Cryptocurrencies Price Prediction: Bitcoin, Ethereum and Avalanche – European Wrap 6 March

Bitcoin price could slip below $20,000 if Powell backtracks his comment

Bitcoin (BTC) price sees traders bracing for a big key event that is set to take place on Tuesday. The big event at hand is the US Senate hearing , where Fed Chair Jerome Powell will testify on Tuesday and Wednesday. Without hearing from Powell for over three weeks now, markets will want to hear if Powell has changed his mind about his disinflationary message from February.

Ethereum price to awaits for directional bias after another fraud surfaces

Ethereum price lacks directional bias as it trades in a tight range after a sudden collapse on March 2. The likelihood of a continuation of this bearish trend is high, considering the weakness in the market and investor sentiment, which is largely bearish-to-neutral. With Silvergate and Eco drama taking the spotlight last week, this week is key due to the testimony of Fed Chair Jerome Powell and the announcement of Non-farm Payrolls (NFP). So, investors need to be extra cautious and perceptive of the incoming volatility as things are likely going to get dicey for crypto markets, including Ether, the second-largest cryptocurrency by market capitalization.

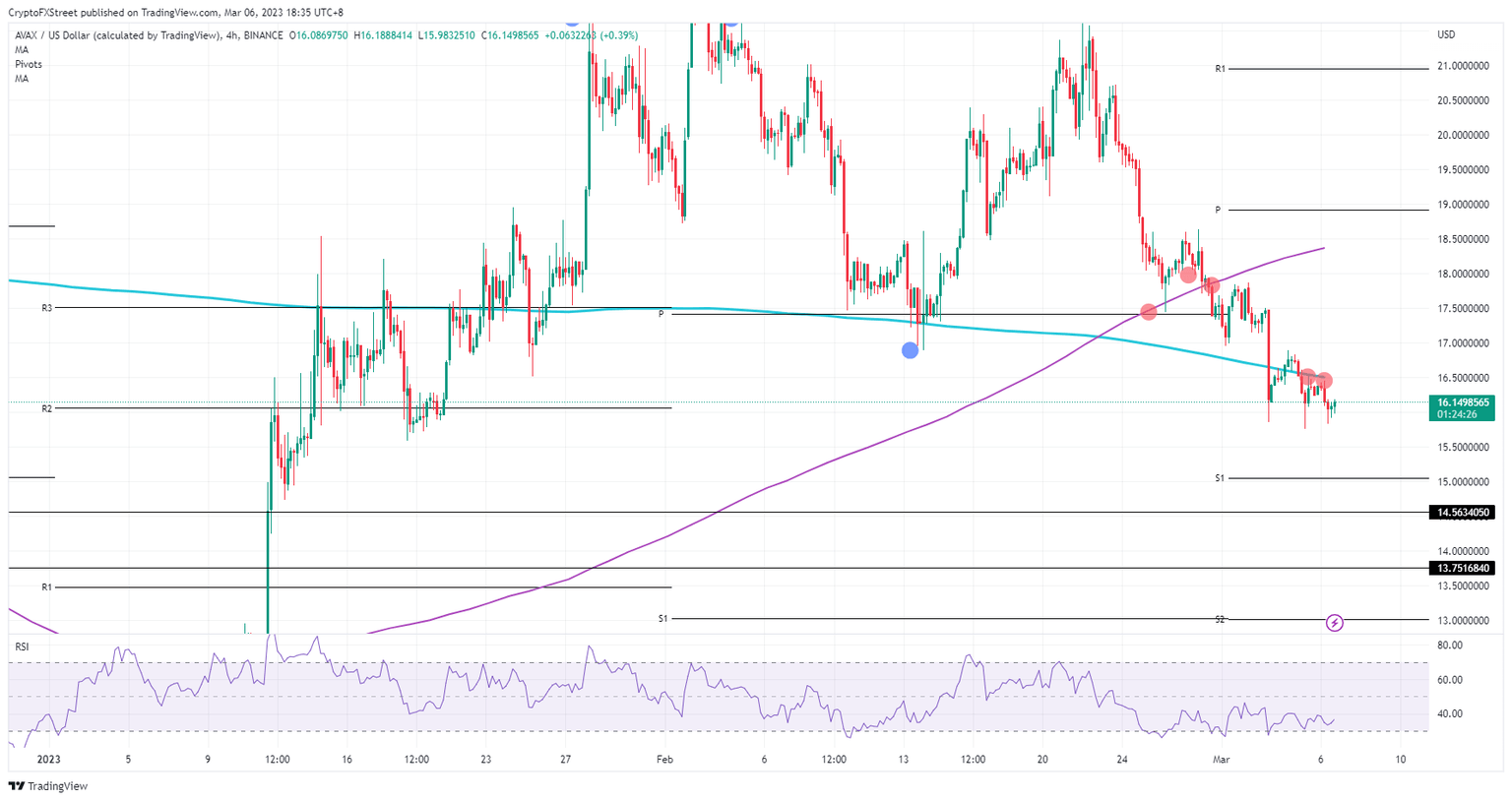

Bears are taunting AVAX bulls as Avalanche price could be at risk of sliding 10% on sell pressure

Avalanche (AVAX) price is having some technical difficulties as price action is under pressure from a major moving average on the charts. Looking back to the beginning of the year, the 200-day Simple Moving Average (SMA) has been a clear guide to whether the uptrend was still supported. As the price action in Avalanche currently resides below it, more pain could come before investors and bulls want to re-engage.

Author

FXStreet Team

FXStreet