Cryptocurrencies Price Prediction: Bitcoin, Monero & Solana – European Wrap 10 December

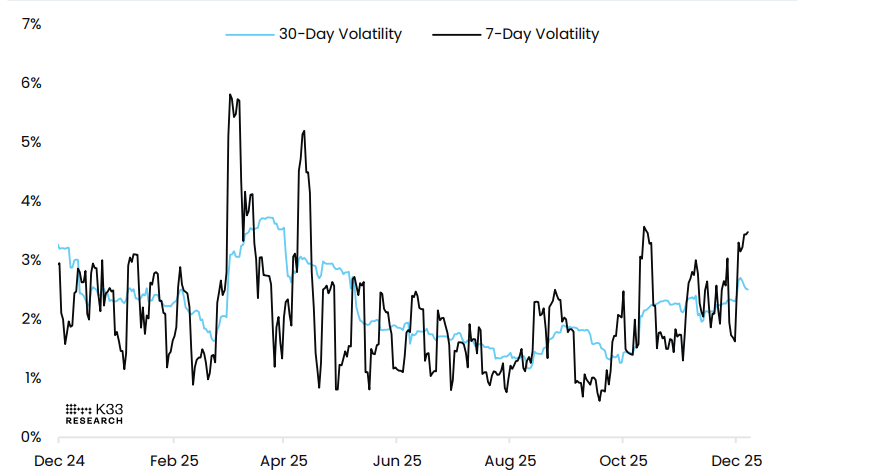

Bitcoin Price Forecast: BTC holds $92,000, primed for volatility as Fed decision looms

Bitcoin (BTC) price enters a pivotal week as traders position themselves ahead of the US Federal Reserve’s monetary policy decision. With BTC hovering near a key resistance zone, Wednesday’s Federal Open Market Committee (FOMC) meeting stands out as the most important market-moving event of the week. The Fed’s forward guidance, inflation outlook, and interest-rate path will likely dictate market volatility, making the announcement a decisive catalyst for the next move in the largest cryptocurrency by market capitalization.

Bitcoin started the week on a positive note, extending its weekend recovery, rising slightly and holding above $92,000 at the time of writing on Wednesday. The largest cryptocurrency could experience heightened volatility as the US Federal Reserve (Fed) is scheduled to announce its monetary policy decision later in the day, and is widely expected to cut interest rates by 25 basis points despite sticky inflation.

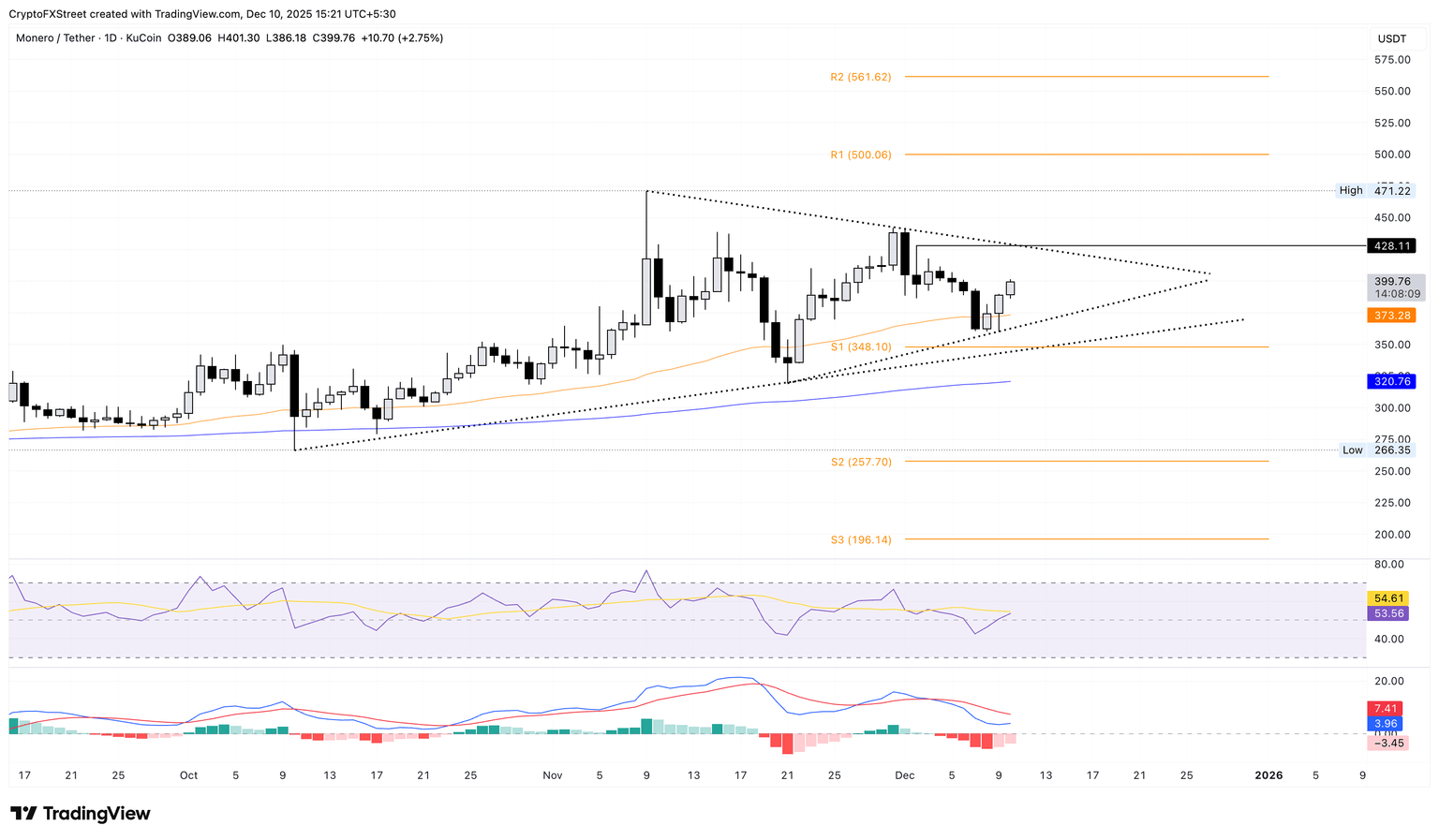

Monero Price Forecast: XMR rally to $400 shows signs of potential short squeeze

Monero (XMR) extends the gains to $400 on Wednesday, recording a 10% rise so far this week. Still, the derivatives market lacks confidence in XMR’s rally, leading to a bearish positional buildup that anticipates a collapse. On the technical side, the privacy coin is targeting a resistance trendline to break out of a symmetrical triangle and extend the rally.

CoinGlass’s data shows a nearly 5% rise in XMR futures Open Interest (OI), to $56.24 million in the last 24 hours, indicating a positional buildup across both long and short positions. Such buildups are often leveraged-based as traders increase their risk exposure amid anticipations of a sharp move.

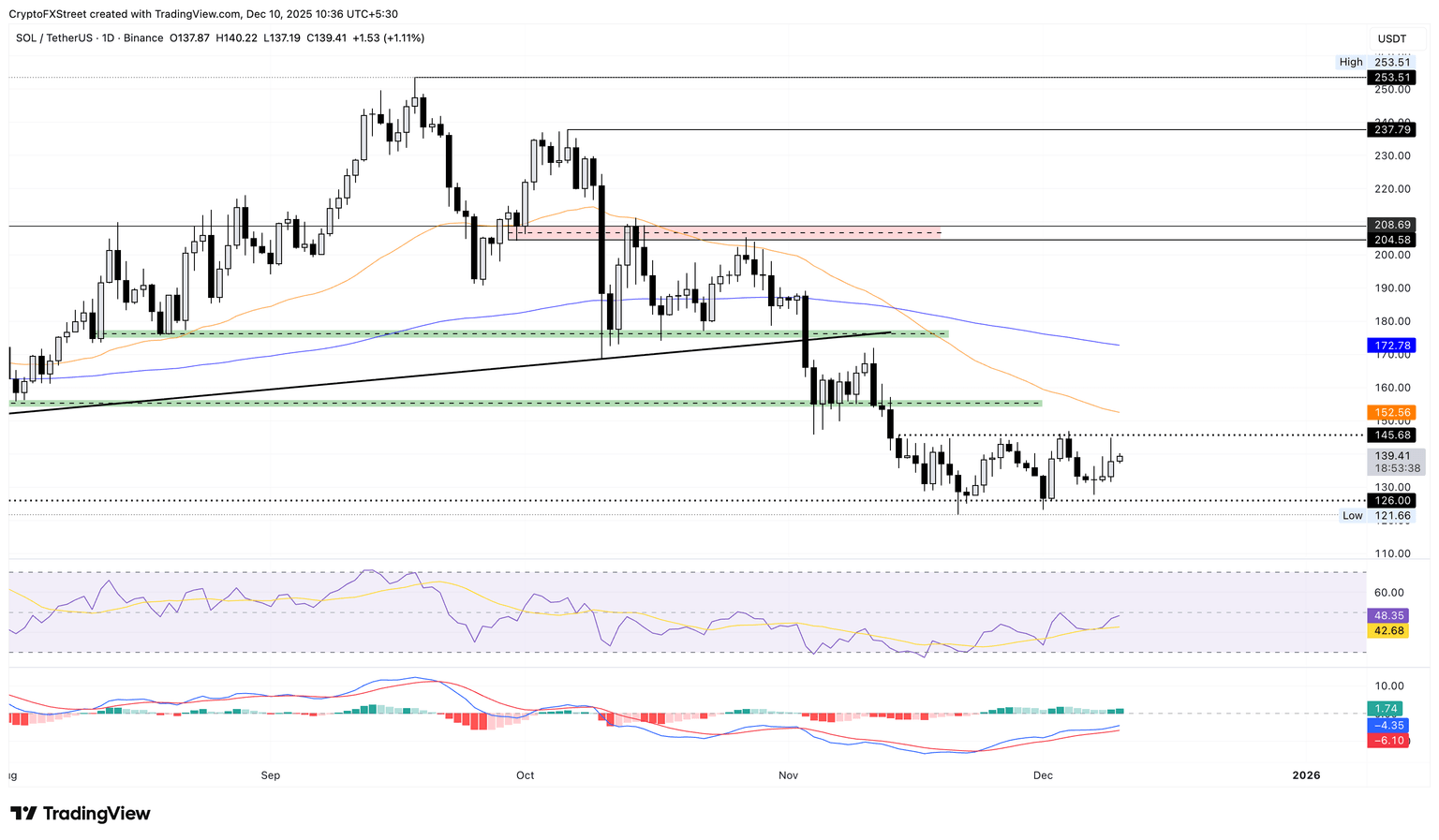

Solana Price Forecast: SOL flashes bullish potential on institutional, retail confidence

Solana (SOL) extends its upward trend for the third consecutive day, trading within a consolidation range of $121-$145. Persistent inflows into Solana Exchange Traded Funds (ETFs) over the last four days suggest steady institutional confidence. On the derivatives side, the risk-on sentiment prevails as the SOL futures market expands alongside increasing bullish bets.

CoinGlass’ data shows that SOL futures Open Interest (OI) stands at $7.26 billion, up 2.89% over the last 24 hours. This indicates that the investors are increasing their risk exposure, anticipating further recovery in Solana.

Author

FXStreet Team

FXStreet