Bears are taunting AVAX bulls as Avalanche price could be at risk of sliding 10% on sell pressure

- Avalanche price under technical pressure from a moving average.

- AVAX could get another 10% drop if another rejection happens.

- Expect support to come in below $15 with bulls ready to buy into the price action.

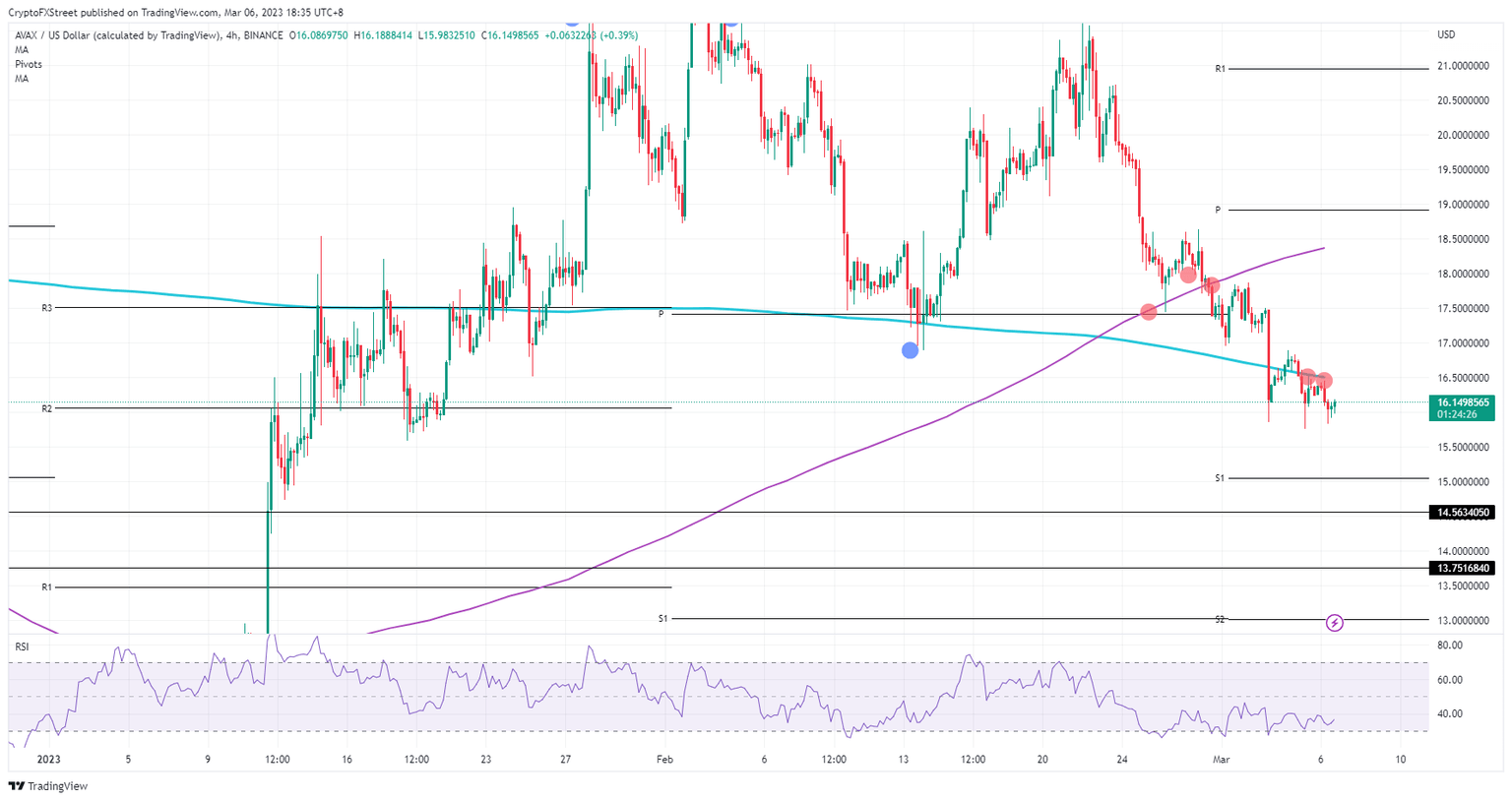

Avalanche (AVAX) price is having some technical difficulties as price action is under pressure from a major moving average on the charts. Looking back to the beginning of the year, the 200-day Simple Moving Average (SMA) has been a clear guide to whether the uptrend was still supported. As the price action in Avalanche currently resides below it, more pain could come before investors and bulls want to re-engage.

Avalanche price could tank 10% with or without a firm rejection

Avalanche price is in a tough spot as price action slips further away from the 200-day SMA near $16.50. That move lower comes after a few rejections got triggered on Sunday and Monday during ASIA-PAC trading. With lower highs and lower lows, a clear near-term downtrend is continuing its pace.

Expect AVAX to drop further as that 200-day SMA only gains strength with each candle that AVAX is opening and closing below it. A clear downward pattern is forming with lower highs and lower lows as no real support is offered nearby. Expect a 10% decline toward $15.50 with the monthly S1 as the first real support element and $14.50 as a line in the sand to catch any spillovers.

AVAX/USD 4H-chart

Upside moves could come when the bulls break this grind lower and push above the 200-day SMA. That means that once $16.50 gets broken to the upside, bulls will want to get in and start buying their way up. Short-term traders might look for $19 to lock in as a profit target at the monthly pivot, but I suggest going for the 55-day SMA at $18.50 in an SMA range trade as a more solid and reliable strategy bearing an 11% gain.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.