Cryptocurrencies Price Prediction: Bitcoin, Crypto & Ethena – European Wrap 3 June

Bitcoin steadies at 105k amid a fragile market mood and BTC ETF outflows, where next?

After falling back from the record high of 111.9k reached on May 24 to a low of 103.9k, Bitcoin is consolidating around 105k. Meanwhile, Ethereum has risen above 2600, and XRP is testing 2.20 resistance.

The cryptocurrency market capitalisation has risen 0.69% to $3.31 trillion over the past 24 hours. The crypto Fear and Greed Index is 58, in neutral territory, down from 68, Greed last week. This drop in sentiment suggests that investors could be hesitant and points to a consolidation phase.

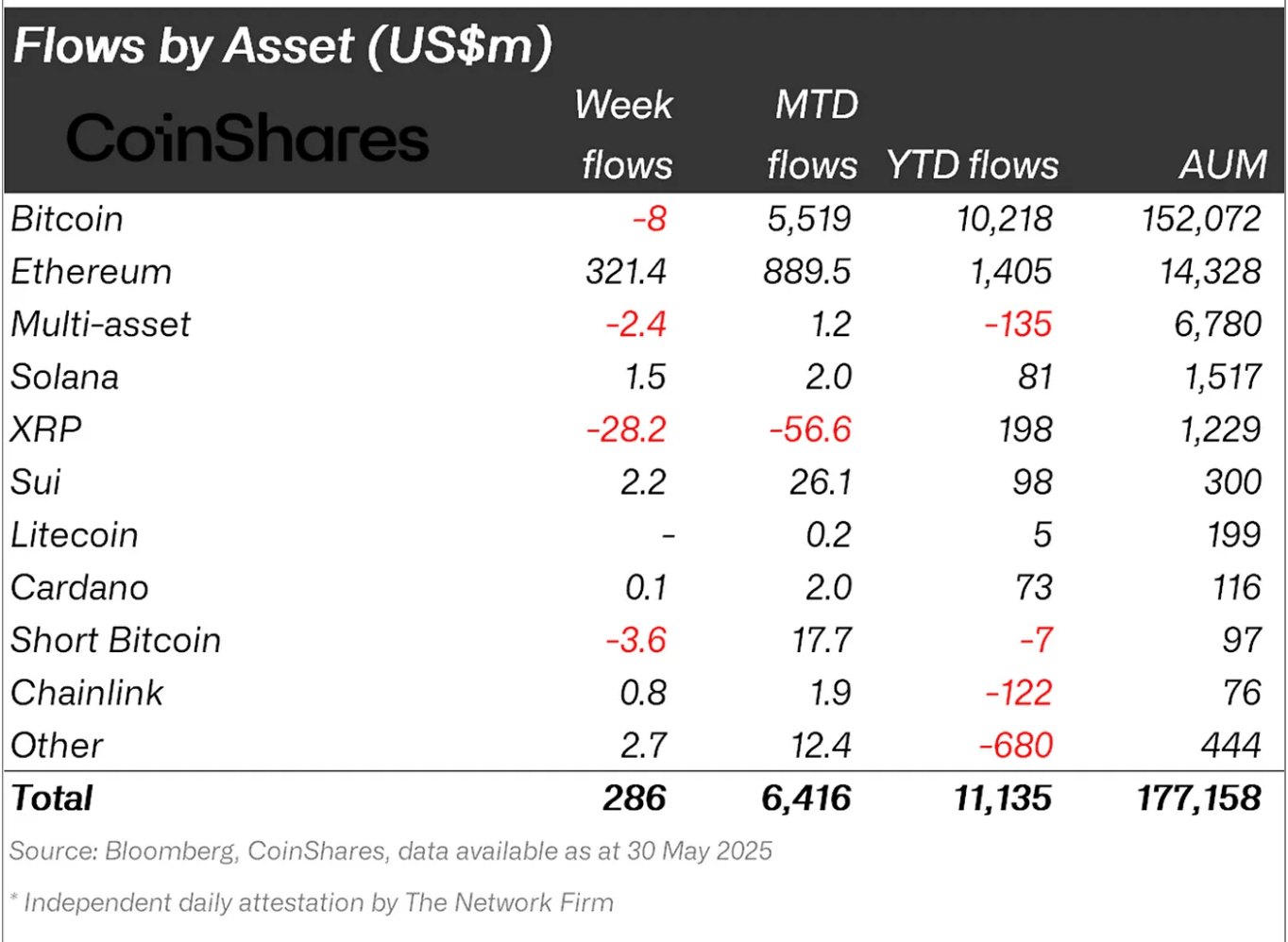

Crypto Today: Bitcoin's downside risks escalate as BTC spot ETF outflows extend

The cryptocurrency market is consolidating losses after starting the week amid high volatility. Bitcoin (BTC) attempted to steady the uptrend above $106,000 but lost steam, resulting in a reversal to $105,204 at the time of writing on Tuesday.

Coinbase asset roadmap adds Ethena, ENA targets $0.34 breakout before listing

Ethena (ENA) inches higher by over 5% at press time on Tuesday after the announcement of Coinbase adding Ethena to the asset roadmap for future listing. With bullish sentiment on the rise amid increased listing chances on Coinbase, ENA’s technical outlook and lifted derivatives data flash a breakout rally possibility.

Author

FXStreet Team

FXStreet

-638845487180800170-638845520531979958.png&w=1536&q=95)