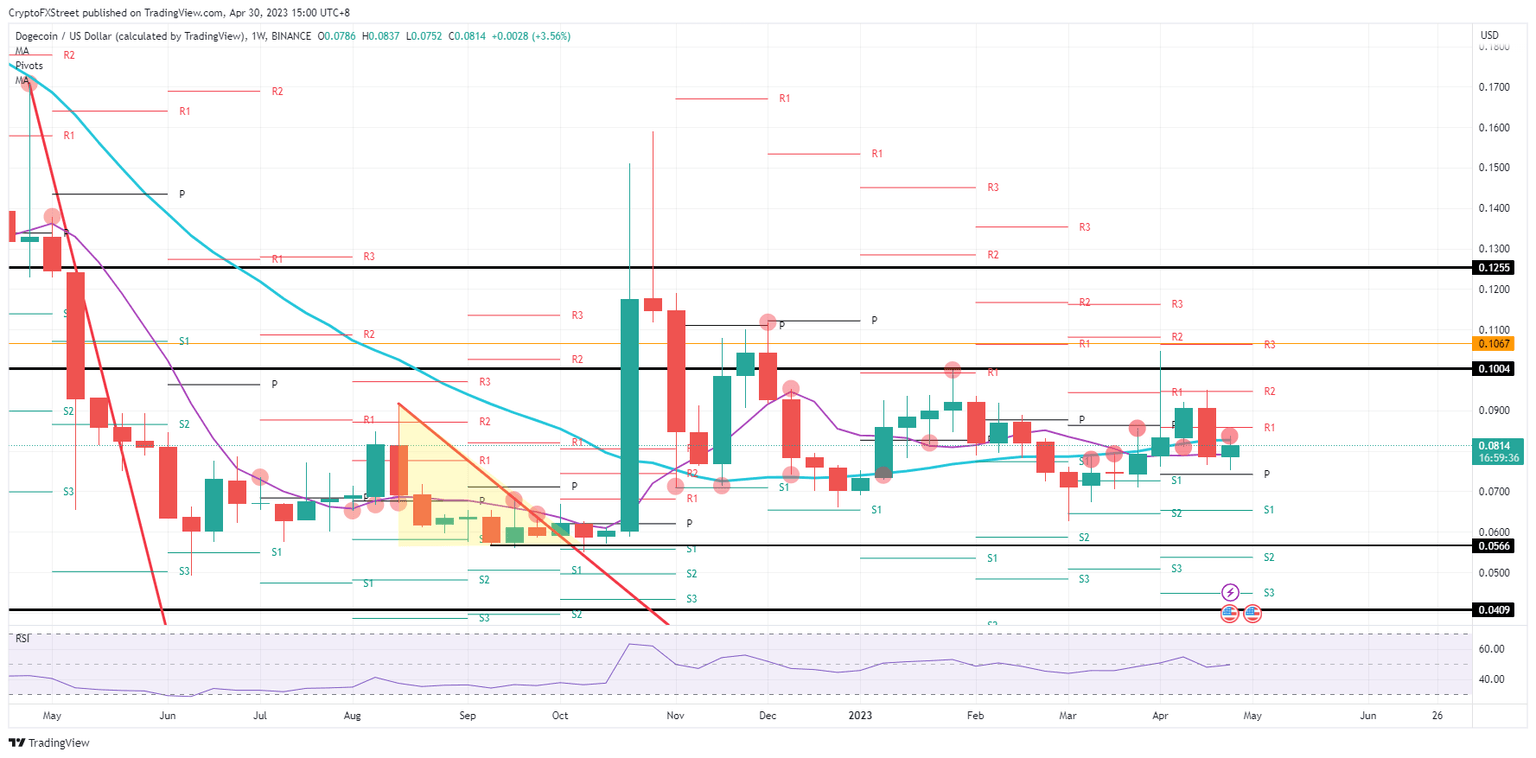

Dogecoin price rejection means trouble for next week where DOGE could tank 30%

Dogecoin (DOGE) price is in dire need of some help, although it is questionable which company Elon Musk could buy to place the Dogecoin logo on it. All things aside, the performance of this week was a straight F, as the Bulls were unable to reclaim a vital support element. By giving up on the 200-day Simple Moving Average (SMA), bulls settled for some small profit this week, while things could get ugly as of next week with 30% losses as the end result.

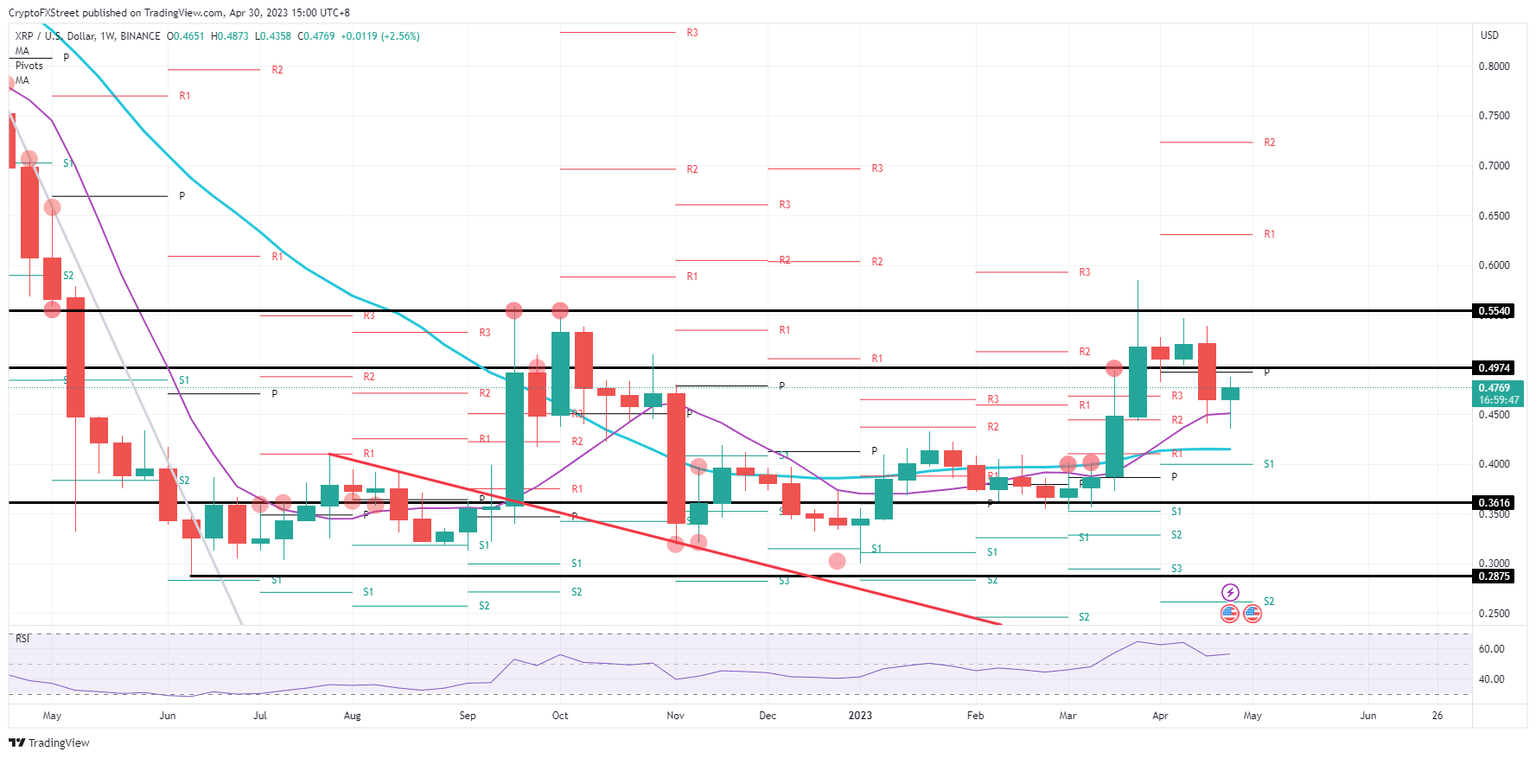

Ripple price to crash 40% as bulls do not respect handles

Ripple (XRP) price is starting to become an example of ‘the faster they grow, the harder they fall.’ The slide of last week with already 10% losses should have been a warning for bulls that sentiment is starting to change across the board. This week looks to be no different, as support got broken again and is showing signs of weaker buying on dips.

Author

FXStreet Team

FXStreet