Cryptocurrencies Price Prediction: Bitcoin, Cardano and Cardano – European Wrap 23 June

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Market diversion could do the trick

Bitcoin price, Ethereum and other cryptocurrencies look to be diverging from global markets this morning after the third recession warning on Wednesday. With commodities still selling off on Thursday and stock markets mixed, cryptocurrencies look to break the trend and shed the weight of the correlation with global market trends. Expect to see possible further decompression, with some gains in the books as cryptocurrencies are looking for the nearest upside price caps.

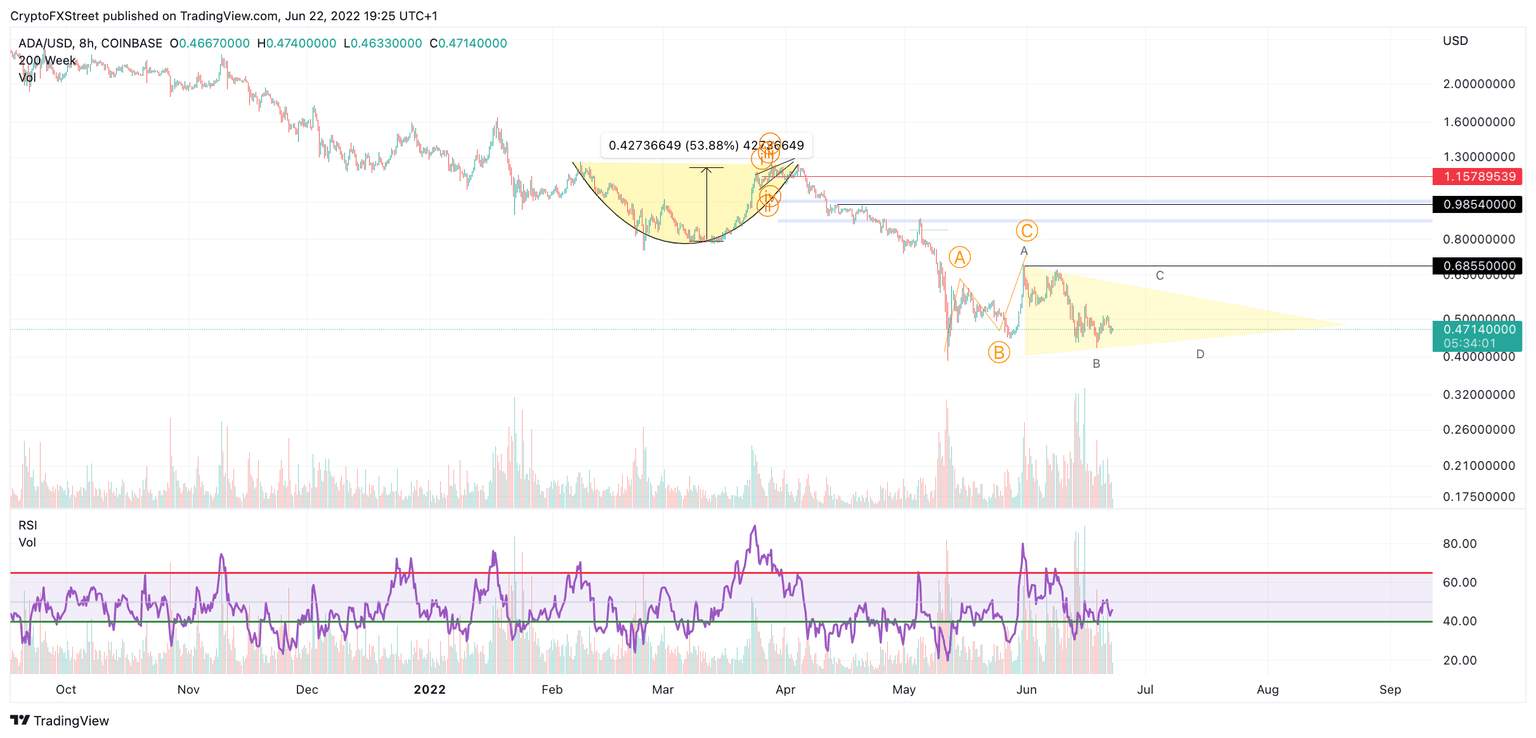

Cardano price remains under heavy pressure ahead of Hoskinson testimony

Cardano price remains under pressure despite experiencing a bounce-back Thursday at the time of this update (11.30 GMT). ADA price again found support at the $0.45 support on a negative Wednesday for most cryptocurrency markets. This level, which had not been seen since June from last year, has become the only remaining lifeline for Cardano bulls, having acted as support three times in the last month. Still, buyers of the layer 1 token are not showing up, which is reflected in the lower highs that each relief rally attempt in the past two weeks has finished at. News surrounding the delay of the Vasil hard fork is not helping one bit, but the testimony later in the day of Cardano founder Charles Hoskinson in the US House of Representatives could help bulls get some life and initiate a potential ADA price turnaround.

Ethereum investors capitulate, but has ETH price bottomed?

Ethereum price has been hovering around a significantly important resistance barrier. This key level prevented ETH from climbing higher in the recent rally. However, things might change soon for the smart contract token, which could result in a quick run-up.

Author

FXStreet Team

FXStreet